The latest round of PMI data for Europe reflects what we’re seeing across the economic sentiment indicators for the Eurozone: the strongest economic sentiment readings since 2000.

This reflects a number of key drivers in the economy and has some key implications for asset markets in Europe, particularly the Euro Stoxx 50 (NYSEARCA:FEZ) and select major European stock indices.

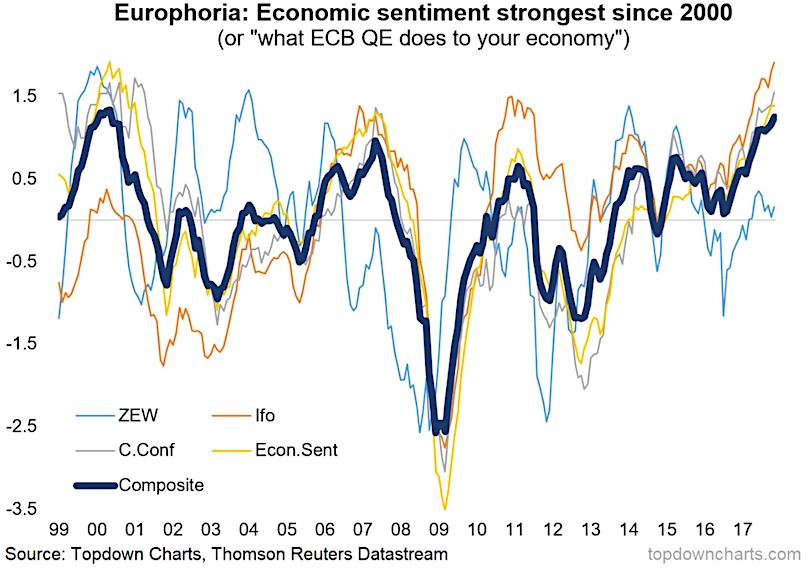

The chart below comes from my latest edition of the Weekly Macro Themes report, which is part of a wider discussion on the outlook for Europe’s economy, currency, bond market, and stock market.

The key chart presents a view of composite economic sentiment in the Eurozone, which combines several key surveys (ZEW, Ifo, consumer confidence, and the EuroStat economic sentiment index). As noted, economic sentiment in the Eurozone is extremely optimistic right now.

European Sentiment Nearing Euphoria – So What does it mean for the markets?

The strong economic sentiment reflects a couple of key factors, chief among them is the European Central Bank’s monetary stimulus program. Improvement in property prices, a weaker Euro, rising asset prices (stock and bond markets), and gradual progress on reforms are among the contributors to the improved economic sentiment. The relative calm on the political risk front is also helpful.

One thing I observed in the report is that the strong economic sentiment stands in contrast to the level of the stock market and the pace of earnings growth. The Euro Stoxx 50 is still well below the 2007 and 2000 peaks. Meanwhile profit margins and earnings growth, while much improved, are yet to regain the levels seen around 2005-07.

My view is that the extreme optimism seen towards the economy should ultimately translate through into improved earnings growth and earnings margins. This will be key for upside for European equities, particularly as the valuation argument has reduced. That is, European equity valuations are now around long term average, so they are not a value play as such. Although I would note that they continue to trade around a 20% discount to US stocks.

While political risk remains a reality in Europe, there remains the prospect of a shock in the bond markets, should this economic optimism translate into accelerating growth and inflation. For now though the main story is that of the stockmarket which has transitioned from a value play to a growth play.

Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.