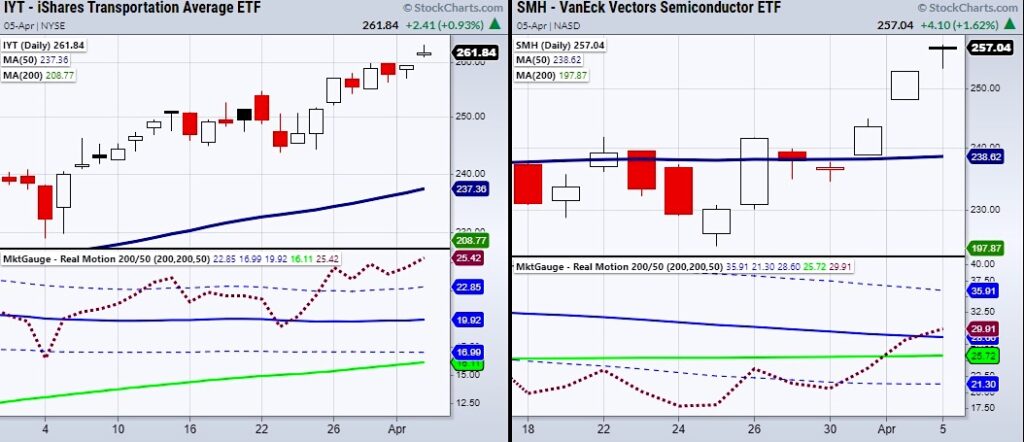

The Semiconductor Sector ETF (SMH) and Transportation Sector ETF (IYT) are the strongest ETFs in our Economic Modern Family that we monitor and trade. They are both in a bullish phase in price and in momentum.

We are measuring momentum based on MarketGauges proprietary indicator RealMotion.

RealMotion was designed to show hidden strength/weakness in a security based on momentum.

Additionally, the Economic Modern Family was created as an easy way to view the condition of the overall market as well as spot upcoming trends.

The other members include the Russell 2000 (IWM), Retail (XRT), and Regional Banks (KRE) which are in a bullish phase.

Biotech (IBB) is the only member sitting in a cautionary phase.

A bullish phase is when the price is over the 50-Day Moving Average (DMA) while the 50-DMA is over the 200-DMA.

A cautionary phase is almost the same with the only difference showing up in the price sitting under the 50-DMA.

As seen in the charts above, RealMotion agrees with the price action for both SMH and IYT.

Having said that, other Family members are having a negative divergence.

This can be seen in IWM with the price over its 50-DMA but with RealMotion showing under its 50-DMA.

Therefore, watch for opportunities in the Semiconductor and Transportation sector as they are showing the most strength in the current market situation.

And also watch to see if IWM, XRT and/or KRE wind up becoming a drain or just need to catch up!

ETF Summary:

S&P 500 (SPY) New All-time highs.

Russell 2000 (IWM) support 221.26.

Dow (DIA) New All-time highs.

Nasdaq (QQQ) 338.19 high to clear. Support 321.22

KRE (Regional Banks) Holding over the 10-DMA at 66.24.

SMH (Semiconductors) 258.59 high to clear.

IYT (Transportation) 258.59 high to clear.

IBB (Biotechnology) 145 support. 150.28 the 10-DMA

XRT (Retail) 88.20 support the 10-DMA

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.