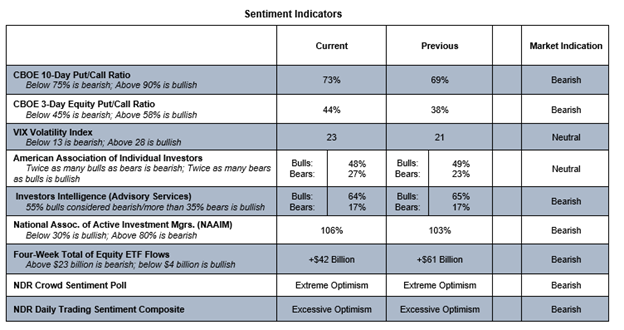

The sentiment indicators continue to show excessive levels of optimism, even considering the tendency for investors to have plenty of good cheer this time of year:

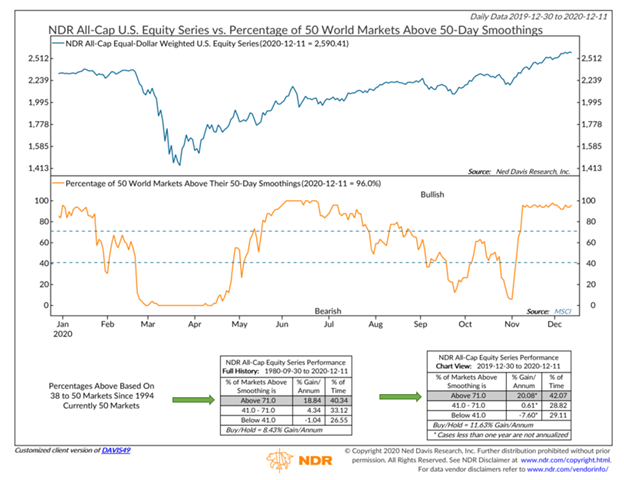

For all of the noise and “never befores” in 2020, some important things held remarkably true to form. Among these is the importance of the broad market when it comes to determining the health of a rally. US stocks struggled this year, as they normally do, when most areas of the world were moving lower (e.g. below their 50-day averages) and they soared when most areas of the world were moving higher (e.g. above their 50-day averages). With more than 90% of global markets above their 50-day averages, the breadth backdrop right now remains bullish.

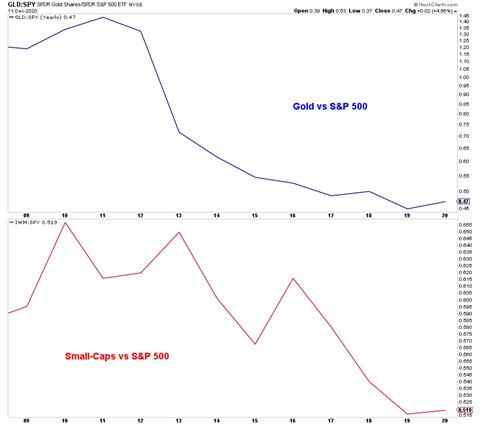

Accompanying the bounce back in the broad market, 2020 saw the emergence of new leadership. For the first time in over a decade, both Gold and Small-caps are poised to outperform the S&P 500 on an annual basis.

The Bottom Line: Stock valuations are stretched and investor optimism is almost off the charts. Those headwinds become more acute in the face of deteriorating breadth and collapsing liquidity. That is not currently the case. Breadth remains strong with new highs expanding (last week saw the most new highs since 2016) and most areas of the market in uptrends. The weight of the evidence has us looking higher as we anticipate the New Year. The leadership trends that emerged in 2020 are likely to carry into 2021.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.