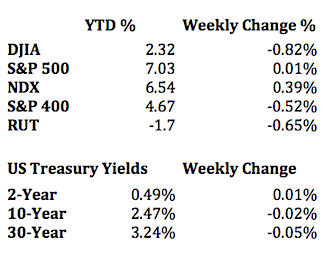

We continue to see the financial markets make slight adjustments to a slowing US economy. Here’s a quick stock market performance update from last week: The S&P 500 virtually ended the week where it began while the Dow Jones Industrial Average declined 0.82% and the Russell 2000 0.65%.

We continue to see the financial markets make slight adjustments to a slowing US economy. Here’s a quick stock market performance update from last week: The S&P 500 virtually ended the week where it began while the Dow Jones Industrial Average declined 0.82% and the Russell 2000 0.65%.

Additionally, here’s what my trending indicators are saying:

US Stock Market Trending Down

Canadian Stock Market Trending Up

US Bond Yields Yields Trending Down

For those keeping score, the S&P 500 is up 7.03% YTD while the Russell 2000 growth index is down 0.65%. The bifurcation between slower growth companies and their faster growth cousins continues. And the economic data continues to show that the slow-down I have been talking about for almost 6 months is occurring. Pending Home sales dropped 1.1% versus an estimate of +0.5%. This will likely cause the Federal Reserve and other economists to reduce their growth forecast.

One of the key drivers of stock market gains, though, is earnings. The markets can continue to go up as long as earnings do. Underneath the hood, though, I believe that companies are finding it harder and harder to maintain, let alone increase, their earnings. Quality earnings come by expanding sales to new customers and introducing new products–that kind of earnings result in businesses expanding and hiring new workers. Nowadays, since the economy isn’t growing, expansion is coming through mergers and acquisitions. That kind of ‘growth’ doesn’t add jobs, it reduces them. Organic growth will likely remain muted until the economy truly begins to take off leaving the U.S. stock markets vulnerable to pullback.

Until then, bonds, REITs, utilities and stocks that behave like bonds should provide better risk-adjusted returns.

Data Bank:

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.