Well, we got that influx of volatility that everyone was waiting on for the past several weeks. The problem with that thinking though is that it was impossible to time.

On Friday, stocks declined sharply and persistently. The market was at its lows when the time keepers showed mercy and rung the bell. For the day, the S&P 500 (INDEXSP:.INX) fell 2.45% and the Nasdaq Composite was down 2.54%.

The drop was long overdue, I suppose. Last month I highlighted some key breadth divergences that may have been warning investors.

Now we must go back to our trading process and/or investing plan to see how (if at all) this action affects the way we’ll move forward. Below is some great investing research, trading ideas, and market insights. Without further adieu, here is this week’s “Top Trading Links”.

MARKET INSIGHTS

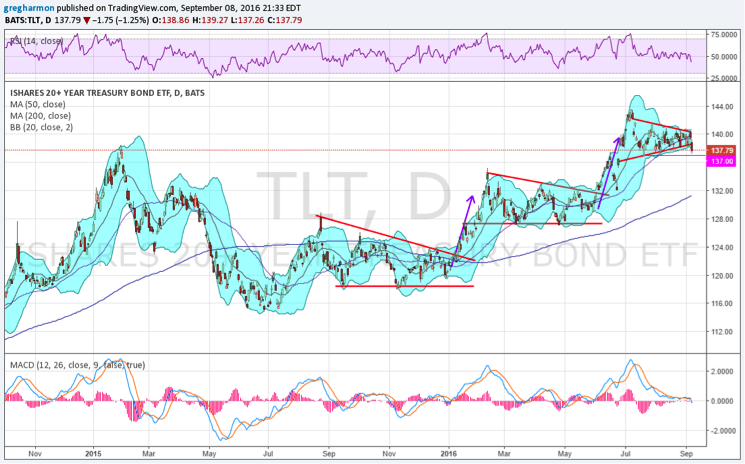

Money is continually flowing into bonds – David Fabian

TLT is breaking down – Greg Harmon

The S&P 500 is testing a key emotional level – Chris Kimble

September is the worst month for stocks, but how bad is it? – Dana Lyons

Hedge Funds are aggressively shorting VIX futures – Paban Pandey

The Chinese Yuan is depreciating again. What does it mean? – Bryce Coward

Inching closer to the market’s second 2016 correction – Michael Gayed

NEWS & RESEARCH

Detailing the Wells Fargo scandal – Josh Brown

The power of quitting – Steve Burns

Why expert forecasters get it wrong – Peter Atwater

The 2016 Investment Company Institute factbook

When you change the world and nobody notices – Morgan Housel

Why do we work so hard – 1843

24 of the best things Jim Harbaugh has ever said – Exploring Markets

Quote of the week:

“The most destructive phenomenon in sports is relief. It’s typically followed by a decrease in performance” – Nick Saban

Thanks for reading.

Be sure to check back next weekend for more links to high level investing research and trading blogs. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.