As the S&P 500 trades into price resistance at 2,800, I want to take some time to highlight parts of the stock market which are beginning to breakdown on a relative basis.

This does not change our view that the stock market is consolidating in a secular uptrend but serves to present area which can be exploited on the short side.

Looking for the Emerging Weakness

A few weeks ago, we argued that it was not the time to become aggressive on the short side of the portfolio and that has proved to be the proper call as the S&P 500 is now trading at its highest level since February. However, the rally has brought the index into resistance near 2,800 (a level which we have been highlighting).

As trade tensions dominate the headlines, we want to begin to isolate the weakest industry groups within the sectors of the market which are likely to underperform going forward. Consumer Discretionary, Consumer Staples, Financials, Materials & Industrials all have bearish Power Bar ratios which are worse than the SPY.

Within those sectors, we highlight industries which are breaking down on a relative basis and some stocks to consider as short sale candidates.

Financials – Capital Markets

The S&P 500 Capital Markets Index has moved below the 200-day moving average relative to the S&P 500 after marking a negative divergence between price and momentum at the March highs. The RSI has become deeply oversold which speaks to the strength of the emerging trend. While a bounce can’t be ruled out in the near-term, it should be used to open short positions Very Bearish and Bearish stocks. See industry chart below.

It is worth noting that $SCHW looks like a weak name in this group.

Consumer Discretionary – Auto Components

The S&P 500 Auto Components Index has broken support relative to the S&P 500 and is below the declining 200-day moving average. The RSI of the ratio has also become deeply oversold as price breaks down which points to the likely emergence of a new trend to the downside. See industry chart below.

It is worth noting that $GT looks like a weak name in this group.

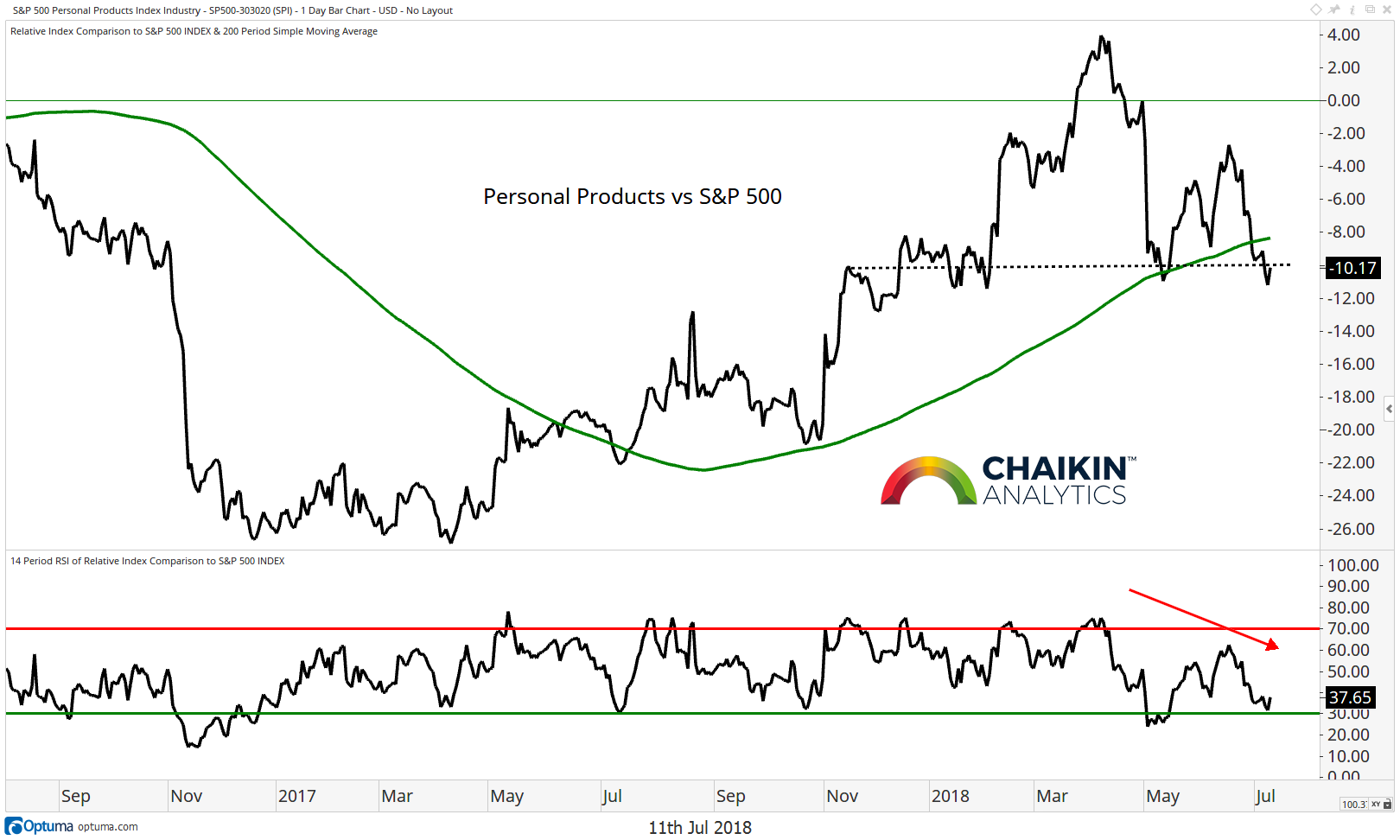

Consumer Staples – Personal Products

The S&P 500 Personal Products Index has fallen below the 200-day moving average relative to the S&P 500 and the RSI has shifted to bearish ranges. The ratio is testing support currently, but bearish momentum tilts the odds in favor of a breakdown. See industry chart below.

