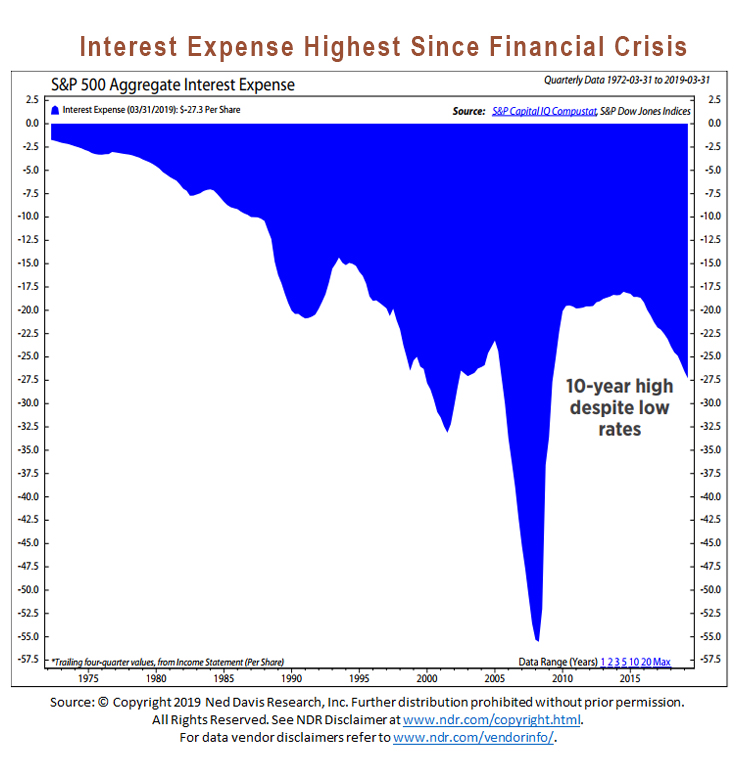

Investors who view continuing low interest rates as an all-clear sign for heavily leveraged companies may want to look at the chart above before breaking out the champagne.

It shows that on a per-share basis, interest costs—driven by voracious borrowing—have hit a level in 2019 not seen since the financial crisis a decade ago.

2019 corporate debt levels (and interest) should definitely be on investors’ radars into year-end and next year.

Why does this matter?

Higher debt-servicing costs on corporate debt could translate to pressure on profit margins as businesses need to siphon from top line revenue to satisfy creditors.

Margin compression is a concern for investors against any economic backdrop much less the late stages of a decade-long expansion.

If the economy slows and consumers and corporations curb their spending, the negative effects of interest costs will be amplified as fixed debt payments will eat into ever-smaller revenue streams.

While the temptation for management to borrow on the cheap in an effort to expand and goose sales can be strong, history hasn’t been forgiving of that approach. As a result, we think in the quarters ahead businesses that have been running with clean balance sheets will once again gain favor with investors.

This article was written by Andy Fleming, CFA and Portfolio Manager at Heartland Advisors.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Definitions

Leverage is the amount of debt used to finance a firm’s assets. A firm with significantly more debt than equity is considered to be highly leveraged. S&P 500 Index is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.