With all the talk of market bubbles and comparisons to the year 2000 and the dot-com mania, it’s worth taking a look at an interesting chart that showed clear signs of market mania toward the peak of the last two major market cycles.

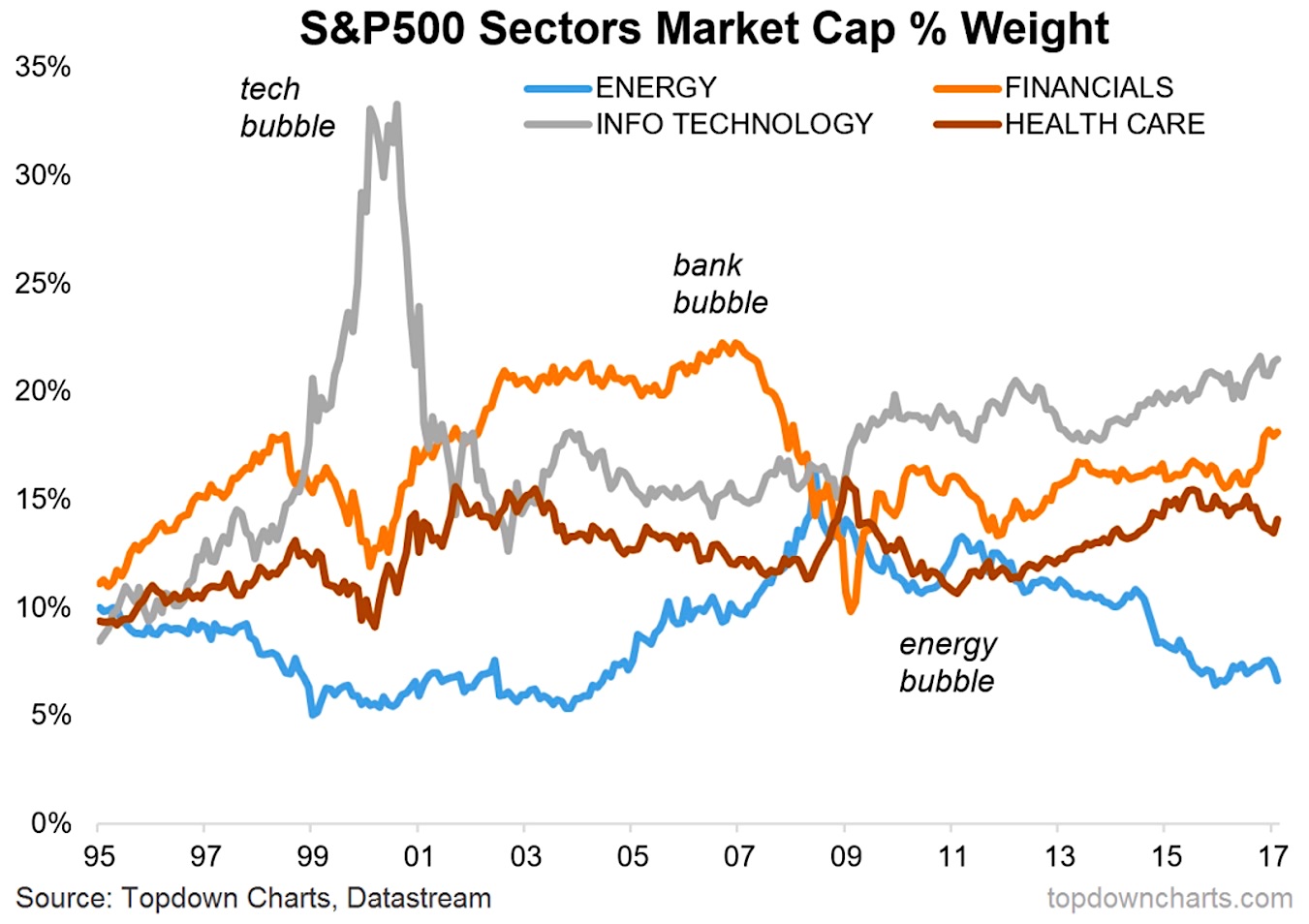

The chart, which appeared in the latest edition of the Weekly Macro Themes, shows the relative weighting (based on market capitalization) of a selection of major S&P 500 sectors (NYSEARCA:SPY).

The reason I chose not to display the other sectors is simply because none of the other major GICS sectors have done what these major stock market sectors have. And that is, show signs of a bubble.

The tech sector is by far the most dramatic standout, spiking to extreme highs at the peak of the dot-com mania. The next interesting one is the financial sector which went from around 10% to over 20%. Energy was likewise interesting, going from around 5% to 15% at it’s peak.

The reason I included healthcare (thinking, in particular about biotech and pharma), is that it was probably the closest thing in more recent times to the type of “sector bubbles” seen in tech and financials. But the movement is nothing like that of the previous 3.

So why would you look at sector weights and indeed why would you try to find sector bubbles?

The main reason is it is one of many potential signs of things getting out of hand at a market top. To be fair, you can get a market top where *everything* gets bid, but the experience has been that for things to really get out of hand there usually is some sort of “story”. A “mega trend” or “structural shift”.

In 2000 it was the “new economy” – but at present there is yet to be a real story to inspire the retail money to really make the final dash into the market and give the bull market its final rush. There’s no guarantee we will get a story, but if and when we do it will probably show up on the charts.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.