The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon and published on their website.

When a company the size of Palo Alto Networks (PANW) confirms a Friday after-the-bell earnings date, we pay attention, especially when it’s never reported at that time before.

At Wall Street Horizon we are always on the lookout for companies that confirm outlier earnings dates, and while this is an outlier as far as day-of-the-week is concerned, the actual date in question is just slightly earlier than when PANW would typically report.

Palo Alto Networks FQ4 2023 Report Date

Palo Alto Networks has reported fiscal Q4 results from 8/22 – 8/24 for the last three years, on a Monday after-market-close (AMC). The prior seven years of reports had been much later, from 8/30 – 9/9, with no day of the week trend.

Due to the 3-year trend we had assumed a report date of Monday, August 21 AMC. Instead, on August 2 PANW confirmed they would report August 18 AMC, the first ever Friday report since they IPO’d in 2012.

An Attempt to Hide Bad News?

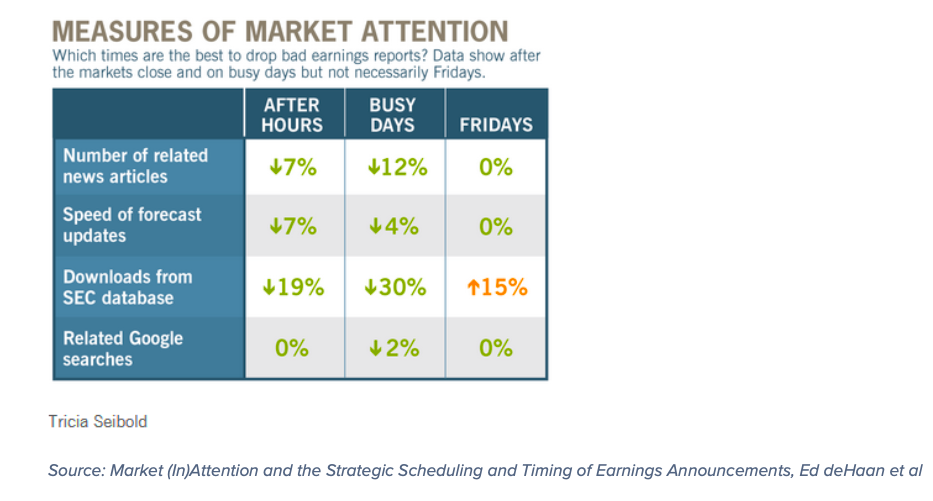

It’s been a well-known tactic for years that companies try to hide their bad earnings reports during times when there is less market attention. That typically means on busy days, after hours, and Fridays. It makes sense that investors would be paying less attention to the markets on a Friday afternoon just as they are kicking their shoes off for the weekend. However, the 2015 academic paper “Market (In)Attention and the Strategic Scheduling and Timing of Earnings Announcements” by Ed deHaan of Stanford University, found using Wall Street Horizon data that while there is actually less attention on busy days, after hours, and when a company confirms with less advance notice, attention does not necessarily wane on Fridays.

But even though investor attention is still intact on Fridays, the research shows that earnings reported after hours, on busy days, and even on Fridays, are significantly worse (relative to Wall Street Expectations) than at other times. Because this seems to be the case, even announcing a Friday AMC report date dings a stock, just as we’ve seen with PANW. Since confirming their FQ4 2023 report date on August 2, the stock has fallen ~15%.

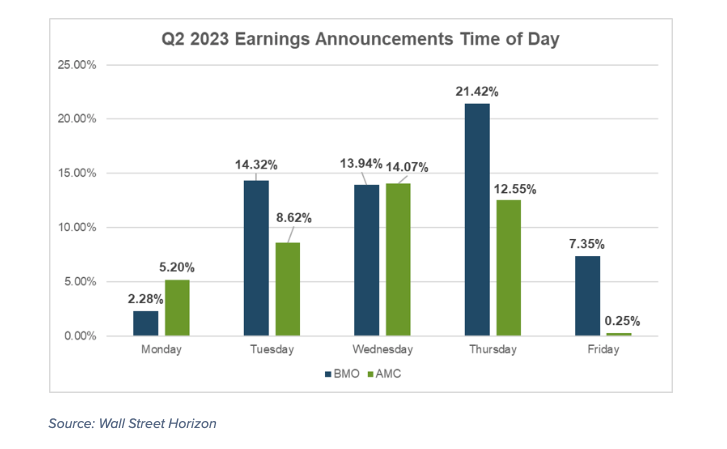

Friday Afternoon Earnings Reports – A Rarity for Large Caps

How rare is a Friday AMC earnings report? Just to put it in perspective, for the second quarter earnings season we screened for companies with market caps over $10B and found that in addition to Palo Alto Networks, only Toronto-based Constellation Software (CSU) confirmed a Friday AMC date. Constellation reported on August 11, and it was the second time in their xx years as a public company that they reported at that time. They did indeed have some bad news to share, which came in the form of an 18% YoY profit decline. Since their report the stock has fallen 3%.

Recent Cybersecurity Results

The very next day after PANW confirmed their odd earnings date, peer cybersecurity name Fortinet (FTNT) reported quarterly results that missed revenue expectations and warned that deals were being delayed due to macroeconomic uncertainty. Fellow cybersecurity names, including PANW, saw their stocks fall as a result. More recently, on August 14, Cyberark (CYBR) reported better-than-expected results for the quarter, lifting cybersecurity stocks.

On Friday we’ll see whether PANW will go the way of FTNT or CYBR, and whether there was anything to their Friday AMC report date.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.