On Wednesday, the Federal Reserve downgraded its economic outlook while at the same time implying that the committee is considering raising rates (they are no longer “patient”, if you will!). So on one hand they acknowledged that the economy isn’t doing so hot, but on the other they said that they are open to raising rates later this year. Yup, some good old fashioned Fed doublespeak.

But it worked in getting the financial markets all lathered up as an “easy” Fed sounds pretty good. But at the same time, bonds also received a bid on the uncertainty surrounding U.S. economic growth. So, we now we have a rally in stocks and bonds underway. And I believe that this dynamic should be monitored as the two should diverge at some point soon, possibly as early as next week. And this could be an important market ‘tell’.

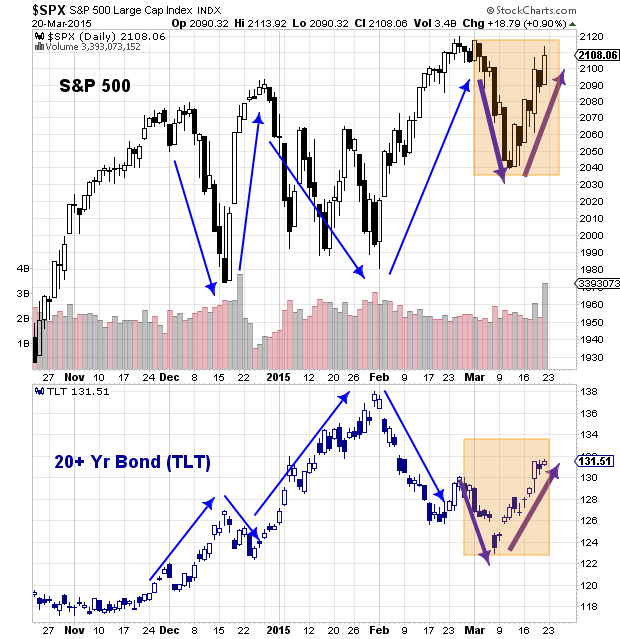

For context, let’s look at the recent performance of the S&P 500 versus the popular bond fund ETF, the 20+ Year Treasury Bond Fund (TLT). As you can see in the chart below, when stocks have topped, bonds have bottomed (and vice versa). Now this isn’t by any means a perfect correlation because over longer periods, they can both move in the same general direction.

But, it’s rare to see these two asset classes mirror each other in lock step over shorter periods. Now look at the orange area on the chart. For the past 3 weeks stocks and bonds have been moving in unison. Which one will blink first?

Note that the 10 and 30 Year Treasury Bonds are showing similar price patterns.

Should bonds head lower again, it could confirm the rally in stocks. Or should they consolidate before heading higher again, it could coincide with a pullback in stocks. Food for thought.

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.