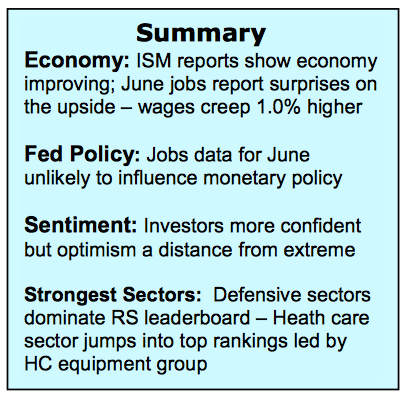

The July stock market rally continued last week with equity markets up more than 1.0% last week. It’s interesting to note hat virtually all the gains occurred on Friday.

A better-than-expected jobs report for June was credited with Friday’s surge in the stock market. However, a new record-low yield for the 10-year Treasury Note (INDEXCBOE:TNX) was more likely the inspiration for the stock market rally. Now the S&P 500 Index (INDEXSP:.INX) is moving to all-time highs.

Investors have been cautious and skeptical toward stocks with equity mutual funds recording net outflows from equity mutual funds in 2016. The fact that interest rates have fallen to levels heretofore thought to be impossible, this sidelined money will likely find its way back into the stock market where the dividend yield on more than 62% of the issues in the S&P 500 return more than the 10-year Treasury. This is likely to be the tailwind that carries the popular averages to new record highs. The focus of attention the next two weeks will be on second-quarter earnings reports. Consensus estimates are that S&P earnings will drop 5.0%. This is unlikely to dislodge the current rally given that the second-quarter results are expected to be the trough for corporate earnings with the outlook for profits improving in the third and fourth quarters.

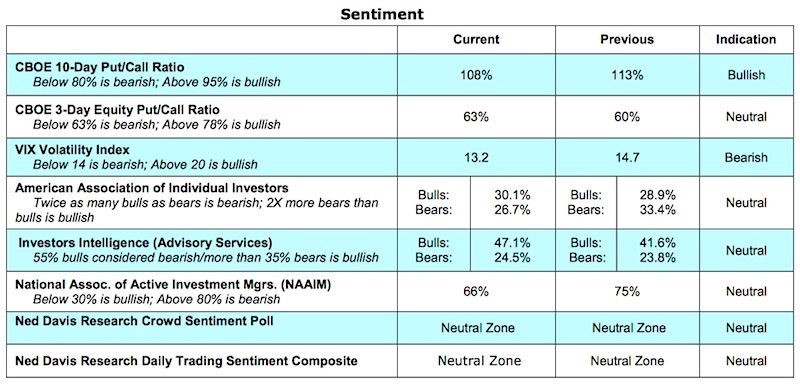

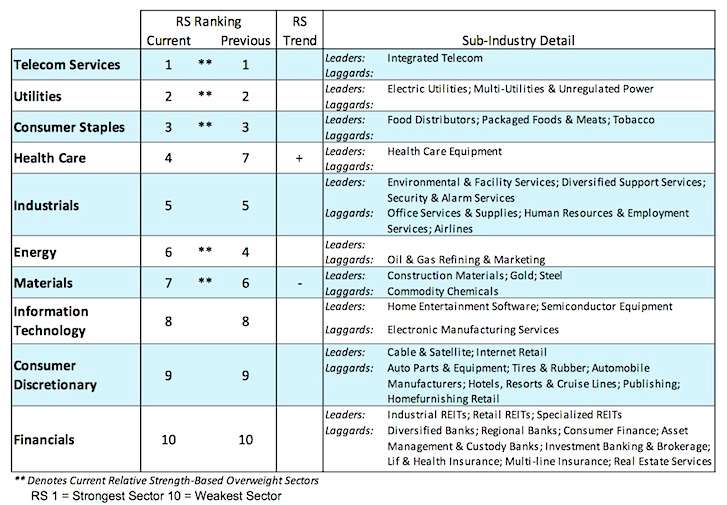

The technical picture continues to improve for equities. Momentum can now be added to positive trends and breadth the market has enjoyed since the February 11 low. Stocks have experienced three sessions in recent weeks where upside volume has exceeded downside volume by a ratio of 9 to 1 or more. This argues that momentum has moved to the side of the bulls. The improvement in market breadth in 2016 over what was experienced in 2015 can be found by the significant expansion of the number of stocks hitting new 52-week highs versus those reaching new lows. Investor psychology remains cautious as witnessed by the fact that more than $14 billion flowed into bond funds last week versus $470 million to stock funds. In addition, despite the better-acting stock market measures of investor sentiment on balance are rated no better than neutral. We will become concerned about the prospects for stocks should the VIX fall below 12, the Investors Intelligence data show 55% bulls or more and the weekly survey from AAII show more than twice as many bulls than bears.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.