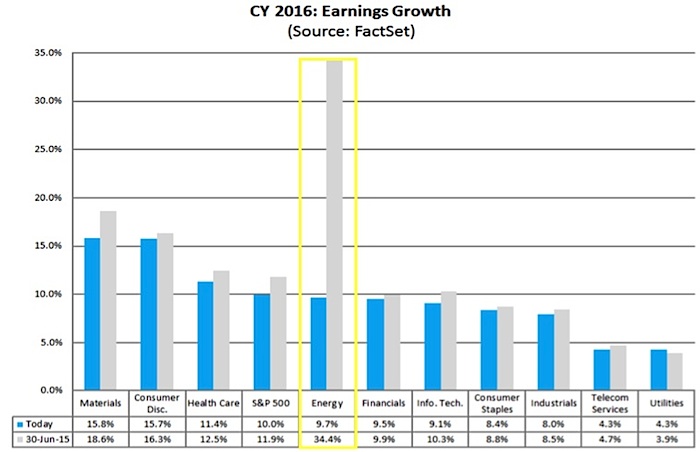

4. Damage in the energy space is FINALLY priced in

Over the last quarter, 2016 earnings expectations for S&P 500 energy stocks have been crushed.

Lackluster Q3 results may be just enough to create a bottom in 2016 expectations. Just look at the drop in the Energy sector!

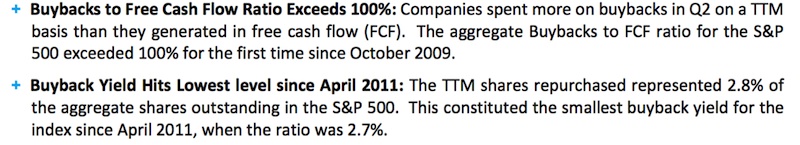

5. Is the share buyback trend running out of steam?

FactSet shared some interesting Q2 data about share buybacks:

Why are buybacks now exceeding Free Cash Flows? Well, FCF of S&P 500 companies dropped 28% year over year.

With cash flows tightening, how will corporations react? Do they continue to spend cash on shares? Do they cut CapEx? Does it still make sense to issue more debt to finance buybacks? I’ll be watching as we move through the quarter.

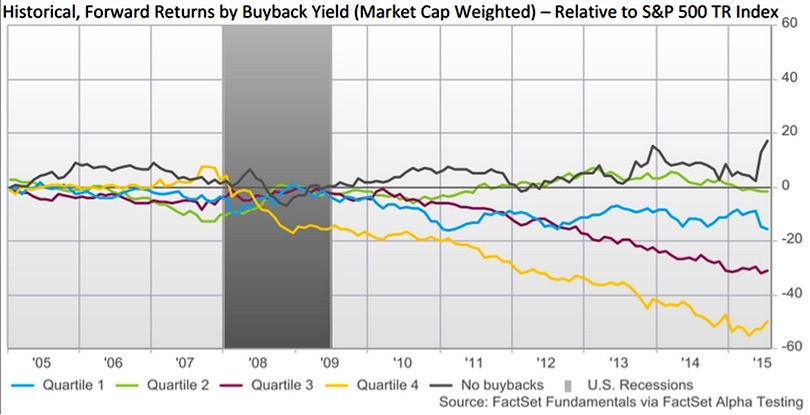

Recently, S&P 500 companies that don’t buy back shares (and buy back the least) have started to massively outperform those who buy back the most. Is the market telling us something?

Also, only two sectors saw an increase in share buybacks: materials and consumer discretionary. Consumer Discretionary (XLY) is by far the healthiest market sector these days. That increase speaks for itself. The data out of the Materials Sector (XLB) is very interesting. It may suggest the best way they can provide shareholder value, is through financial engineering (IE a lack of new projects worth investing in at this time). That specific lack of project investment is something you want to see for a cyclical bottom in the space. Also, the increased share buybacks make the eventual turnarounds in these stocks all the more powerful.

Thanks for reading!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.