Investing Insights, Themes, and Highlights:

– After Two Rate Cuts, Fed Appears Data Dependent

– Outside of Manufacturing, Economy Still Chugging Along

– Margin Contraction Could Pressure Valuations

– Equity Funds Seeing Inflows

– Political Noise Could Elongate Pre-Election Volatility

– Breadth Improving, but Not Yet Bullish

Perspective. How you feel about the stock market right now can depend on your perspective – what you are looking at and over what time frame.

Considering only the performance of the S&P 500 Index over the course of 2019 (up nearly 20% for the year and just a couple percent below all-time highs) might lead to a discussion of persistent strength and cyclical uptrends. Looking only at the Value Line Geometric Index (a broader albeit more obscure index that provides a sense of how the median stock is faring) since early 2018 might lead to a discussion of down trends and stock market weakness.

Incoming economic data can be seen as pointing to impending weakness (the manufacturing and overseas-related data) or remarkable resilience (building permits & housing starts at new recovery highs) as the economic expansion enters its second decade.

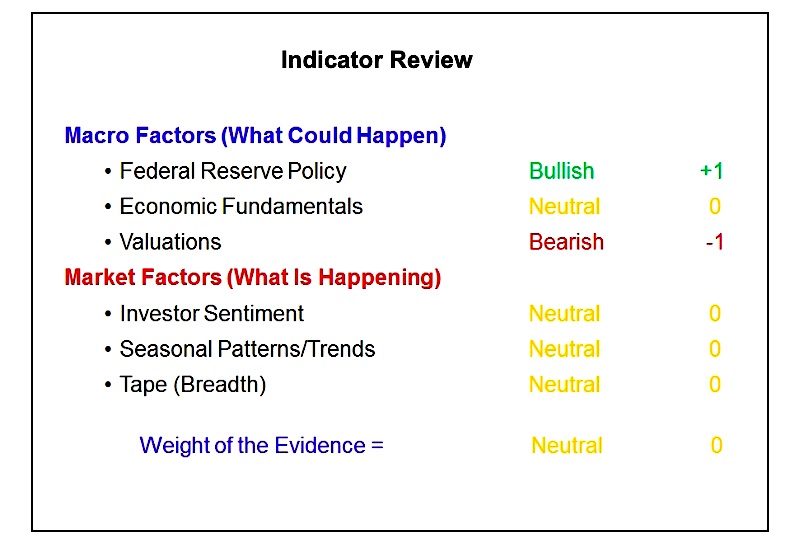

Maintaining perspective in the face of mixed stock market and economic data is a challenge even without rising political tensions in advance of next year’s Presidential election. Distinguishing between news and noise will be as difficult as ever. I strive to help investors navigate this environment by relying not on feelings, but on the weight of the evidence. While I expect that conditions might improve going forward, we do not yet have that evidence in hand and so maintain a neutral view on stocks for now.

The Federal Reserve, and with them most central banks around the world, are lowering interest rates. The Fed lowered the fed funds rate at both the July and September FOMC meetings.

The dot plot published after the September meeting shows that at this point there is not a clear majority of FOMC participants that view further easing in 2019 as appropriate. The futures market expects another cut this year – if not in October then in December. Whether the Fed meets those expectations will depend on the tone of the incoming economic data, which has recently has been exceeding expectations.

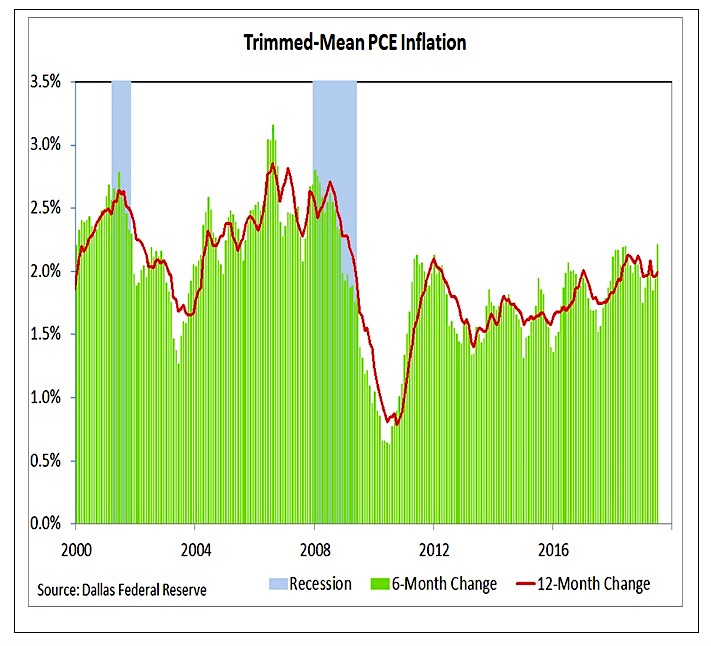

While the data on economic growth (more on that in a moment) gets the bulk of the attention, there is reason not to overlook the inflation data. The inflation picture is not totally benign. The six-month change in the trimmed-mean PCE inflation indicator has risen to its highest level in a decade. This measure (published by the Dallas Fed) is moving in the direction of the median CPI (published by the Cleveland Fed). These academically-rigorous inflation measures show more price pressure than the politically expedient core inflation measures that exclude food and energy prices. This could complicate the market’s expectation of additional easing by the Fed.

Growth has generally slowed across the economy, though the latest data on new home sales and housing starts/building permits shows activity moving to new cycle highs.

The 12-month trends for both manufacturing and non-manufacturing activity have rolled over.

Weakness in manufacturing has been more acute. While this represents a smaller share of overall economic activity than it has in the past, manufacturing data is still seen as being a leading indicator for the economy.

I am keeping a close eye on manufacturing new orders – persistent weakness there would have negative implications for growth going forward and could coincide with a shift in investor appetite from the “risk off” pattern of the past two years to one of “risk aversion.”

continue reading on the next page…