The current two year bull run in commodity markets has been just as impressive as the run in stocks. Many individual commodities have risen to a point where individual investors are taking notice and wanting in. From Energy to Ag to the Metals, they are all collectively working right now. But, if you want in, you need a plan that defines your risk. Even when markets feel comfortable, the unexpected can and does occur, many times causing technical damage to stock holdings. To get a leg up, investors and traders alike need to know where to place their stops, especially when venturing into extended markets. In today’s annotated chart column, we will take a technical deep dive within the strength and construct of the Commodities Sector, focusing specifically on an individual coal stock, Arch Coal (Ticker: ACI), as well as ETFs for Gold (Ticker: GLD) and Commodities Tracking (Ticker: DBC). Note that ETF stands for Exchange Traded Fund.

The current two year bull run in commodity markets has been just as impressive as the run in stocks. Many individual commodities have risen to a point where individual investors are taking notice and wanting in. From Energy to Ag to the Metals, they are all collectively working right now. But, if you want in, you need a plan that defines your risk. Even when markets feel comfortable, the unexpected can and does occur, many times causing technical damage to stock holdings. To get a leg up, investors and traders alike need to know where to place their stops, especially when venturing into extended markets. In today’s annotated chart column, we will take a technical deep dive within the strength and construct of the Commodities Sector, focusing specifically on an individual coal stock, Arch Coal (Ticker: ACI), as well as ETFs for Gold (Ticker: GLD) and Commodities Tracking (Ticker: DBC). Note that ETF stands for Exchange Traded Fund.

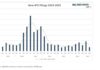

Looking at ACI, we see a stock poised for a breakout and run into the low 40’s. One idea on the long side is to buy a small position here and add on weakness, with a stop at trend line resistance (dotted line) around 33.50 and rising. Another purchase could be made on a breakout above 36.50, with a trailing stop starting at 35.50 and adjusted accordingly.

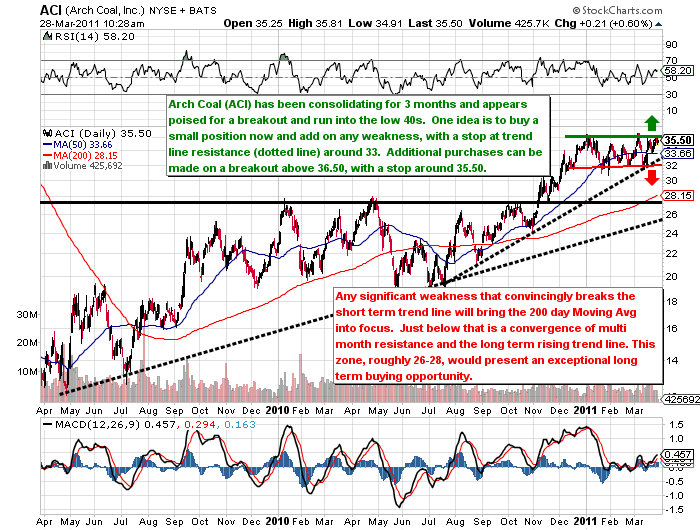

GLD is a bit extended, but could offer opportunity on a breakout, or a move back to the trend line. A break of the trend line would spell trouble over the near term.

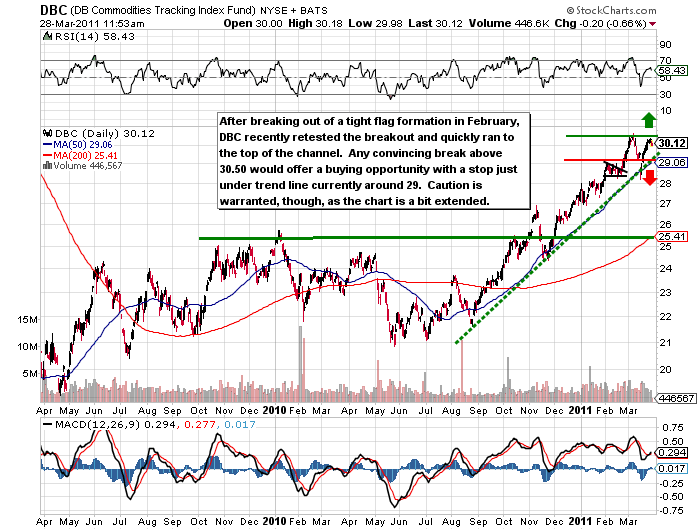

And finally, DBC broke out of a tight range in February and has bounced back and forth between 29 and 30.50. Watch those areas for clues.

One parting note: Getting stopped out of a position is not the end of the world. In fact, stops are an excellent tool for managing risk. If done correctly, a stop will lock in gains or limit losses. The additional cash can then be reallocated within your portfolio or used to enter the same security at a more confident price point. Have a good week.

Previously published as a blog by Minyanville.

—————————————————————-

Your comments and emails are welcome. Readers can contact me directly at andrew@seeitmarket.com or follow me on Twitter on @andrewnyquist. Thank you.

No positions in any of the securities mentioned at time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.