Over the past several weeks, the answer to this question is yes. Over the past several months, the answer to this question is maybe.

Different timeframes provide different perspectives (i.e. trading vs investing).

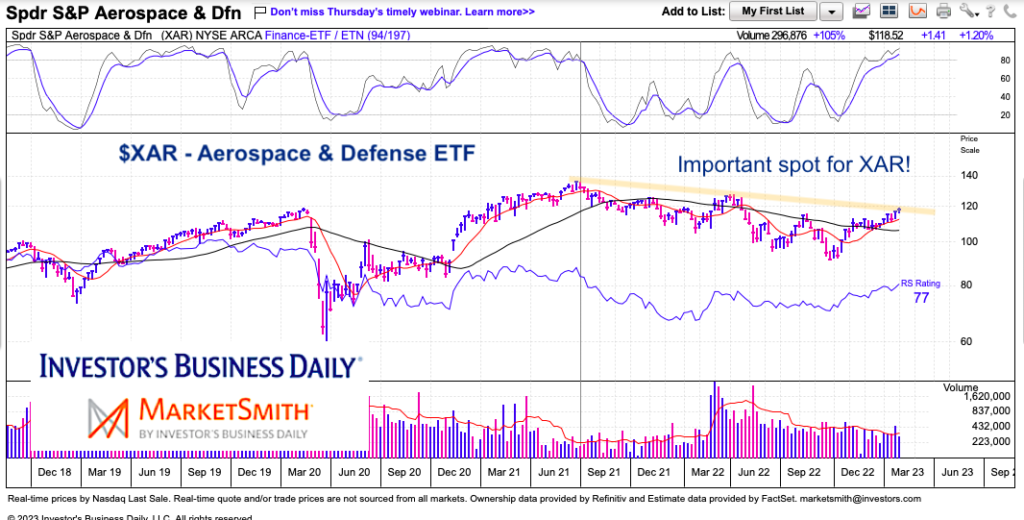

Today’s “weekly” chart of the Aerospace and Defense ETF (XAR) is simple, yet important. Price has rallied with strength and now faces important resistance.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$XAR Aerospace & Defense Sector ETF “weekly” Chart

A very strong rally has bulls thinking about a potential retest of all-time highs. But this cannot happen until we see a decisive breakout and weekly close over the down-trend line with follow through. Note that the 40-week moving average is attempting to flatten out but not quite there and volume has been a bit light.

The prospect of international war makes this a sector to keep on your radar. Just keep stops tight in case of a false move in either direction.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.