While the debate continues as to whether or not the Federal Reserve will hike rates in its upcoming meeting in two weeks, gold prices are giving off vibes as if it expects one.

Yesterday was a risk-off session as far as equities were concerned, with the S&P 500 Index down nearly three percent. The SPDR Gold ETF (GLD) opened up 0.74 percent, but was sold off in the initial minutes. When it was all said and done, the yellow metal closed up just 0.35 percent.

A month ago, when GLD finally started to move – out of two-week sideways consolidation – it quickly rallied eight-plus percent in a month (peaking at $112.12). That peak in the gold ETF came within two points of two-year resistance at $114.50. Gold had plenty of oversold conditions to unwind (and still does), but it was unable to go attack that resistance.

Medium- to long-term, the good thing, as far as gold bugs are concerned, is that the 200 day moving average is no longer dropping. It is now flattish. In the near-term, however, GLD is struggling to take out $110, where resistance goes back 10 months (see chart above).

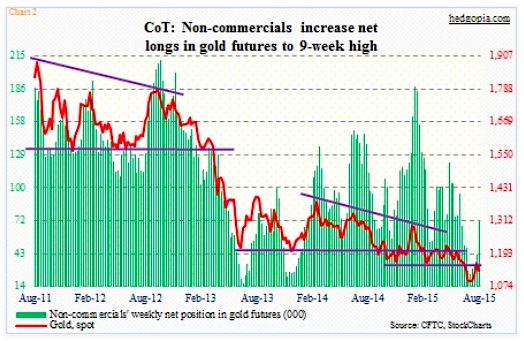

If we are to go by how non-commercials are positioning themselves, it is only a matter of time before that resistance gives way. As Chart 2 below shows, they have been adding to net longs in gold futures for a month now – up 46,268 contracts, to 70,733 as of last Tuesday’s Commitment of Traders (COT) report. These traders have done a good job of divining price swings in gold.

But if gold prices are unable to rally past overhead resistance due to Fed rate hike fears, then the issue may not get resolved until after the September 16th-17th Federal Reserve FOMC meeting. If this is the case, then traders should watch the August’s jobs report (due out this Friday). If it is strong – perceived or real – then the Gold ETF (GLD) probably comes under pressure.

Given this, it is probably not a bad idea for longs to either stay out of gold tactically or use options to earn some premium.

On July 7th, I wrote a post about Gold, wherein July 17th 111 puts were hypothetically sold for $0.60. The short put got assigned. The effective cost of $110.40 was further reduced by three weekly covered calls – earning $2.17 – to $108.23. September 4th 109 calls bring $0.94. It is a decent premium, considering that there are three sessions remaining in the week. In-the-money calls are used. If called away, this will ensure a profit of $1.71. Else, the effective cost drops further to $107.29.

Thanks for reading!

Sign up and receive our investing research and trading ideas in your inbox. No strings; it’s free.

Twitter: @hedgopia

Read more from Paban on his blog.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.