If you are finding yourself fluctuating between bullishness and bearishness, then congratulations!

Hopefully, that also means you are waiting for certain signals to help you commit to one way or another.

Here are the signals we are waiting for before overly committing to a bias.

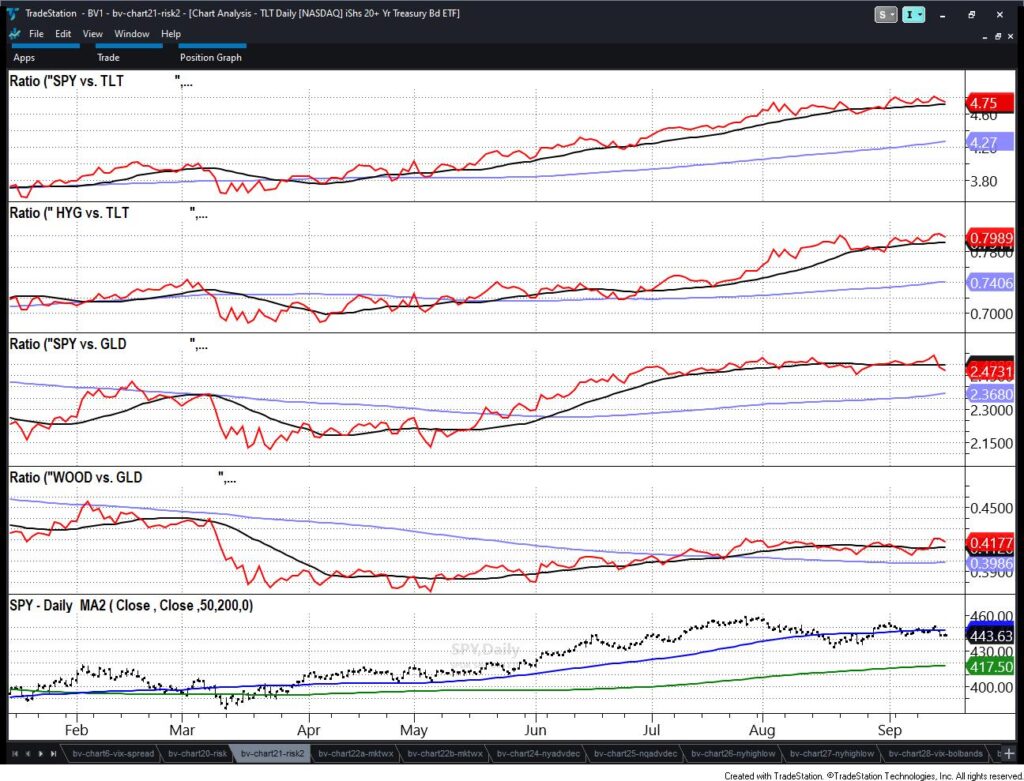

- As we wrote over the weekend, how the junk bonds (high yield high debt bonds), do independently, and how they perform against the long bonds (TLT).

- How the retail and transportation sectors do (along with small caps) as they represent the “inside” of the US economy.

- How DBA (ags) and DBC (commodity index) do relative to the strong dollar and higher yields.

The first chart shows you that a sell signal mean reversion as far as the ratio between long bonds and junk bonds signaled.

However, junk still outperforms long bonds-at this point, that says risk on-but a cautious risk on with junk gapping lower and taking out summer lows (but holding March lows at 72.61).

Retail (XRT) had a solid reversal bottom last week.

Now, must clear last Friday’s highs. And hold June lows… Plus, XRT outperforms SPY right now.

Transportation (IYT) is now underperforming SPY. Although consolidating after braking under the 200-DMA (green), it looks vulnerable.

Could that change? A move over 235 would be a good start.

Looking at DBA, that whole commodities sector is outperforming the SPY. Makes you wonder what would happen if the dollar and/or yields soften.

Trading slightly below the July 6-month calendar range high, we anticipate DBA can continue higher, especially if price retakes the 50-DMA (blue line).

DBC, fell right onto support at its 50-DMA. Momentum also fell into support. Furthermore, DBA also outperforms SPY.

This certainly makes the case for higher commodities and inflation as a trend again, especially if long bonds, and the dollar soften.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.