March 2015 marks the last of seven exact meet-ups from the Pluto-Uranus cycle that began in the summer of 2012. So why is this important to investors? And how do planetary cycles align with market cycles?

Well, here is a quick recap from my March 2013 post that aligns the astrological cycle to the larger secular financial market cycle:

To understand these larger secular cycles, which coincide with Pluto-Uranus, the question is, “What are the common themes or drivers we can see around these times?” According to Ed Easterling’s work, Unexpected Returns: Understanding Secular Stock Market Cycles, secular cycles are driven largely by inflationary shifts (Easterling, 2005). The Roaring Twenties was followed by the debilitating deflation of the 1930’s; the bull market of the 1950’s was interrupted in the mid-60’s by high inflation, which reached double digits just before the secular bull of 1983-1999; and during the last decade, the celebration of the Great Moderation ended as deflation and another secular bear followed the euphoria of the dot.com bubble.

The first Pluto-Uranus square was in June 2012, the long-term bond market peaked after the Euro Summit and signaled a renewed optimism that the worst of the global crisis was behind us. However, as was the case with the 1930’s and the 1970’s, recovery from a major secular shift is often uneven, uncertain and painfully drawn out.

Uneven Recovery

By November 2013, at the fourth Pluto-Uranus square, it was difficult to find a market bear amongst the many converted bulls within the market cycle. Nonetheless, by New Year 2014, slow wage growth became the new economic buzzword. Here on See It Market, I began tracking the anemic wage growth concerns in October 2013.

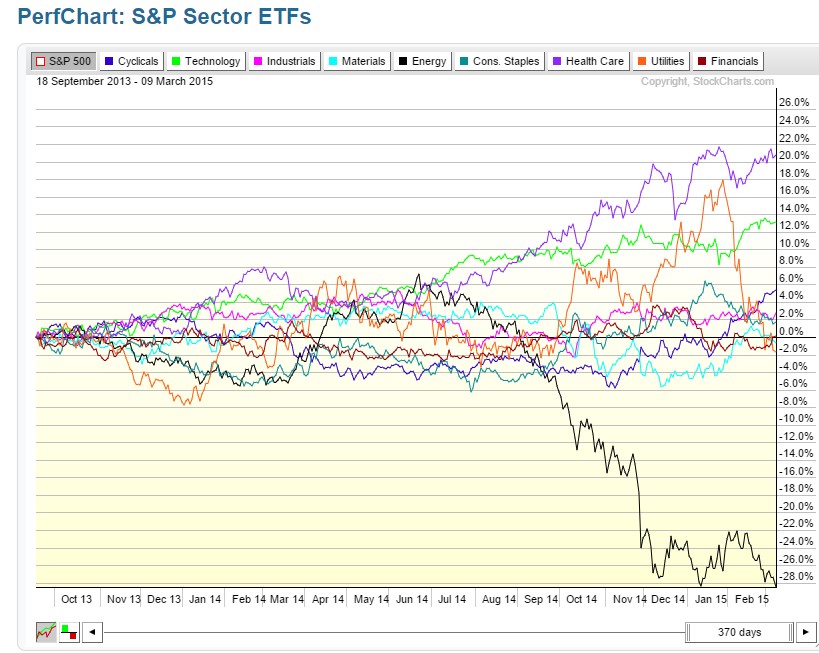

2014 was a difficult market, because market rotation can be disorienting for many of us. The Perfchart for the S&P Sector ETFs below demonstrates this with the market’s sharp rotation to energy and utilities for the first half of 2014. Here again, we see the Energy Sector (XLE) drop off like a veritable falling knife, creating another round of confusion for the remainder of year.

Performance Chart: S&P Sector ETFs Oct 2013-Present

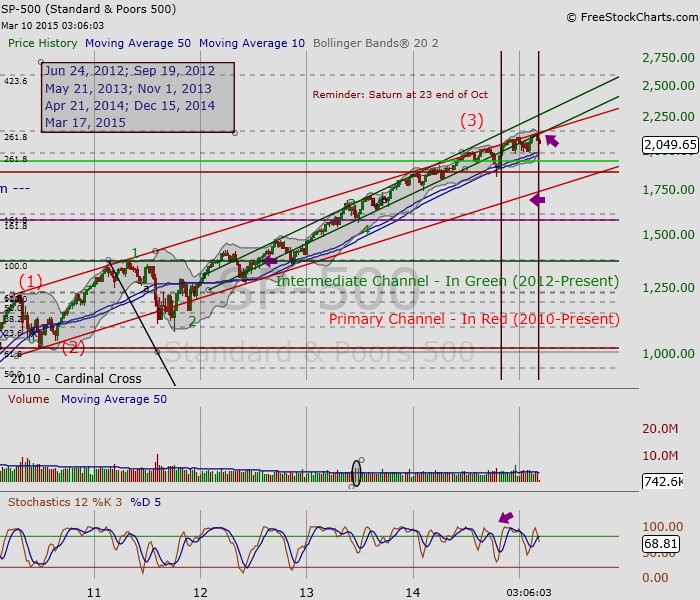

Primary and Intermediate Channels From Elliott Wave

The next chart I’d like to look at is the S&P 500 (SPX) from 2010 to the present (see below). As you can see, the market has traded in the Intermediate Channel (in green) since 2012. Until this past summer, the SPX had not failed to test the top of this channel. This fall, we actually saw the SPX fail to find support at the lower end of the Intermediate Channel. However, the stock market found support at the 10/50 week moving average.

Today, it’s worth noting as we head towards the final Pluto-Uranus square mid-March, that the bottom of the green channel will soon be above the top of the Primary Channel. While the market can and has traded above major channels in the past, it often means a sharper correction when it finally drops below it. As a demonstration of this, note what happened to gold in the fall of 2011 when it shot above its long term channel and hovered for several weeks before falling back through.

S&P 500 Chart 2010-Present

The Final Pluto-Uranus Square and the Consumer is on the Mend

In 2014, anemic wage growth was a signal that the consumer had not been keeping pace with the market recovery and the market cycle needed time to develop. In response, the market rotated to the defensive sectors in energy and utilities. Oil dropped like a knife in the fall and all eyes went back to Europe which woke us up to the reality that the global recovery has been uneven and continues to be difficult for many in the West (post-financial crisis). Yet, it is hard to ignore that US consumer wage growth has seen a sharp uptick in recent quarters. While growth rate is still well below historic levels, the consumer is decidedly on the mend. Just this weekend the local craft fair and farmers market in my part of the world created a traffic jam. The small businessman has not given up. Therefore, if this last square is finally timing the long-awaited correction, main street may be telling us it’s not time to panic, but a time to reassess and watch where the market will rotate next.

Thank you for reading.

Follow Maria on Twitter: @rinehartmaria

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.