The lifeblood of the U.S. economy is the consumer. And this shows its face through the SPDR Retail Sector (XRT).

Retail has been a MAJOR under-performer for the past several months, warning that the economy is in worse shape than analysts contend.

Many pundits have written off inflation as a mild impediment. BUT this round of inflation is worse than many expected. Food prices are significantly higher than a year ago and energy continues to be an uncertain cost as geopolitical issues continue to bubble up around the globe.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

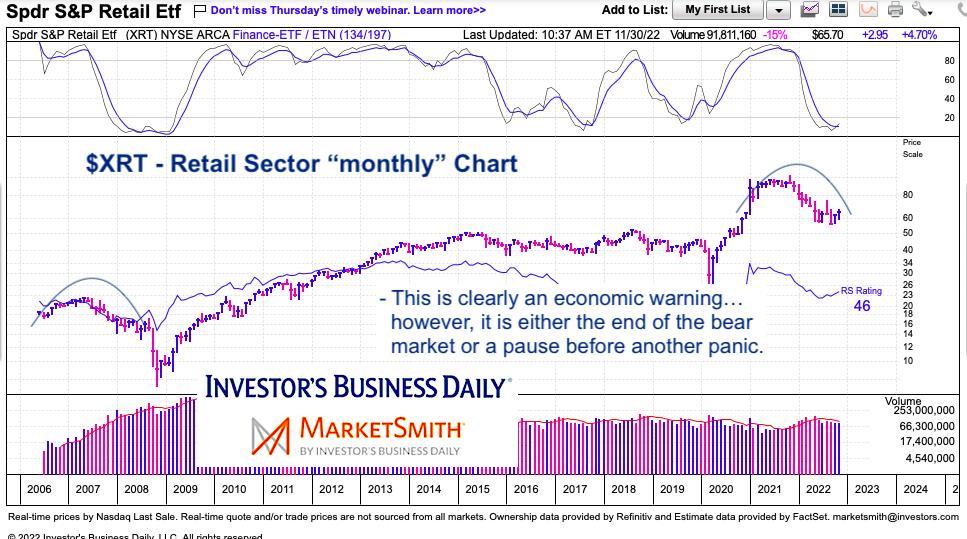

$XRT Retail Sector ETF “monthly” Chart

The retail sector is nearing a critical inflection point. We are in a bear market and the economy is hurting… but could it get worse? This was the question in 2008, and a similar pattern broke down and caused a panic.

Investors will simply need to watch the recent lows. XRT is oversold and weak. New lows would warn that another drop across the markets could be imminent.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.