Things change fast in markets. And active investors have no choice but to adapt.

The big rally to start October has stocks moving into some overhead supplies levels, but the move has been meaningful. The coming weeks will be important to see how the markets handle some key price levels.

But there’s so much more happening under the surface. And that’s where we turn to the best of the financial web for additional investing research, market insights, and trading ideas.

Here’s one of my favorites from the week – a great way to kick off this week’s “Top Trading Links”:

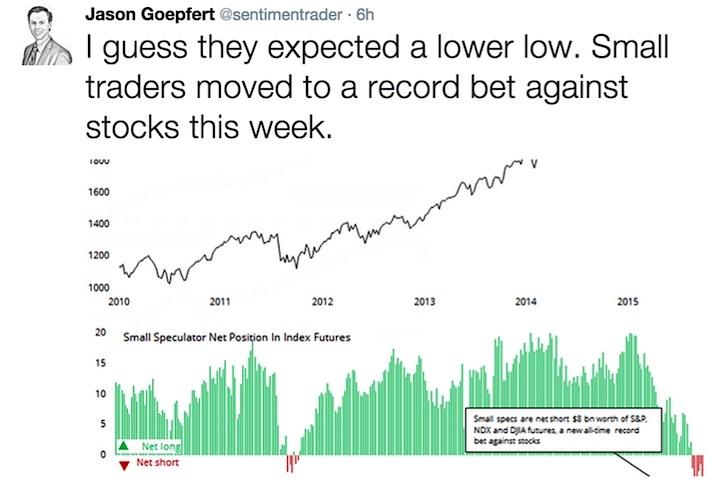

@sentimentrader notes small traders got very bearish last week. They have been pummelled and the recent lows are looking quite sustainable.

MARKET INSIGHTS

@RyanDetrick digs into the TD Ameritrade Investor Movement Index:

“Now, digging into what exactly happened, turns out retail investors were actually net buyers in September. The reason this Index dropped so much was investors moved into stocks that were less volatile than the market as a whole.”

It pays to be flexible. @kimblecharting points out the S&P 500 has formed a double bottom pattern.

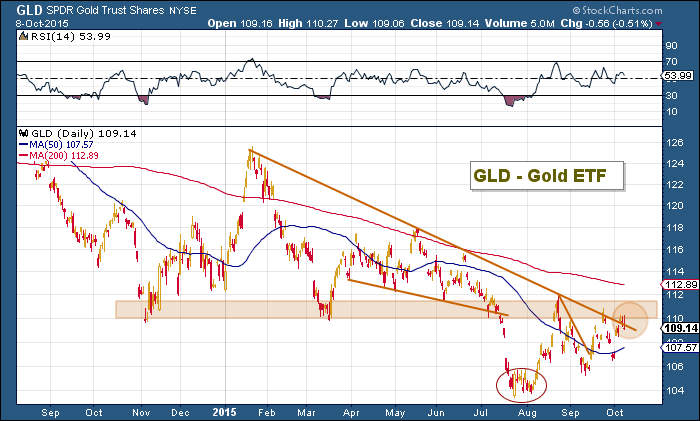

@andrewnyquist talks Gold and shares an updated look at the chart:

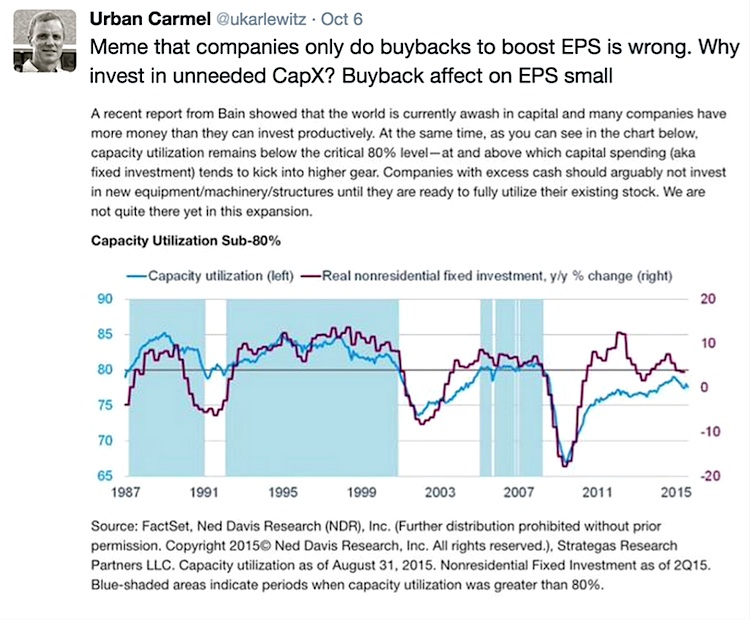

Are corporations too flush with cash? @ukarlewitz shares a great note on capacity utilization:

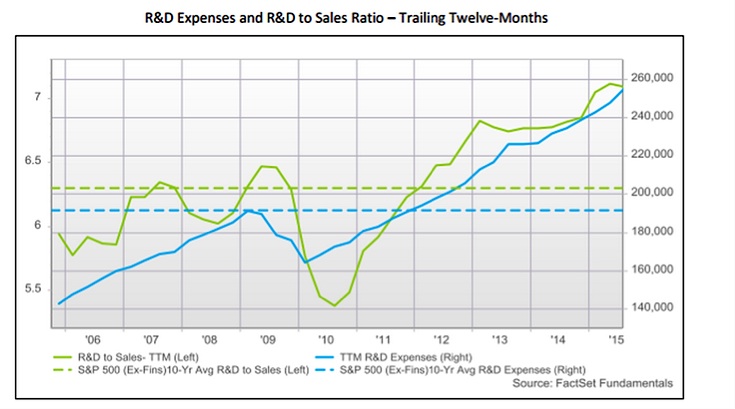

This is an interesting point as R&D spend among S&P 500 companies continues to hit new highs.

continue reading more “Top Trading Links” on the next page…