The current setup in the US Dollar index (CURRENCY:USD) is rare in that a clear and logical fundamental and technical case can be made for a rally (or a move to the upside).

Could this simply be a correction within an ongoing bull market for the US Dollar?

At the same time, the price action has set up a clear line in the sand to inform risk management for investors.

I talked through this issue in detail in the latest edition of the weekly report for clients, including a series of key charts, this article picks out my favorite charts and discusses the key drivers at a high level.

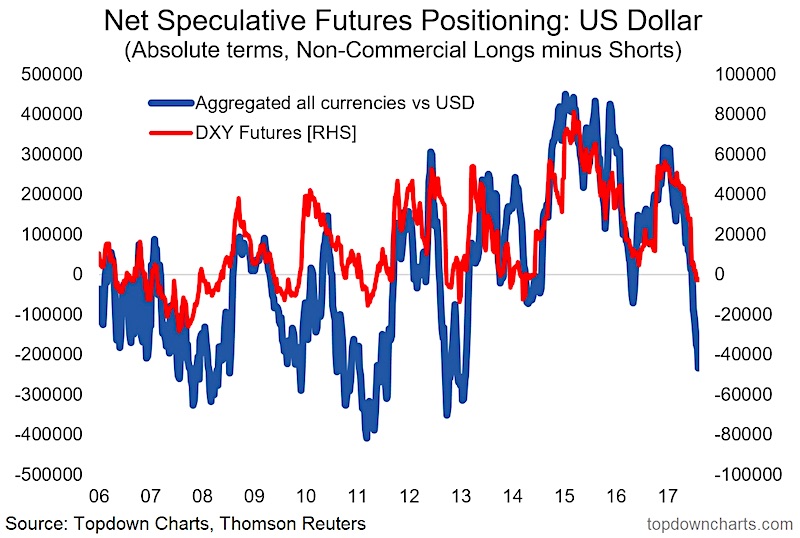

The chart in question: net speculative futures positioning in the US Dollar Index itself as well as the aggregated view across the futures for all USD pairs (which is at a the lowest point since early 2013).

From a technical or tactical standpoint my indicators show the US Dollar moving from a starting point a couple of months ago of: “over-loved” (the chart above – futures positioning), “over-bought” (G10 FX market breadth), “over-valued” (slightly overvalued on my measures), and “overly-relaxed” (average USD FX option implied volatility trading at multi-year lows).

It’s now showing up as unloved (the positioning unwind), oversold (market breadth washout), slightly undervalued, and with considerable yield support. Our indicator combines several measures of yield differentials and it is showing up as the most supportive ever for the US dollar – a key factor that provides conviction for the bullish call… and the case that a bull market correction may be ending for the Dollar.

The other thing is the Fed is edging closer to further rate hikes and balance sheet normalization or passive quantitative tightening (QT). From a money supply point of view and yield support, rate hikes and QT should be US Dollar bullish (*all else equal….). So when I see the US labor market looking increasingly tight I think about wildcards.

Back to that opening remark, I could be completely wrong in my assessment – it is just a working theory after all. Probably the key variable to make me change my mind would be a downside break of 92. That would probably be the key element to confirm a transition from bull market to bear market vs a bull market correction.

Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.