This article was written by Andrew Fleming, CFA – Portfolio Manager.

The conflicted macro backdrop was reflected in performance where there was no clear pattern of winners and losers in either cyclical or defensive areas.

For example, traditionally defensive areas such as Real Estate and Consumer Staples lagged but Utilities and Health Care were up.

Instead of following a risk-on/risk-off view, investors gravitated to areas with strong momentum.

The rush into momentum continued a familiar trend and further stretched already elevated valuations. Meanwhile, some attractively priced areas where fundamentals appear to be improving failed to keep pace.

Market Outlook:

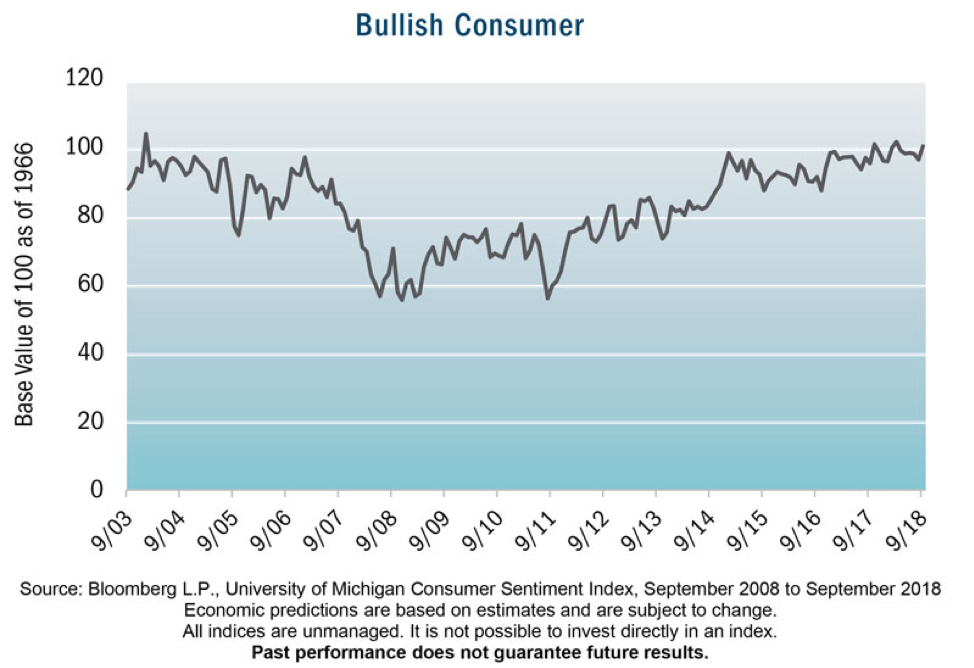

Economic data continues to reflect a buoyant economy. A focus on hard data as opposed to the latest speculation about the impact of upcoming elections and rising interest rates reveals a backdrop where corporate earnings are up, unemployment is at lows not seen in several decades, and manufacturing activity remains strong. Conversely, the accelerating pace of rising rates, China trade issues, and November elections could pose real risks to further expansion.

We remain confident in the strength of the economy but recognize that with major indices hitting new highs, investors face increased risks of an outsized reaction to headlines and stock specific news. We also acknowledge the pace of growth will ebb and flow, and so we are focused on owning businesses that:

1) Have strong or improving balance sheets

2) Are well positioned to expand operating margins through self-help initiatives and idiosyncratic catalysts

3) Are generating strong free cash flows, and

4) Are undervalued.

We continue to believe businesses with opportunities to reduce costs and improve margins through internally focused efforts should be well-positioned to capitalize on operating leverage in an expanding economy or modestly grow earnings should sales plateau.

Heartland Advisors Disclosure: “Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in this article are those of the presenter. Any discussion of investments and investment strategies represents the presenter’s views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Heartland Advisors defines market cap ranges by the following indices: micro-cap by the Russell Microcap®, small-cap by the Russell 2000®, mid-cap by the Russell Midcap®, large-cap by the Russell Top 200®.

Small-cap investment strategies, which emphasize the significant growth potential of small companies, have their own unique risks and potential for rewards and may not be suitable for all investors. Small-cap securities are generally more volatile and less liquid than those of larger companies.”

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.