The Federal Reserve decided to not raise rates at their meeting last Thursday. For some folks in the media, it came as a shock. Not for me. And I think for several of the reasons in this article, that now is a great time to hold treasury bonds.

Over the last weeks and months I have explained that global growth has been slowing. There is a cause and effect relationship between what happens in an economy generally and what goes on in that country’s stock market. For example, growth slowing in China is the cause of the nervousness in its stock market. The effect has been unprecedented market volatility in the Hang Seng index and aggressive government manipulation attempting to stop its decline.

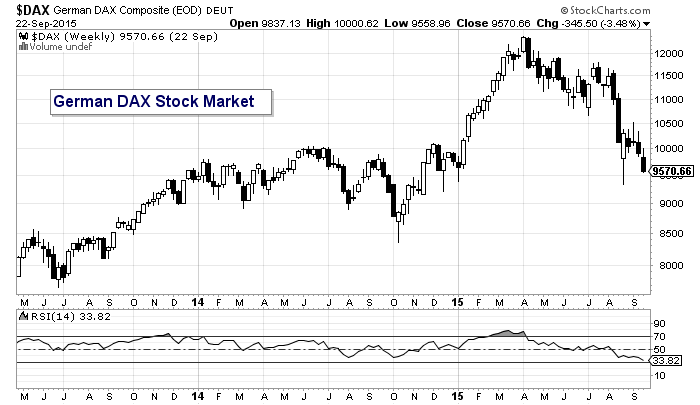

The same thing is happening in Europe. They have been struggling to generate growth and inflation the last several years. Germany had been one of the bright spots as its economy continued to power ahead. Not any longer.

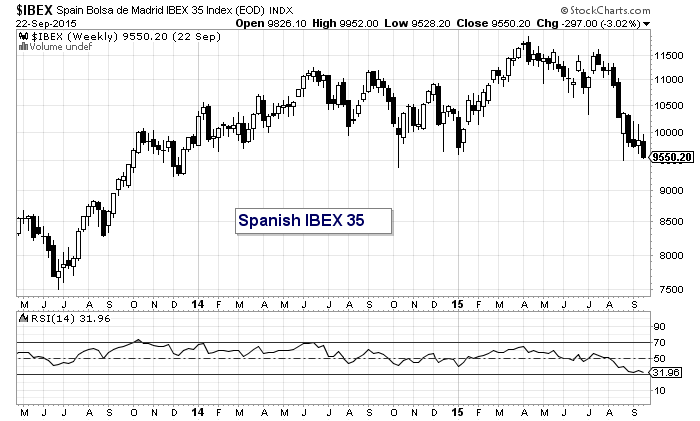

The lack of growth and inflation in Germany has caused investors to question the future profitability of stocks. The result is that investors have been selling stocks and moving to bonds or cash, having the effect of a sharply declining stock market. The same is happening in Spain and several other countries in Asia.

For instance, the German stock market (the DAX – pictured above) is now in crashing lower, down -21%, and it isn’t alone. Spain is also down -21%. The Canadian stock market (TSX) was down around 19% before its recent recovery.

Now, the economic numbers are consistently showing that US growth is also slowing. Time for Bonds?

This shouldn’t be a surprise to those who track and monitor growth statistics and trends. Unfortunately, is appears that few in the Wall Street System do. Nor do the news outlets spend much time explaining what has really been going on in the economy. For instance, a few months ago US growth from 2012 forward was revised down to 2% annually. The evening news shows trumpeted the second quarter GDP number when it was revised up to 3.7%! Wow, our economy must be doing fantastic! What they haven’t told you, though, is that some forecasting tools are estimating that 3rd quarter GDP will only be 1.5%.

Maybe that is why so many of the Federal Reserve Governors that were so vocal about raising interest rates suddenly changed their minds!

Here’s the thing: our economy isn’t going to suddenly shift into a higher gear in time for them to raise rates in October, nor December. I have been saying that it is likely there won’t be an interest rate increase until the middle of 2016 or later. In fact, based on the latest economic data, the probability of the United States entering into a recession is growing. It would not be a surprise to me if that were to happen in 2016.

Yet, the Wall Street cheerleaders continue to say that the recent downturn in the stock market is a buying opportunity! But they’ve said that throughout the entire decline. They say stocks are on sale! Then even more on sale when they go lower. The problem is that when an economy slows (and when it is battling deflation) that even stocks that have fallen 20% can still fall further. In other words, cheap gets cheaper and investors simply don’t have endless supplies of money. It takes serious planning and careful allocations.

read more on the next page…