Today’s installment of trading ideas and news includes 3 stocks and charts that I am watching.

Goldman Sachs (NYSE: GS), Chevron (NYSE: CVX), and Deere and Company (NYSE: DE).

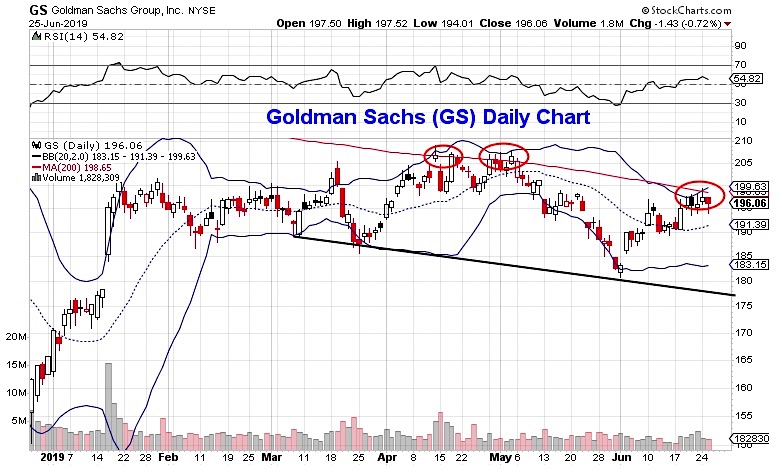

Goldman Sachs (GS)

The 200-day SMA acted as resistance in April and May; so far we are seeing it once again attract sellers (also near the psychological level of $200).

We could be in store for a return to the downtrend line from March prior to seeing a significant rebound.

Q2 earnings are due out on July 16th.

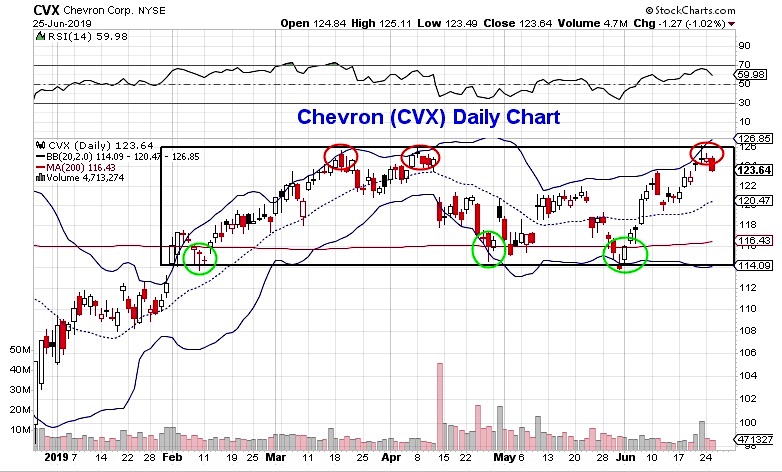

Chevron (CVX)

CVX retested the $126 level for the third time since March last week and now shares are starting to pullback once again. The trading range remains from $114 to $126.

The price of light sweet crude oil itself is struggling with the 200-day moving average near $59 per barrel. The energy company will report Q2 earnings on July 25th.

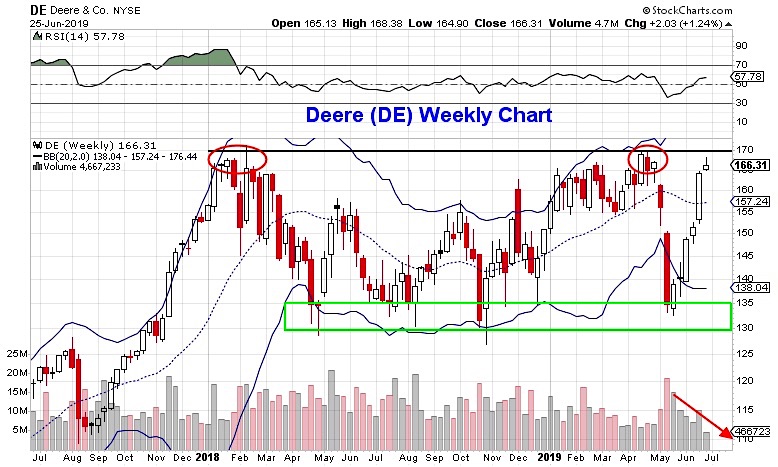

Deere & Company (DE)

DE is up 5 consecutive weeks in a row as it closes in on a retest of major resistance at $170 (been in place since early 2018). It goes ex-dividend on 6/27 ($0.76 per share). Consider the July 19 2019 $170/$180 bear call spread for a $1.90 credit. These options are expensive as the implied volatility on the $170 calls is 22.2% vs historical volatility of 18.6% (delta implies a 34% chance of hitting the strike price level by expiration in 23 days).

As long as the stock doesn’t close above $180 this trade is favorable to keep on. I would look to take profits if you can buy back the spread for a $0.50 debit or if the underlying pulls back to the high $150’s or $160. Earnings aren’t due out until August 16th.

Twitter: @MitchellKWarren

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.