Last Thursday saw a powerful rally in stocks. Several indices went on to notch new records. The Nasdaq Composite surpassed its March 2000 intra-day high. The Russell 2000 small cap index broke out to a new high. Several others, including ETFs, broke out of recent ranges. The SPDR Consumer Discretionary ETF (XLY) belongs to the latter category. But will the breakout stick?

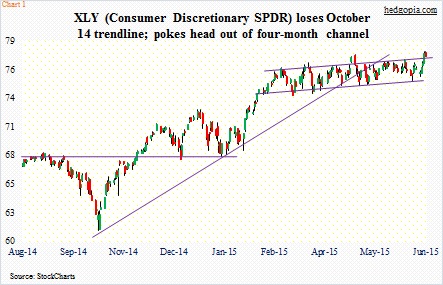

For the past four months, XLY ($77.45) has been trading within a slightly rising ascending channel. Late April, when it lost its October 2014 trendline, the subsequent drop found support on the lower end of that channel. Last Thursday, it broke out of it (see chart below). A higher high above an ascending channel can signal continuation. Shorts have a decision to make.

To refresh, hypothetically on June 1, June 5th weekly 76.50 calls were sold for $0.47. At expiration, XLY closed at $76.52, thereby creating an effective short at $76.97.

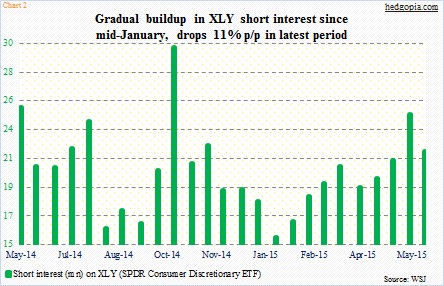

Two weeks ago, XLY once again found support on the lower end of that channel, which also approximated the lower Bollinger Band. Shorts likely got squeezed back then. By the end of May, short interest on the Consumer ETF stood at 21.9 million, down 11 percent period-over-period. But it has been gradually rising – from 15.6 million mid-January (see chart below). A rally like the one witnessed last Thursday has the potential to cause a squeeze. Mid-June numbers will be published this Wednesday.

So how do investors deal with the situation at hand?

On a daily basis, XLY is way overbought. If bulls prevail, there is room for it to run on a weekly chart, though. A breakout is a breakout, and deserves the benefit of the doubt.

Given all this, rather than covering outright for a slight loss, here is an option strategy that could either earn some premium or result in short covering for a slight gain.

Weekly June 26th 77 puts fetch $0.29. If the Consumer ETF continues to rally or goes sideways this week, a short put effectively raises the price it was shorted at to $77.26. If XLY drops below 77, the short put gets assigned, effectively covering the short position at $76.71, for a gain of $0.26.

Thanks for reading!

Twitter: @hedgopia

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.