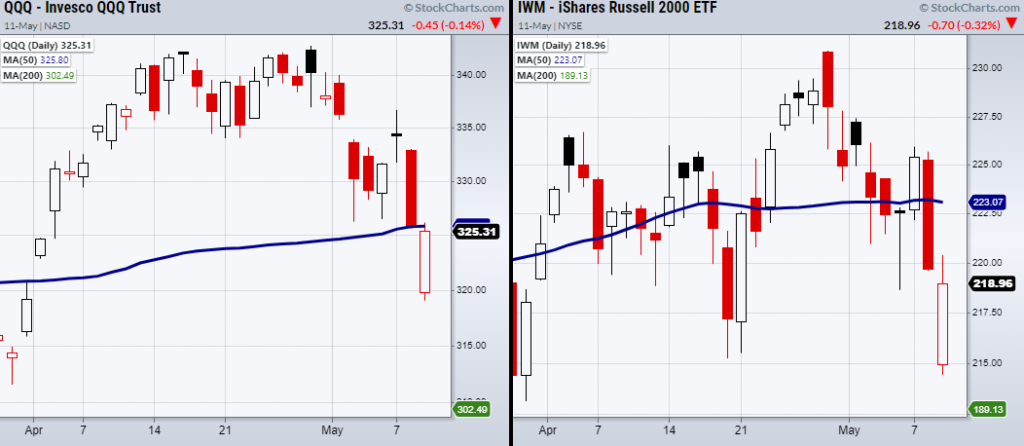

On Tuesday, the Nasdaq 100 (QQQ), Russell 2000 (IWM), and S&P 500 (SPY) gapped lower before rallying to take back some losses.

One of the most important stock market indices to gap lower was the teach heavy index ETF, QQQ.

This is important because big tech companies were the first to lead the rally created from the pandemic back in March of last year.

With tech leading the charge higher, it has also been a cause for worry if it were to weaken. If so, it could be signaling that overall market strength is lessening or fear from other things like inflation is gaining weight.

With that said, the QQQ also broke an important support area created not only by the 50-Day moving average but also from consolidation in price action going back to this March.

Similarly, the small-cap index broke its 50-DMA. However, IWMs’ price action is much sloppier with it repeatedly trading around the 50-DMA for over a month.

Additionally, the SPY and the DIA are holding a bullish phase with price trading over their 50-DMA.

Therefore, the QQQ is key as it is sitting in a very pivotal area. If it can clear back over its 50-DMA at $325.9 and hold this will look good for the coming week.

On the other hand, if the QQQs cannot clear back over the 50-DMA, stay cautious as fear could trigger a greater selloff.

To see updated media clips, click here: https://marketgauge.com/media-highlights-mish/

ETF Summary

S&P 500 (SPY) 411 support area.

Russell 2000 (IWM) Like to see this hold over 217.

Dow (DIA) 342.43 pivotal area.

Nasdaq (QQQ) Needs to clear back over the 50-DMA at 325.91.

KRE (Regional Banks) 67.83 support.

SMH (Semiconductors) Filled the gap at 232.38.

IYT (Transportation) Held the 10-DMA at 273.59.

IBB (Biotechnology) Cleared back over the 200-DMA at 146.91.

XRT (Retail) Bounced off the 50-DMA at 90.59.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.