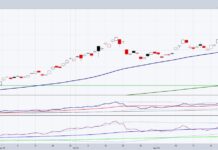

Starting with a chart of the 20+ Year US Treasury Bonds ETF (NASDAQ: TLT), we can see that its price cleared the key moving averages and the July 6-month calendar range high.

The Leadership indicator is the most important part to watch.

Right now, TLT slightly outperforms the benchmark.

Should that continue, considering the FOMC policy hits the markets this week, that could be an early warning sign we are about to enter a risk-off environment.

Yes, I know that sounds strange after we see the S&P 500 ETF (SPY), Nasdaq 100 ETF (QQQ), and Semiconductors ETF (NASDAQ: SMH) make new all-time highs.

However, the Economic Modern Family is a bit more sobering.

What if the rate cuts are less generous than expected?

Regional Banks (KRE), while in a bullish phase, are very far from the all-time highs. KRE is sensitive to Fed policy. If cuts are slower, banks face continued pressure on loan demand and NIMs (net interest margins).

Russell (IWM). Small caps benefit the most from lower rates. If the Fed disappoints, small caps could lag again. With IWM just inches from the all-time high made in November 2024, failure here leaves the potential for a massive double top.

Transportation (IYT), Also rate-sensitive (cost of capital, financing large equipment). Higher-for-longer rates could weigh here. IYT is hanging onto support but not even close to the 2025 highs yet.

Are Valuations stretched?

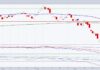

Note the ellipse drawn on the Real Motion indicator.

The red dots or momentum indicator did not clear the overhead Bollinger Band. Plus, momentum declined while the price went to new all-time highs.

Semiconductors (SMH) is our poster child for stretched valuations.

Any disappointment in AI adoption, or a slowdown in cloud spending (Oracle backlog hype vs. delivery), risks sharp pullbacks.

Should Russell 2000 fail, we will look for at least a correction in tech.

And then there are geopolitical risks.

Regardless of what the Fed does, this is a huge X factor.

Transportation (IYT) has Direct exposure to fuel costs. Higher oil/energy prices re-inflate costs across shipping, airlines, and logistics.

Retail (XRT), after seeing a decline in consumer confidence, can get squeezed by higher food/energy, leaving less for discretionary spending.

Regional Banks (KRE): Our Prodigal son is concerned about Inflation that lingers without growth = stagflation risk → bad for credit quality and loan demand. Plus, the credit market brings its own share of hidden leverage risks.

Of course, a bull market always climbs the wall of worry.

And all of this could be a big nothing burger.

The simplest gauges to watch for this week are

- TLT rallies further not because of rate cuts but because the market switches to risk off.

- The Russell 2000 IWM fails to reach a new all-time high and instead breaks below this past week’s lows (around 235), sending shivers about a double top.

This Week’s Watchlist

- Will Fed confirm or temper rate-cut expectations?

- Semis: extend leadership or face profit-taking?

- Does consumer sentiment worsen further?

- Do equity outflows accelerate?

- Oil/energy pricing — inflation risk or relief?

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.