Salt, Wampum, Benjamins – Is Bitcoin Next?

Currency was first developed about 4000 years ago. Its genius was in the ability to supplant barter thus greatly improving trade and providing a better means for storing value. As illustrated in our sub-title above, currency has taken on many different physical forms through the years.

Given the recent advances in technology, is it any surprise the latest form of currency resides in the ether-sphere? In this article we explore the basics of cryptocurrencies and the important innovation they support, blockchain. We also offer an idea about whether or not Bitcoin (CURRENCY:BTC), or another cryptocurrency, can become a true currency worthy of investment.

A Primer on Cryptocurrency and Blockchain

Cryptocurrency is an independent, digital currency that uses cryptology to maintain privacy of transactions and control the creation of the respective currency. While not recognized as legal tender, cryptocurrencies are becoming more popular for legal and illegal transactions alike. Bitcoin (BTC), developed in 2009, is the most popular of the cryptocurrencies. It accounts for over half the value of the more than 750 cryptocurrencies outstanding. In this article we refer to cryptocurrencies generally as BTC, but keep in mind there are differences among the many offerings. Also consider that, while Bitcoin may appear to be the currency of choice, Netscape and AOL shareholders can tell you that early market leadership does not always translate into future market dominance.

Before explaining how BTC is created, acquired, stored, used and valued, it is vital to understand blockchain technology, the innovation that spawned BTC. As we researched this topic, we read a lot of convoluted descriptions of what blockchain is and the puzzling algorithms that support it. In the following paragraphs, we provide a basic description of blockchain. If you are interested in learning more, we recommend the following two links as they are relatively easy to understand.

The Ultimate 3500-word guide in plain English to understand Blockchain – Mohit Mamoria

A blockchain explanation your parents could understand – Jamie Skella

Blockchain is an open database or book of records that can store any kind of data. A blockchain database, unlike all other databases, is stored real time and is accessible for anyone to view its complete history of data.

The term block refers to a grouping of transactions, while chain refers to the linkages of the blocks. For instance, when a Bitcoin transaction is completed Bitcoin “miners” work to solve the cryptology algorithm that will enable them to link it to the chain of historical transactions. As a reward for being the first to solve the calculation, the miner receives “newly minted” Bitcoin. As the chain grows, the effort needed to solve and verify the algorithms increase in complexity and demand greater computing power. As an aside consider the following statement by Bitcoin Watch (courtesy Goldman Sachs): “BTC worldwide computational output is currently over 350 exaflops – 350,000 petaflops – or more than 1400 times the combined capacity of the top 500 supercomputers in the world.” Needless to say, a tremendous amount of computing resources and energy are being used by Bitcoin miners, and it is still in its infancy. Could these resources be better employed in other industries, and if so, how much productivity growth is Bitcoin (and the like) leeching from the economy?

The takeaway is that blockchain is an open, real-time database that provides anonymity to its users. It is not controlled or regulated (yet) by any government. Bitcoin (BTC) miners, driven by the incentive to earn BTC, and fees at times, verify and authenticate the database. Blockchain technology is incredibly powerful and will likely revolutionize data management regardless of whether cryptocurrencies thrive or disappear.

BTC

Bitcoin Mining (Creation): New Bitcoins are created as payment to BTC miners that solve the aforementioned calculations that verify transaction data and link it to the blockchain. This ingenious reward system incentivizes miners to compete to perform these calculations, enabling the blockchain to exist. Currently there are approximately 16 million bitcoins outstanding out of a proposed limit of 21 million. As the blockchain grows, the calculations required to mine BTC and add to the chain become more complex, making each bitcoin harder and more costly to earn than the prior one.

Obtaining and Storing Bitcoin: Other than mining Bitcoin, the only other way to obtain them is via transactions and exchanges. One can earn bitcoin by selling a product or service to someone willing to pay in BTC, or one can purchase them with traditional currency through a BTC exchange. BTC can be exchanged for cash or goods and services in a similar fashion. There are reportedly over 100 BTC exchanges, and BTC ATMs are gaining in popularity. BTC’s are stored in a so-called “wallet”. Wallets may reside on a mobile phone or a desktop computer. The decision to use one versus the other largely comes down to a trade-off between security and ease of use.

Transacting with Bitcoin: Each wallet has a unique key which serves as a personal identifier. When one wishes to transact, the buyer and seller swap their personal keys and the transaction information is posted for miners to verify and post to the blockchain. The identity of the buyer and seller is never revealed. This is one reason that black market, money laundering and tax avoidance transactions are popular on BTC exchanges. While not 100% accurate, you can think of a BTC transaction process as similar to a debit card transaction, but instead of banks verifying, approving and transferring cash to fund the transaction, miners fill that role.

Valuing Bitcoin: Valuing BTC is just like valuing any other currency. One can compare BTC to U.S. dollars or to any other currency. One can also compare the value of BTC to its purchasing power or what one may buy given a set amount of BTC. Currently, BTC is rising rapidly versus all major currencies thus its purchasing power is following suit. As marginal interest in BTC versus sovereign nation currencies increases, the rise in value could continue.

In trying to provide a succinct summary of BTC, we left out many details which you may find pertinent and/or interesting. As blockchain technology represents an important innovation and will certainly find many other uses besides cryptocurrencies, we would encourage you to apply further rigor and read beyond the scope of this article.

BTC – Currency or Investment Fad?

