Last week we saw devastating economic numbers – retail sales, industrial production, and housing have all hit new lows.

Now 22 million people have applied for unemployment benefits over the past four weeks erasing most of the job gains of the past decade.

But yet last week the S&P 500 Index and broader stock market indices advanced for the second week in a row.

The economic data is more about what has occurred in the past. Markets look ahead.

The sentiment in the current market is clearly focused on an eventual rebound rather than the bleak economic numbers.

There were several signs of hope last week that inspired investor optimism: a report from Gilead Sciences that it is showing positive results in clinical trials on a treatment for COVID-19; data suggesting a flattening of the curve of the pandemic infection across major economies; and the release of a plan by the Federal Government to re-open the economy in phases.

Additionally, and possibly most important, the massive fiscal and monetary stimulus and the Fed stating that as far as lending is concerned, they are not going to run out of ammunition has boosted investors’ confidence.

What indicators will show that an economic recovery is underway?

It remains to be seen if the massive fiscal and monetary stimulus will be enough to support a quick economic rebound. A more likely scenario is, based on a gradual reopening of the economy in phases beginning in mid-May, that with social distancing, testing, and temperature checks, a slower recovery will lead to profit growth returning in the first quarter of 2021.

Currently 24 states believe they meet the criteria to open their economies for Phase One. Texas and Vermont will open some of their businesses today.

1 – An economic recovery depends on containment of the COVID-19 virus. No matter how much stimulus the Federal Reserve throws at this, recovery in the economy will hinge on a decrease in the number of cases of the virus in the major metropolitan areas (which we are currently seeing) and a decrease in the number of deaths from the virus.

2 – Leading indicators, including weekly jobless claims and the four-week average of claims, should begin to show improvement in order to confirm that economic conditions have begun to improve.

3 – The Dow Jones Industrial Average trading above its 200-day moving average, oil prices above $30 per barrel, and copper prices above their 200-day moving average would suggest the economy is on the rebound.

Market Technicals

Leadership in the market is confined to only a few large-cap stocks, mainly a limited number of technology stocks, consumer staples and healthcare stocks, while most stocks within the S&P 500 Index are trailing and small-caps have lost ground. Leadership tends to shift to more aggressive sectors before an important sustainable advance.

Entering the new week only 26% of S&P 500 stocks are trading above their 200-day moving average and 39% are trading above their 50-day moving average. We need to see more than 60% of stocks trading above their 200- and 50-day moving averages to declare that a sustainable uptrend is underway.

What’s next?

In a recession, prices usually plummet. In almost all pullbacks, stocks retest their lows. It is most common in bear markets for exhaustive selloffs to be followed by extraordinary rallies and then retests of the lows. Historically a retest occurs 70% of the time.

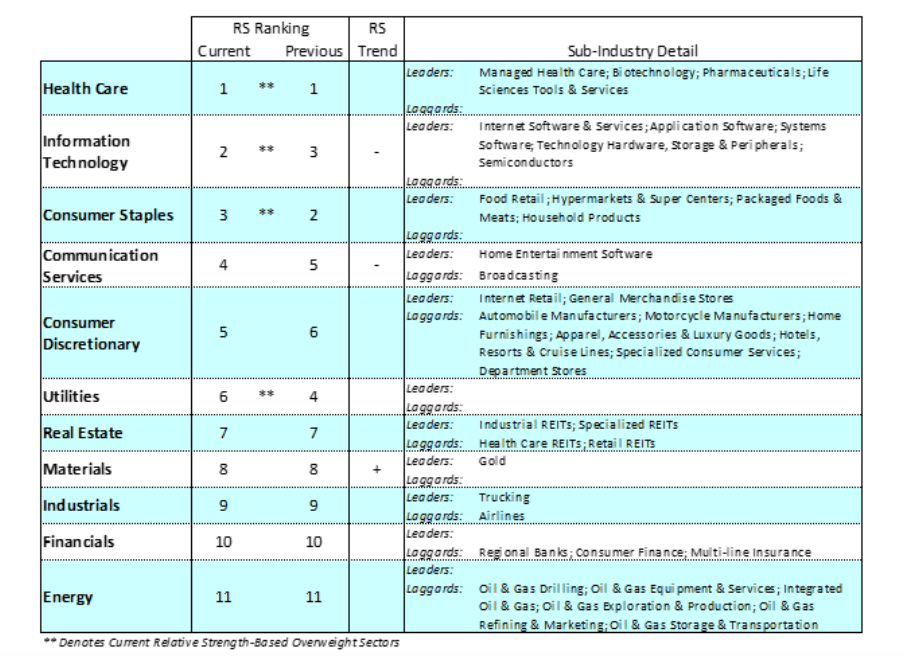

The strongest sectors in the current market are almost the same (with the exception of technology) as the strongest sectors in the 2008 recession: healthcare (managed healthcare, biotechnology, pharmaceuticals, science tools and services), information technology (internet software, application software, systems software, storage and peripherals, semiconductors), consumer staples (essential products, household goods, food retail, super centers, packaged food) and communication services (home entertainment software).

We will likely see ongoing volatility as investors react to hopefully good news regarding the virus and the inevitable bad news regarding the economy. It is important to have a plan, stay disciplined and not sell on panics or buy on euphoria. Investors should use rallies and pullbacks in the market to rebalance their portfolios to fall in line with their desired goals and risk tolerances.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.