It’s been popular to like the energy stocks as a value play. I think that’s a very risky idea.

Here are 4 observations that highlight my cautious approach to the energy sector (and stocks):

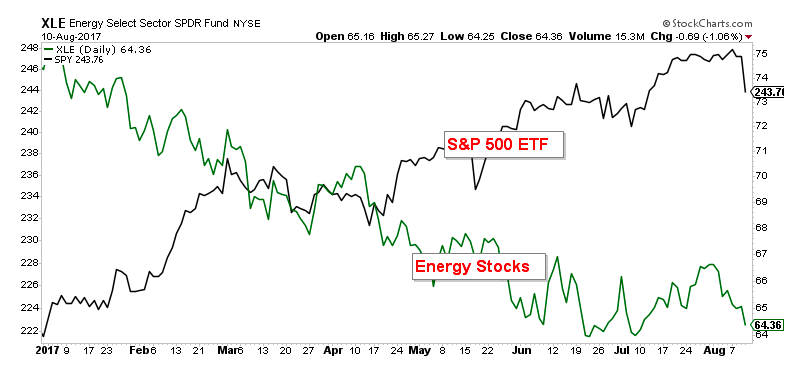

1. The Energy sector (NYSEARCA:XLE) and stocks have lagged the rally this ENTIRE year. This year has seen the best global bull market of the decade. If energy stocks can’t move higher during these epic bull market conditions, when can they? See chart above.

2. Psychology plays a big part in these lagging stocks. There are many people who have missed or underperformed in this rally. Many of those people don’t want to ‘chase’ those extended(strong) stocks. Instead they look to things that could be better buys. Energy and Retail have attracted those type of bottom fishers. This sets up a devastating value trap as buyers are buying relative weakness at exactly the wrong time.

3. Energy Producer ETF (NYSEARCA:XOP) has been a great B.S. detector for oil prices. Although oil has rallied from 42 to 50, XOP is on verge of making a new low. We want to see oil stocks outperforming oil to look to for great opportunities in the space.

4. The closer these stocks get to the 2016 lows, the more interesting they get. As you can see, that’s still 20% away in XOP. That’s a lot to risk for potentially being too early.

Catch more of my analysis over at North Star TA. Thanks for reading and good luck out there.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.