The Q3 13F filings came out this week so I have been busy scanning the data. I have 50 hedge funds I track each quarter to get an idea of where the money is moving. The information below is looking at net market value change, so it takes into account both net share changes and the change in the stock price.

Stocks with largest positive market value change for Q3 13F filings (vs. Q2): BABA, MA, FB, JCI, GOOG, SYF, AMZN, GILD, AR, INFO, ADSK, GT, MRVL, EDU, AMSG, GS, CPN, CBG, MRK, LDOS, PPG, LXRX, UAL, ADBE, MSFT, AAPL, PRGO, PXD, SYK, V, JBHT, LVS, LLY, EQT, THS, WAB, PE, FL, NKE, APC, MTB

Stocks with largest negative market value change for Q3 13F filings (vs. Q2): BUFF, FAST, CMCSA, C, AGN, T, CDK, PM, APD, INFY, DHR, CF, UPS, TV, TDG, ITW, GOLD, SABR, HSY, SBAC, BIDU, MO, YUM, CME, SWN, NWL, DVA

A look at some of the more interesting names that the funds were buying in Q3:

Antero Resources (NYSE:AR): Antero Resources is a name that saw a lot of institutional buying in Q2 as aggregate shares held rose 11.74% on 13F’s – Note that Brave Warrior added over 5M shares making AR its single largest holding. In Q3 I am seeing much of the same with notable funds like Sailingstone Capital adding 6.389M shares taking AR to its 4th largest holding and 13.25% of the portfolio. As well, Scopia Capital, OZ Mgmt., and Pennant Capital took new positions in Antero Resources stock. It is also the 5th largest holding for Baupost Group.

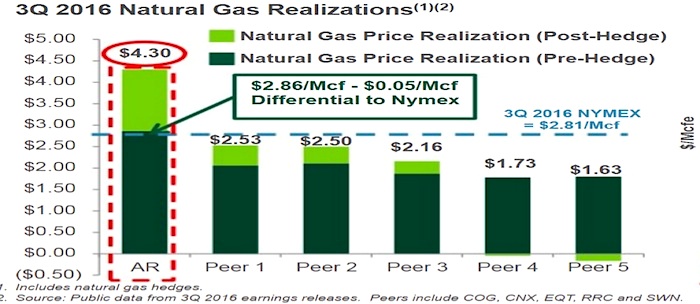

The $8.08B Gas Company trades 1.18X Book and 8.8X FY17 EV/EBITDA. AR is targeting $1.08/share in earnings for FY18, nearly double FY15 levels. Antero Resources (AR) is focused in the Antero, Marcellus, and Utica shale regions with Q3 2016 net production of 1,875 MMcfe/d and 629,000 net acres. The Company is eyeing 20-25% production growth in 2016 and 2017, and has seen a 36% reduction in well costs since 2014. AR is also developing ethane optionality with an estimated 100,000+ Bbl/d ethane targeted production stream in 2017. It has significant ethane exposure at 18%, Natural Gas at 65% and C3+ at 16%. AR also has the highest realizations and margins among Appalachian peers and the largest gas hedge position in US E&P. SIG upgraded shares to Positive on 10-28 with a $35 target after the earnings report. On the chart, AR shares traded above $65 back in 2014, and in April of 2016 cleared a long downtrend. Shares have since consolidated in a tight $25-$28 zone, and once it clears $28 it should start a strong move back to at least $34.

AmSurg (NASDAQ:AMSG): AmSurg is an unusual name attracting some notable investments in Q3 with SouthernSun, Bloom Tree, Viking Global, Brookside Capital, and Samlyn Capital all notable buyers. The $3.55B Company provides Physician Services and Ambulatory Services. Shares of Amsurg (AMSG) trade 13.4X Earnings, 1.18X Sales, 1.56X Book and 9.25X FCF. AMSG is also seeing revenues grow sharply with $3.15B in FY16 running nearly 3X the 2013 levels, and EPS at $4.31 at nearly 2X.

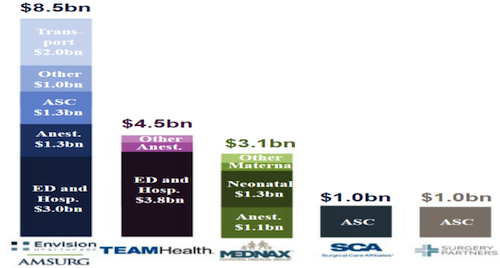

AmSurg is merging with Envision Healthcare to create a nationwide healthcare services Company. The deal is expected to be double digit accretive to EPS in 2018 and cross-selling of the client base is seen as a growth accelerator. The combined company’s business segments are shown below and with so many addressable and fragmented markets, the combination can lift market share. The main overhang right now is the pending changes to ACA. On 9-26, Citi started shares at Buy with a $79 target. On the long term chart, AMSG shares have pulled back to the 40 month MA and also a 38.2% Fibonacci at $58.50, and clearing $69.50 is the key to an upside move back to $80, and potentially new highs.

CBRE Group (NYSE:CBG): CBRE Group’s stock saw large buys from a number of key funds including Eminence Capital, Lakewood Capital, Value-Act, Criterion Capital, Pennant Capital, Samlyn Capital and Cantillon Capital. Value-Act has a 12.1% active stake, interesting in a Company with so many moving parts for potential value unlock opportunities. The $9.45B commercial real estate services Company trades 12X Earnings, 0.73X Sales, 3.3X Book and 35.3X FCF. CBG has posted 20% Y/Y revenue growth each of the last 3 years and EPS seen growing 6-10% annual through 2018. CBG paid $1.48B for Johnson Control’s (JCI) global workplace unit last year. Occupier Outsourcing accounts for 26% of fee revenues, and in Q3 signed 113 total contracts including 52 client expansions. CBRE Group (CBG) is the leader in commercial real estate services and serves over 90% of the Fortune 100. On 1-6, Wedbush started shares Outperform with a $35 target, seeing enhanced revenue and earnings stability with its shift toward contractual revenue business lines. On the chart, shares have pulled back from 2015 highs near $39 and finding support near $25, just above its monthly cloud. If shares can get back above $30, it will start a trend move and target $40+.

Pantheon Holdings (NYSE:PTHN): Pantheon Holdings is a recent IPO, but interesting to see some notable funds taking positions, including TimeSquare Capital, Samlyn Capital, and Alyeska. The $4.2B provider of outsourced pharmaceutical development and manufacturing services trades 20.4X Earnings and 2.32X Sales. Pantheon (PTHN) is targeting 49% EPS growth next year and 21% the following year. PTHN is the only single source end-to-end provider and 25% of the top 100 global drugs are developed or manufactured by Pantheon. Last quarter the Company saw strong growth in all segments with strong demand for biologics driving the DSS segment, and the DPS segment has 90% of revenues under contract for 2017. PTHN also shines among peers in all metrics and seeing margin expansion as well as rapid EBITDA and FCF generation. On 8-15, RW Baird started coverage at Outperform with a $32 target, and sees future M&A as a sweetener to the already healthy earnings growth.

Thanks for reading.

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.