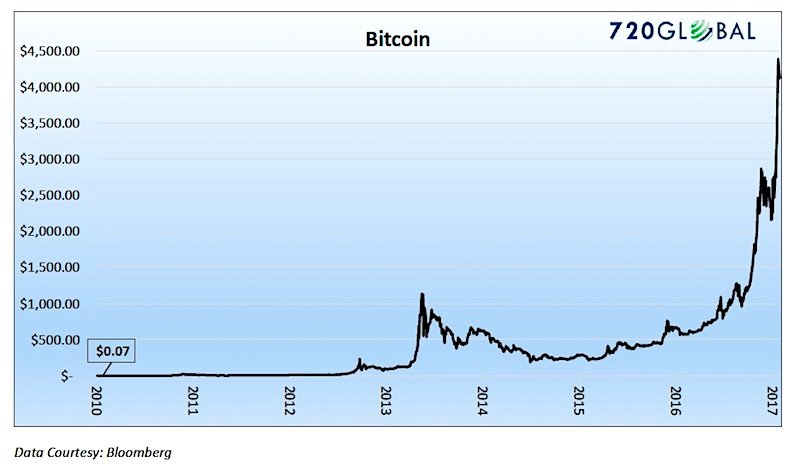

Since BTC started trading in July of 2010, it has risen over 51,000 percent! This meteoric rise in the price of a bitcoin, as graphed below, has certainly attracted many traders and speculators to the cryptocurrency space. While price gains are certainly drawing short term players, others are buying it for its promise as an alternative currency. It is this aspect of BTC that we believe is most relevant.

BTC is a pure fiat currency, meaning it is backed by nothing tangible other than the value users ascribe. Currencies, whether fiat or hard money (backed by something tangible of value) derive value from their utility and scarcity. As the Weimar Republic and many other nations throughout history have learned, economic disasters occur when governments ignore the value proposition and recklessly print money.

The U.S. dollar, also a fiat currency, is backed by the full faith and credit of the United States as well as a small amount of gold. While some may not ascribe too much value to “faith and credit”, almost 250 years of economic progress, military might, and the most powerful tax base in the world strongly argue otherwise. The dollar is globally accepted for almost any kind of transaction, and, despite recent actions of the Federal Reserve, dollars remain relatively scarce. Put another way, even billionaire Bill Gates would stop to pick up a dollar bill laying on the ground. Visit a third world nation and notice how many vendors not only accept U.S. dollars but encourage their use over the domestic currency.

The question investors, not short term speculators, are tasked with answering is, “Will enough people value BTC to make it a respected and often used currency?” In our opinion, the most crucial information needed to answer that question is understanding how governments will respond to the rise of BTC. Gaining a sense for what is at stake for existing currencies and the economies that employ those currencies offers keen insight into the future of BTC and its ability to become more than an afterthought in global trade.

The preamble to the U.S. Constitution states the purpose of the Federal government is to: “form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity.” In other words the government’s role is to protect the freedoms and liberties of its citizens. If the government has no ability to fund itself and is unable to provide defense and law enforcement it cannot uphold the Constitution. More precisely – the sovereignty of any nation, regardless of its form of government, rests upon the strength and integrity of its currency.

All transactions, and their participants, that occur with BTC are anonymous. Accordingly taxes cannot be efficiently assessed, black market transactions are made easier, and fraud can easily escape the eye of law enforcement.

If BTC continues to gain in popularity there is little doubt in our opinion the government will seek control or at a minimum the personal data from the transactions. In fact the SEC has recently opined on the matter claiming that “tokens” such as BTC can be deemed securities and may need to be formally registered. This is just a first step but given the potential threat, we envision government will impose a way to remove the secrecy BTC offers, allowing taxation and legal supervision to occur.

We strongly believe the government will not allow BTC to become a full-fledged currency, at least in its current form, but we think they are enamored with the technology. It is possible that a deeply regulated and controlled version of BTC or a new government cryptocurrency could at some point usurp the dollar as we know it today.

Before summarizing this article we leave you with a few pros and cons of BTC:

Pros

- BTC is unregulated, allowing users to avoid taxes or any other kind of governmental, banking, and law enforcement scrutiny.

- BTC is in limited supply which should help it to retain its value over time. We caveat that with the fact that there are many competitors, each with their own rules about creation.

- BTC creation is not subject to the whims of central bankers that appear constantly looking to devalue their respective currencies via inflation.

- Transacting in BTC is easy. As more sellers of goods and services accept BTC its flexibility improves.

- Typically storing BTC is less expensive than most other national currencies as well as precious metals. Additionally, transaction fees and other banking costs are largely avoided.

Cons

- Bitcoin is unregulated. Regulations to enforce market structure and prevent fraud are not available.

- There are over 750 cryptocurrencies and the number is growing rapidly. Which one will emerge as the dominant currency beyond the first mover stage? Conversely, which ones will fail and leave holders with nothing?

- BTC security is not fool proof. Wallets have been hacked on both desktop computers and mobile phones. Due to the anonymous nature of the exchanges, remediation of such actions is difficult.

- Price volatility makes accepting BTC a risky proposition. Accordingly transaction fees are becoming popular by many merchants.

- The energy costs and computing power associated with mining BTC is massive and will increase as the complexity of the blockchain and the number of users grow. Seemingly these resources could be put to better use.

Summary

The U.S., E.U., Japan, China and Great Brittan have devalued their currencies significantly over the past ten years. The recent success of cryptocurrencies is a meaningful sign that central banker actions have not gone unnoticed by the users of traditional currencies. While we applaud the concept of a currency that is scarce and avoids the whims of bureaucrats, we do not own, nor do we have plans to own cryptocurrencies in the future. The current market is one of significant volatility and heavy speculation. Additionally, the bigger concern is that global governments have the means to make or break cryptocurrencies. Until these powers more fully reveal their intentions on BTC, the risks are too speculative to warrant involvement.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.