- Regional bank deposits support the view that the banking system is healthy.

- Tesla’s gross margins fall below management’s stated floor of 20%. Anticipated as per our data newsletter last week.

- Inflation real-time trackers finish the week at 3.94% Y/Y.

- Netflix is on a nice path forward as subscribers seem to be stabilizing.

This week was an eventful one with a range of important events, including earnings reports that provide insight into the state of the economy and consumer behavior. Additionally, there were earnings from regional banks that helped provide a clearer assessment of the banking system’s health, individual storylines like Tesla and Netflix, and real-time inflation tracking, which showed a slight decline. Let’s jump into these quickly and in under 3 minutes!

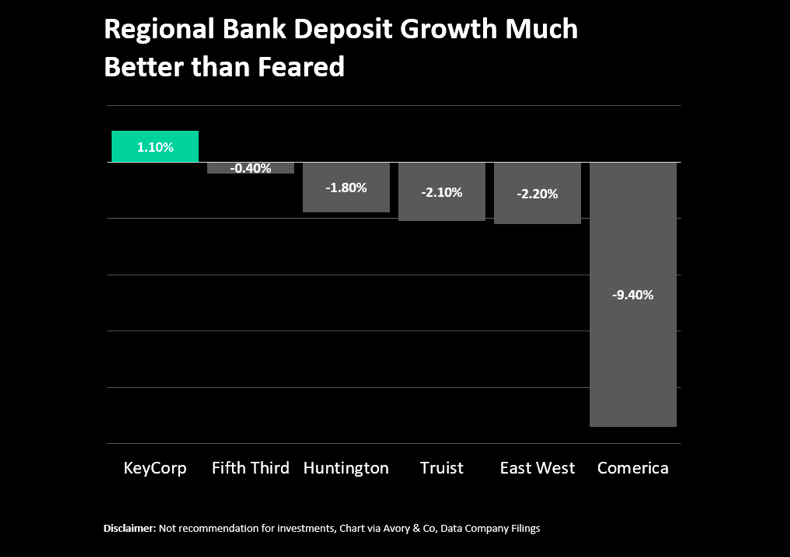

REGIONAL BANKS EXPERIENCE LESS DEPOSIT FLIGHT THAN EXPECTED, INDICATING THAT THE SCARE MAY BE SUBSIDING.

One of the more pertinent data points this week was the deposit growth figures from regional banks. In light of the collapse of SVB, there has been concern that other banks may experience a similar deposit flight. However, thus far, most regional banks have seen only limited deposit outflows, with some even hinting at deposit growth in April, which could help offset some of the exiting deposits. This is a positive development and reduces the likelihood of further bank contagion.

I was on the Closing Bell on Public this week with Anne Berry and mentioned how the concern was around liquidity within banking. Now that liquidity is less of a concern, the focus shifts to earnings.

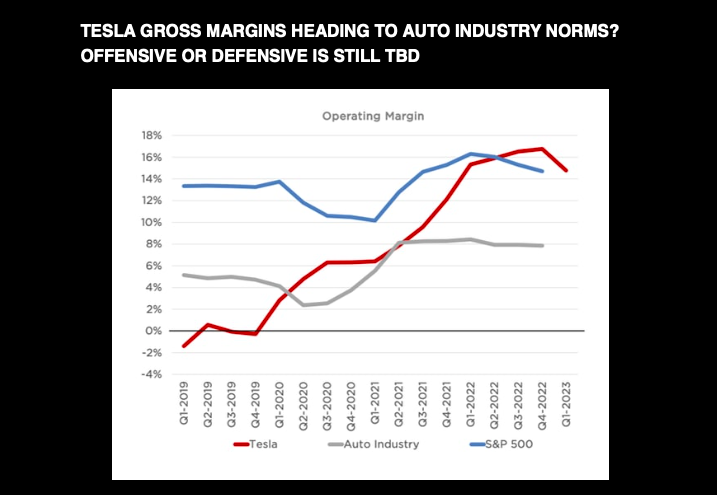

TESLA GROSS MARGINS HEADING TO AUTO INDUSTRY NORMS? OFFENSIVE OR DEFENSIVE IS STILL TBD

Tesla has long been a pioneer in the electric vehicle market, and by most traditional metrics, the company has been very successful. To be clear, we like Tesla, but at what price?

