The U.S. Dollar Index and its associated ETF have reached and exceeded the targets we presented last week, and they are now approaching an area of even stronger resistance. Meanwhile a popular ETF for the Euro is approaching support. We believe there will be an opportunity for countertrend trades in both currency ETFs soon, which could last until mid-summer.

Our newly released eBook highlights additional trading opportunities that are emerging this month in currencies and precious metals.

The weekly chart for the CurrencyShares Euro ETF (FXE), which corresponds to a long position in EUR/USD, shows nearby extension targets that should act as a base for an Elliott fourth wave. The path we have drawn on the chart below is speculative, as there are a variety of forms that a fourth wave can take. However, a typical retracement target measured upward from the 100.44 support level would be around 111.21. We will be able to refine the upward target when the actual price low for wave (iii) becomes clear.

Euro Currency ETF (FXE) – Weekly Chart

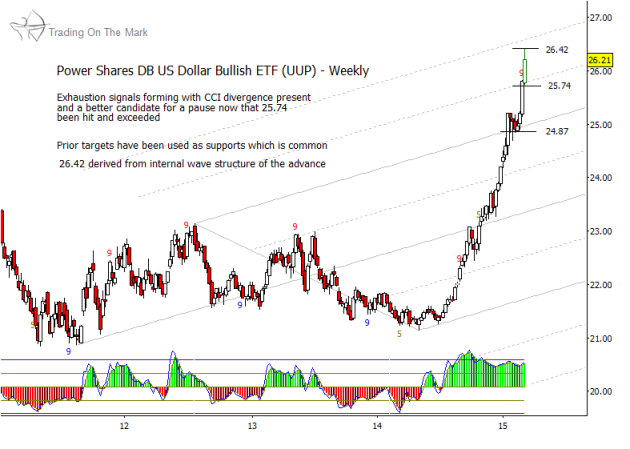

Our updated weekly chart for PowerShares US Dollar ETF (UUP), the currency ETF that tracks the U.S. Dollar Index, shows how price broke through our recent resistance target of 25.74 and tested the next resistance level at 26.42. The chart is giving several signals that traders in long positions should consider taking profits. For example, note the exhaustion signal on last week’s candle from the Wave59 “nine-five” indicator. There is also a growing divergence between price and the Adaptive CCI momentum indicator. We strongly believe a correction is due.

US Dollar Currency ETF (UUP) Weekly Chart

Thanks for reading. Have a great weekend.

Follow Tom & Kurt on Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.