Do you ever feel like a dirty old man with a wandering eye when it comes to investing? As traders and investors we’re constantly hit with a barrage of information about what stock to buy, where to put our money, and what’s guaranteed to be the next big thing. In fact, if you’re willing to pay a one time fee of just $199, the options are even better! The problem is that at least 99% of the information available is garbage or irrelevant and endlessly chasing the next big thing won’t make you money over the long run. While it’s easy to intuitively understand that, we tend to have a treasure hunt mentality that causes us to keep looking around. That concept of always looking for the next best thing is similar to the cliché of a dirty old man looking around. See… and you didn’t think it was related.

So how do we avoid the allure of looking for the next best thing? We need to build a system of investing principles that put us in a position to succeed. Let’s review 3 principles that I think are key to successful investing.

1. Investing Principles – Expected Outcome

One of the biggest challenges we face as investors is ourselves. Even though we know that most information out there is a waste of time, we tend to think that outcomes could potentially be different because they involve us. We, as in humans, sometimes have a tendency to be overconfident in any outcome that involves us. However, the only thing that matters is the expected outcome.

The expected outcome of a system is what we statistically expect to happen over time. The reality is that, over time, expectancy will take over in any system and bad systems will ultimately lose. By definition, any system with a negative expected outcome is a poor use of capital.

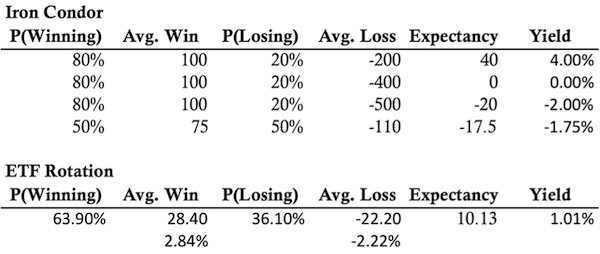

Quick note: Expected Outcome = P(Winning)*Avg. Win – P(Losing)*Avg. Loss

In trading and investing, we should always look for opportunities with a positive expected outcome (assuming we want to make money).

2. Investing Principles – Opportunity Cost of Capital

In addition to always wanting to make positive expectancy bets, we have a limited amount of capital and we want to use that capital in the most effective way possible to increase wealth. The challenge is that there are quite a few psychological aspects that come into play with trading and investing, which makes the equation slightly more complicated. For example, I tend to be relatively cautious and prefer systems with low equity volatility. Other people don’t mind big ups and downs. Ultimately, we need to find systems that increase wealth and fit with our personalities.

In Economics, the opportunity cost is the cost of the foregone option. In investing we implicitly consider the opportunity cost, but we don’t tend to describe it that way. Most investors will naturally look for a system that generates higher returns and forego systems that grow less over time. The big problem is that most individuals don’t know what type of returns to expect or what options they’re opting against. That dilemma is why it’s imperative to have an idea of your expected outcome.

Suppose we wanted to evaluate the returns for two systems, an Iron Condor System and an ETF Rotation System. In the table below, we’re looking at some hypothetical returns from trading Iron Condors and an ETF Rotation System. The average wins are based on $1,000 capital at risk. The ETF Rotation System numbers use probabilities from a backtest so we can assume they’re at least a reasonable estimate.

The reason Iron Condor trading is popular is that most people think they’ll achieve the option in the table with the 4% yield. However, my guess is that quite a few people end up achieving one of the other three lines in the table. That being said, all that matters is the return YOU achieve rather than the hypothetical outcomes.

The second part of the table considers an ETF Rotation System. In the ETF Rotation System, we can expect around a 1% monthly return by following the system and investing 100% of our capital. Given the choice between the two options, some people will choose to pursue the Iron Condor system with the hope of achieving a higher yield. Whether or not they achieve that yield depends on a combination of skill and a little bit of luck.

3. Investing Principles – Compounding

There aren’t many free lunches in investing, but compounding a system with positive expectancy is one. Compound interest is one of the most powerful concepts in investing because as wealth increases, earnings on that wealth increase as well. Compound interest is like a little snowball rolling down the hill that continues to grow. As the snowball gets larger, there’s more surface area to pick up snow and it grows faster.

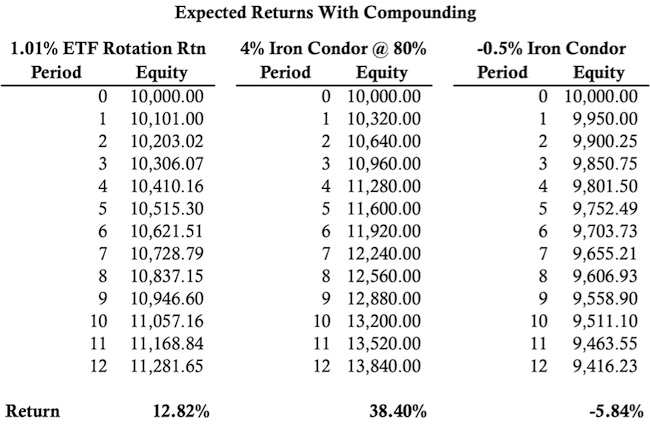

The table below looks at three compound interest scenarios. One for the ETF Rotation System that grows at 1.01%, one for the Iron Condors, and the last is for the Iron Condor trader that tries but doesn’t quite make it. Note that the 4% yield Iron Condor trader was limited so that only 80% of the account was invested. That assumption seems consistent with most options traders leaving some portion of their account in cash for adjustments.

Presented with the three compound interest scenarios in the table above, most people will want to pursue Option Two with the high return. In fact, they might use credit to buy a wheelbarrow to push away their expected haul before they even start trading. The challenge is that achieving Option Two might be harder than most people realize and they might fall somewhere between Option Two and Option Three. Ultimately, you’re the only one who knows where you fall on the table, but it is important to be honest with yourself.

So will he ever get the babe?

Do you remember the discussion about not chasing the next best thing above? Option Two in the Compounding Table is sort of like a very attractive lady walking past a dirty old man. Whenever you’re being pitched a course or an idea, you’re usually being promised Option Two. If you’re not being promised Option Two, you’re being promised the way Option Two “should” make you feel… that or you’re not buying the right garbage. Who doesn’t want a 38% compound return?!

Do you remember the discussion about not chasing the next best thing above? Option Two in the Compounding Table is sort of like a very attractive lady walking past a dirty old man. Whenever you’re being pitched a course or an idea, you’re usually being promised Option Two. If you’re not being promised Option Two, you’re being promised the way Option Two “should” make you feel… that or you’re not buying the right garbage. Who doesn’t want a 38% compound return?!

The real take away from the discussion above is that we need to have a positive expectancy system that is executed consistently over time. In order for a system to be consistently executed over time, we need to ignore noise and resist the urge to find the next best thing. In other words, we should NOT invest like a dirty old man.

Visit can my blog for more information on Momentum Investing using ETF Rotation Systems.

Follow Dan on Twitter: @ThetaTrend

The author holds positions in IYR and related securities RWO, SCHH, and IWM at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.