We have several quantitative trading models that we follow. And we use our own proprietary indicator to rank the strongest performing ETFs in all the models.

This model is our Sector Rotation Portfolio with conservative risk parameters.

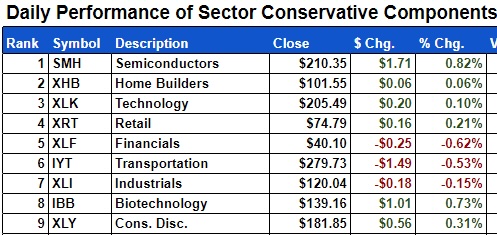

The top TSI ranking sector ETF is and remains the Semiconductors (SMH).

You can see number the number 2 and 3 sector ETFs are homebuilders (XHB) and technology (QQQ).

Technology is close enough to semiconductors.

Homebuilders are not in our core contingent of ETFs we follow as they are important, but not among the most salient aspects of the US Economy.

The fourth ranking sector ETF though, is the Retail Sector (XRT). Last night’s market update covered why that is so important to the overall macro.

And what is also exciting is that the Transportation Sector (IYT) is number 6 and Brother Biotechnology is number 8.

That makes four of the six members on the top 10 of the trend strength rankings.

Why is this so exciting?

I created the core family of ETFs to follow in 2016. The Family represents the economy for sure, but also the market.

The market is often 6 months ahead of the economic statistics.

The Family is the best leading indicator as it reflects the market but also tells us what to expect going forward.

As our Sectors ETF model has well outperformed since 2007, naturally since the Modern Family has made the cut, means that they too can begin to outperform.

“Leading sectors always outperform” is the basis of our quants.

And it is the basis of why we use the Family to gauge how the market will do (and the economy).

We already know how powerful the move in SMH or semiconductors has been to date.Imagine if Retail, Biotechnology, Transportation and even Financials continue up the TSI ranking food chain?

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.