Recent data suggests that demand for Tesla is beginning to fall. Last week we highlighted surveys and search demand on Google that both point to the same conclusion: demand for Tesla is decreasing. This was reflected in the company’s recent earnings report, which showed that gross margins had fallen below their stated floor of 20%. As shown on the chart, margins are moving in the direction of traditional car makers. Some argue that this is a strategic move by Tesla to drive volume, but the company had already set a goal of 1.8 million deliveries at the start of this year and held this view this week despite cutting prices 3-5 times. This suggests that price cuts are not being used to drive incremental demand, but rather to maintain existing demand. Longer term Tesla is clearly well-positioned and has a massive cash cushion.

REAL-TIME INFLATION TAKES A LEG LOWER THIS WEEK TO SUB 3.95% ON A YEAR-OVER-YEAR BASIS.

I will be quick on this one, but inflation continues to decelerate sharply in real time. As of this morning, we saw a sharp decline in the real-time figure, now sitting at 3.94%. This compares to the official figures of 5-6%.

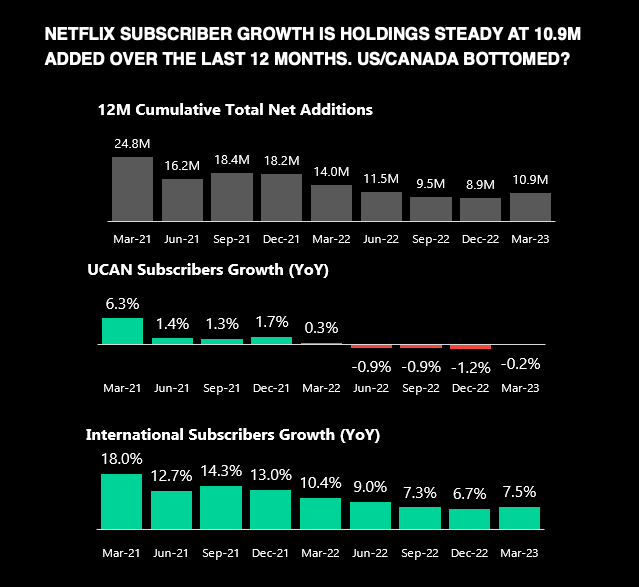

NETFLIX SUBSCRIBER GROWTH IS HOLDING STEADY AT 10.9M ADDED OVER THE LAST 12 MONTHS. US/CANADA BOTTOMED?

Netflix remains the leader in streaming. This week they proved this out by growing subscribers close to 2 million and sharing positive information about their password-sharing initiatives, ad-supported plan, and live shows. The most noteworthy news was that their new ad-supported tier is already generating an average revenue per subscriber equal to that of their standard plan, indicating that it is generating around $7-8 per subscriber in ads. This is significant for three reasons.

- Even if standard subscribers move to ad-supported, the overall revenue per subscriber will be the same.

- Ad-supported may accelerate users overall which may boost the dollars coming from advertisers. I could see a free plan with heavy ads, along with a low-tiered plan with ads.

- Lower paid plans will logically reduce churn, therefore increase lifetime value.

The negative though is that the more their users shift to ad-supported models, the more cyclical the Netflix business will become overall.

Net-net the fear of churn stemming from subscribers shifting to cheaper plans no longer holds.

This is not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Twitter: @_SeanDavid

The author or his firm may have positions in the mentioned companies and underlying securities at the time of publication. This is not a recommendation to buy or sell securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.