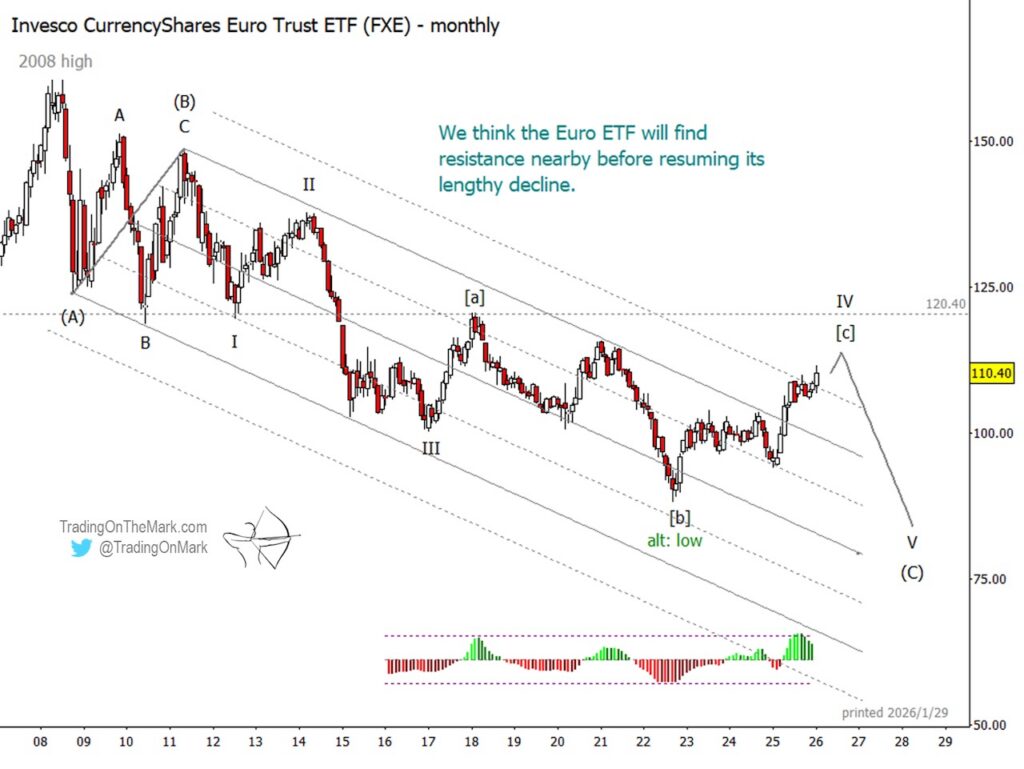

The Euro is nearing important price resistance, and we believe there is potential for a downward reversal that would take it to new lows.

Today we present our bearish Elliott wave scenario for the Invesco CurrencyShares Euro Trust ETF (NYSEARCA: FXE).

The last time we wrote about FXE, it was testing the upper boundary of the channel shown on the monthly chart below. Soon after that, price moved downward to test the quarter mark within the channel, whereupon it bounced beyond our expectations and escaped the channel’s main boundaries.

The move was more bullish than we predicted, but we again believe a downward move is due soon. We think price can reach a new low within the next two to three years.

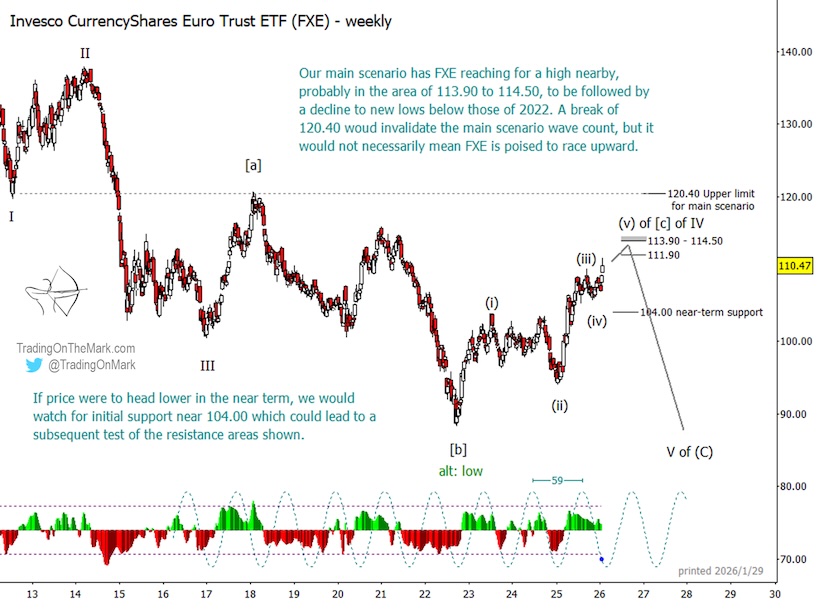

Our weekly chart shows that price is approaching Fibonacci-based resistance that is consistent with the Elliott wave count we’re using. The nearest resistance is quite close at 111.90, but the area near 113.90 – 114.50 looks like a better confluence of targets.

When the upward move is complete, we expect a new downward impulsive structure to begin forming as a fifth wave within larger wave (C).

FXE could rise as high as 120.40 without invalidating the wave count. However, we note that the U.S. Dollar Index is currently testing an important support area. Our wave count for the Dollar suggests it should begin climbing soon, and that would be consistent with a falling Euro.

Note that the placement of (i)-(ii)-(iii)-(iv) labels on the smaller sub-waves is speculative right now. We believe sub-wave (iv) is complete, but a test near 104.00 could still happen before price goes on to reach the marked resistance areas.

Trading On The Mark provides technical analysis with an emphasis on Elliott wave methods for a variety of markets. At our website you can see the latest charts and connect with our livestream commentary during the trading day.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.