It is worth noting that $EL looks like a weak name in this group.

Materials – Metals & Mining

The S&P 500 Metal & Mining Index is below the 200-day moving average relative to the S&P 500. The RSI of the ratio is in the process of shifting to bearish ranges which opens the door to further weakness. See industry chart below.

It is worth noting that $ATI and $CMC look like weak names in this group.

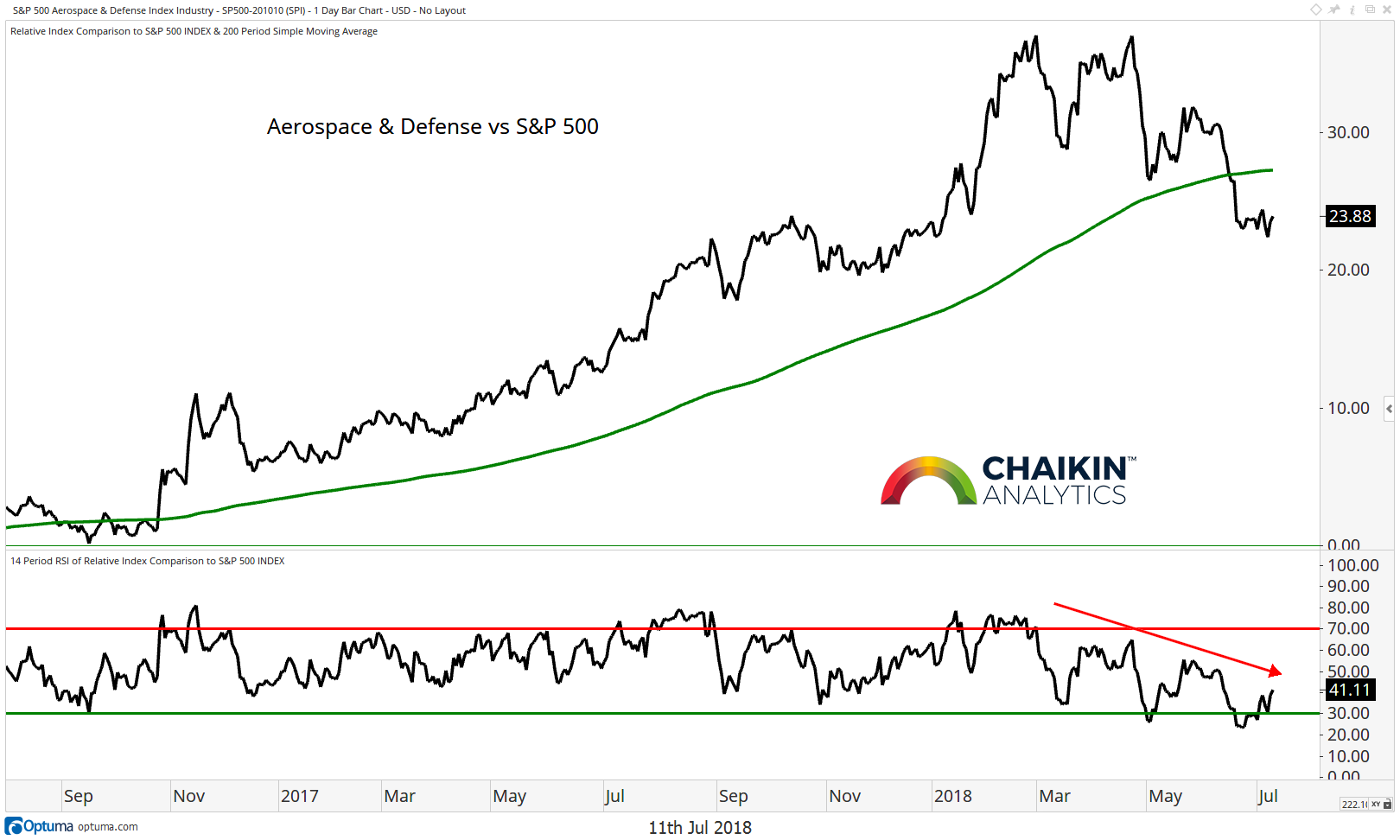

Industrials – Aerospace & Defense

The S&P 500 Aerospace and Defense Index is in the process of reversing its uptrend relative to the S&P 500 and has fallen below the 200-day moving average. The RSI of the ratio has made a series of lower highs including a negative divergence at the price high in March. Additionally, the RSI made its lowest low in two years recently which increases the odds that the emerging downtrend is likely to continue. See industry chart below.

It is worth noting that $HRS $HXL $HEI $MRCY look like weak names in this group.

Conclusion

With the S&P 500 trading into resistance at 2,800 and trade tensions escalating, now is the time to identify emerging areas of weakness within the sectors of the market which have the potential to underperform based on their Power Bars.

You can gain more insights into our methodology and stock picking over at Chaikin Analytics. Thanks for reading.

Twitter: @DanRusso_CMT

Author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.