September corn futures closed down 23 ½-cents per bushel week-on-week, finishing at $4.30 ¾ on July 19, 2019.

The big question right now: Is reality setting in for Corn Bulls?

It was a tough week for Corn Bulls on a variety of fronts, let’s assess what went wrong and whether or not the uptrend in corn futures can be reestablished in the coming weeks. NYSEARCA: CORN

Why the sell-off in corn this week?

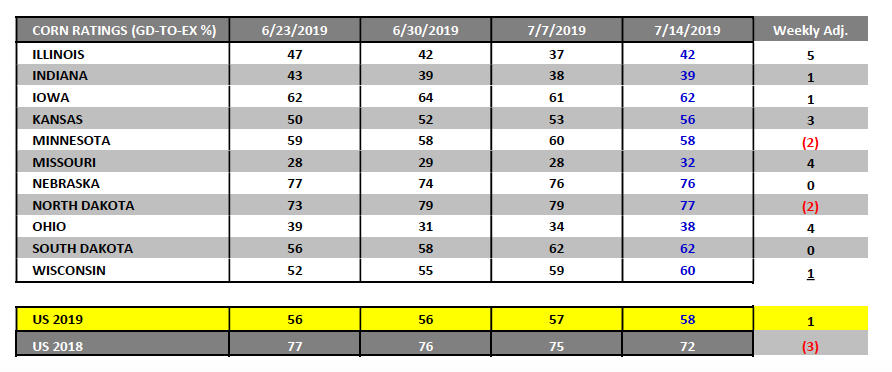

Monday’s Weekly Crop Progress report showed the national corn good-to-excellent rating improving 1% overall to 58%. However, more importantly, the state good-to-excellent ratings for Illinois, Indiana, and Ohio all increased anywhere from 1 to 5%.

Now the actual ratings for those 3 states inarguably remain less than impressive (Illinois at 42% good-to-excellent, Indiana at 39%, and Ohio at 38%).

That said the market tends to focus on the direction in ratings versus the physical numbers themselves. Therefore the impression is that yield potential in the Eastern Corn Belt is trending higher not lower, which is a reflection of improving weather conditions and mild optimism regarding the forward view on current forecasts calling for slightly below-normal temperatures in both the 6 to 10-day and 8 to 14-day outlooks through 7/31.

Corn Bulls are starting to lose a percentage of their audience that up until this past Monday had been entirely focused on planted acreage worst-case scenarios. In addition there have also been studies released this week shooting holes in the assumption that if U.S. prevent plant acres in corn total 7 to 8 million acres, that automatically equates to U.S. planted corn acreage declining to 83.7 to 84.7 million acres (91.7 million = June 28 Acreage estimate).

History has shown that’s an incorrect conclusion. For example in 2013, 3.6 million corn acres were reported as prevent plant, however final U.S. corn plantings only declined 2 million acres versus the June acreage estimate. This type of data is making Money Managers, who as of July 9thwere still long over 187k corn contracts, uneasy.

The lack of U.S. corn demand is getting more and more attention. Wednesday’s EIA report showed U.S. ethanol inventories climbing to 23.37 million barrels for the week ending July 12, by far a record high for the month of July. Since June 21, ethanol stocks have increased 1.8 million barrels. This has occurred during a time when stocks typically decrease due to increases in summer driving/gasoline demand. August ethanol futures have responded by breaking 14 to 15-cents per gallon since establishing a day high of $1.602 on July 15. This has put pressure once again on industry average ethanol margins.

Furthermore on Thursday, weekly U.S. corn export sales totaled just 7.9 million bushels for old-crop (2018/19 marketing year) and 5.2 million bushels for new-crop (2019/20 marketing year). These totals have been alarmingly bad for some time and continue to suggest that U.S. corn values are not competitive in the world market at current price levels.

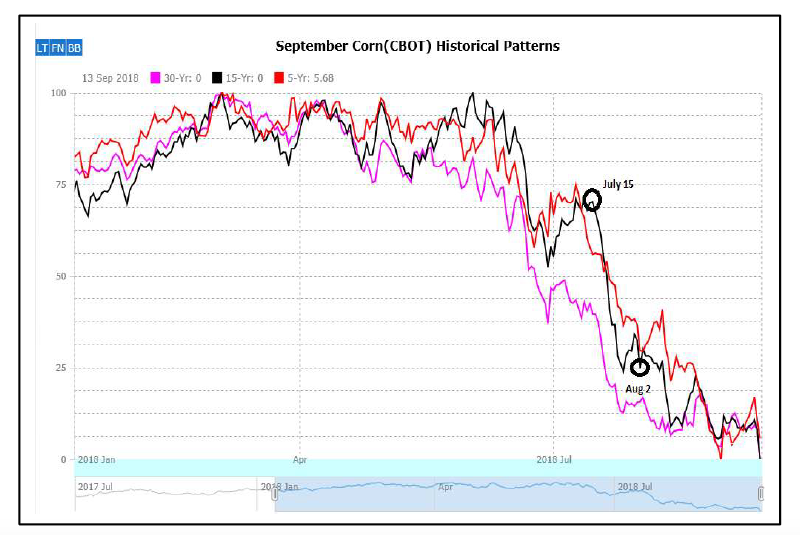

Last but not least…the 5, 15, and 30-year price seasonals all turned lower on July 15 through August 2 (see chart above). That seasonal has been rock solid in most years not named 2012. Therefore in the absence of a significant weather concern or the fear of a U.S. corn yield heading sizably backwards, corn premiums have historically been extracted during the month of July. That’s not to say this year couldn’t be slightly different with the market adding back in a premium during the first week of August and prior to the August 2019 WASDE report (released on August 12th); however the question is from what value does the market rally back? Point being an August rally could equate to simply a re-test of the $4.50 level in September corn futures versus some major rally to new contract highs.

US CORN FUTURES TRADING OUTLOOK

Corn futures clawed back some of the week’s losses on Friday; however it was still not a great week for Corn Bulls. This begs the questions “Can this market once again reverse course and regain upward momentum or was this week’s price action an indication of a market having exhausted supply-side Bullish storylines?”

I’m somewhat mixed regarding my forward view. I do think traders still want to own corn on breaks back to key price support (i.e. 50-day moving average at $4.26 and 50% Fibonacci retracement at $4.105). However I also believe they’ll be patient before extending longs or chasing additional ownership above $4.45 CU19. This likely means we’re headed for more of a sideways trading pattern into the end of the month and possibly the first week of August.

I mentioned above all the reasons corn futures seem to be facing more and more price resistance including slumping demand (exports, corn-ethanol use), slightly improving crop conditions, a relatively benign 6 to 10-day forecast, and a negative price seasonal. That said, where as in most years this would likely aid in corn futures continuing to sell-off well into the month of August and even September, 2019 could prove different due to the looming acreage question.

I am of the opinion planted corn acreage will eventually be reduced by 4 to 5 million acres. A 5 million acre reduction and 168 bushel per acre national corn yield equates to 2019/20 U.S. corn ending stocks slightly less than 1.4 billion bushels versus the USDA’s July forecast of 2.01 billion. Therefore if and when these types are adjustments are made to the U.S. corn S&D (possibly in the August WASDE report) I would expect corn to rally. However I’m not convinced CU19 has to rally beyond its current contract high of $4.68 ¾ if U.S. corn ending stocks remain in the 1.2 to 1.4 billion bushel ranges.

For now…if given the opportunity to buy Sep corn down around $4.10 to $4.12 I’d probably take my shot but until then I’m willing to be patient.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.