In my opinion, the metals and their respective commodity currencies are preparing for a very tradable bounce. Note the use of the word “tradable”, as this type of rally will not be “long term” in nature as the metals are in established macro down trends. I see these opportunities being 4-8 weeks in duration and spawned from the extreme negative sentiment in the precious metals space, along with emerging market currencies.

As is often the case with commodities, there is a tie in to currencies. It’s like the global circle of life: relationships between asset classes can support different investment/trading ideas. One class of currencies that I like to stay in tune with is the “commodity currencies.”

A currency is a labeled a commodity currency because it typically depends heavily on the export of certain raw materials for income. The most widely followed and, therefore, liquid are the New Zealand Dollar (“Kiwi”), the Australian Dollar (“Aussie”) and the Canadian Dollar (“Loonie”). For this post, we’ll simply focus on the Aussie (more on that later).

This post is going to go into a little bit more detail around metals, currencies and ratio analysis. When I see an article like this: Commodity Currencies In Decline, I start to search for tradeable patterns that go against the grain (so to speak). So let’s look at why I think commodities and commodity currencies are setting up for a bounce.

Gold Miners & Sentiment: Just this weekend, I did a quick google search on “Gold Sentiment” and found this article:

Gold Mining: An Avalanche Of Bearish Sentiment

“TORONTO – “This is the worst I’ve seen in 30 years.”

Yep, it is getting pretty bearish. Last week, I posted about Barrick Gold Corp (ABX), one of the largest gold mining companies in the world. It hit an important downside target/level. This area should be watched closely. Note that price briefly pierced this level ($6.80) Monday but the stock opened today around this level.

The Sentiment “against” the metals is approaching or at all-time lows. Goldminer stocks that show relative strength and momentum should offer opportunity over the coming weeks.

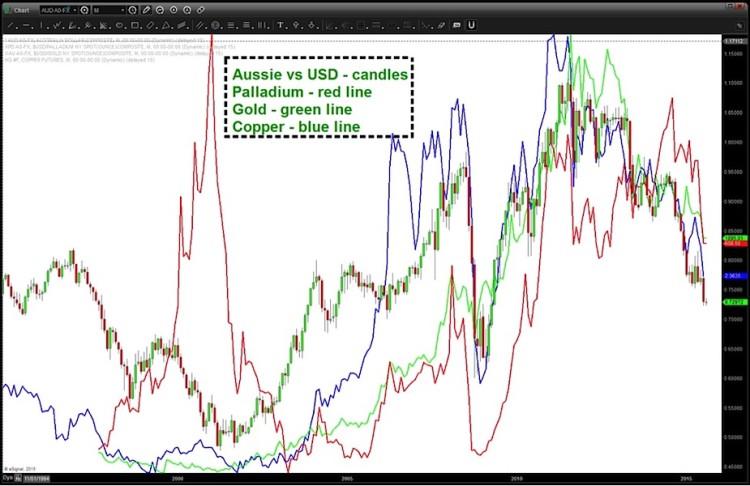

Australian Dollar with Gold and Palladium

Of all the commodity currencies, the Aussie is showing the most well defined risk zone, in my opinion. On monthly charts, I LOVE measured moves and as you can see the blue lines are exact price corrections that drive us into a zone with 7 other technical factors that point to this area as support. The “low” might be in place. We’ll just have to see…

Now let’s look at the Australian Dollar with Gold, Palladium and Copper overlaid. Take note of the inflection points (highs and lows) and how we can use these commodities to support areas of resistance and support.

Lastly, here are independent charts of Palladium, Gold and Copper:

Palladium Chart

Gold Chart

Copper Chart

Thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.