While consumers continue to face sticker shock when filling up their gas tanks, buying groceries or even paying rent, the debate among economists and investors continues to focus on whether recent spikes in prices are temporary.

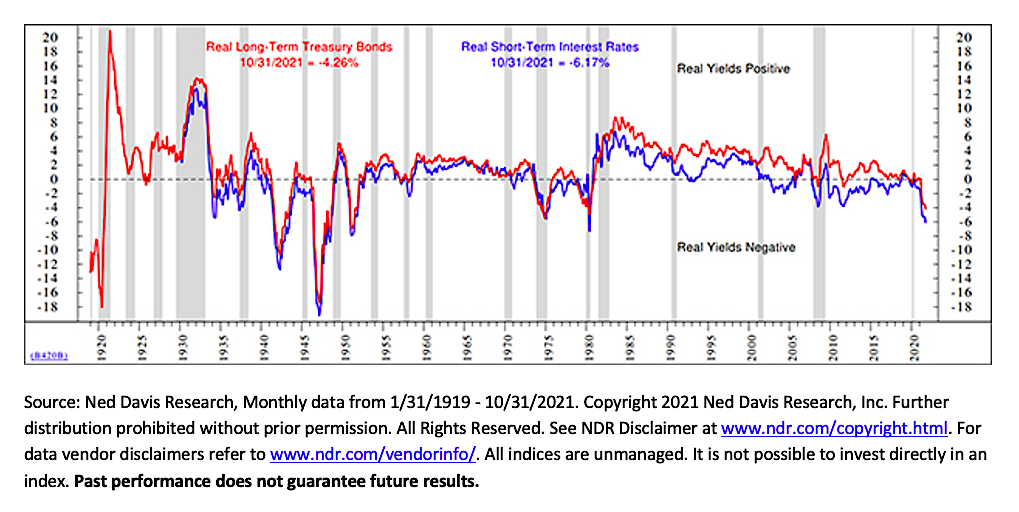

Judging by U.S. treasuries, where real yields on short- and long-term bills are stuck in negative territory, as shown in the chart below, the consensus remains that the surge in prices is transitory.

But what if the predictive prowess of treasuries is missing the mark?

It wouldn’t be without precedent. From roughly 1975 through 1979 consumer prices exploded while the treasury markets failed to keep pace with the stubborn nature of escalating costs. The result was negative inflation-adjusted yields for U.S. government-issued debt, while equities averaged double-digit annual gains.

The most striking performance for stocks was in small cap value, which posted annualized returns of over 36% during the stretch, almost triple the returns for large growth stocks.*

With value stocks, investors generally expect that earnings growth rates will be stable, while in periods of low inflation, investors exhibit a willingness to pay up for growth stocks on expectations of significant earnings expansion in the coming years. However, when inflation is high, future earnings are worth less in today’s dollars as purchasing power is eroded. Whether inflation is transitory or long-lived, we believe the current complex economic backdrop offers ample opportunities for individual companies to distinguish themselves in the eyes of investors.

This dynamic should benefit active investors who focus on fundamentals and identifying catalysts for positive change. If cost pressures persist, the benefit could be even more pronounced among attractively valued businesses.

This article was written by Will Nasgovitz, CEO and Portfolio Manager.

Disclosure:

*US Small Cap Value data is calculated using CRSP Data.

Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

There is no guarantee that a particular investment strategy will be successful.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

Portfolio holdings are subject to change without notice. Current and future portfolio holdings are subject to risk.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Growth and value investing each have unique risks and potential for rewards and may not be suitable for all investors. A growth investing strategy emphasizes capital appreciation and typically carries a higher risk of loss and potential reward than a value investing strategy; a value investing strategy emphasizes investments in companies believed to be undervalued.

Economic predictions are based on estimates and are subject to change.

Definitions:

Active Investing is an investment strategy involving ongoing buying and selling actions by the investor. Active investors purchase investments and continuously monitor their activity in order to exploit profitable conditions. Growth Rate represents the rate of growth of equity securities within the Fund’s portfolio and is not meant as a prediction of the funds future performance, income earned by the Fund, or distributions made by the Fund. There can be no assurance that a company’s actual earnings growth rate will be consistent with the estimate. Inflation Risk is the possibility that the value of assets or income will decrease as inflation shrinks the purchasing power of a currency. Treasury Bond is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years. Treasury Yield is the effective rate of interest paid on a debt obligation issued by the U.S. Treasury for a specified term. Yield is the income return on an investment.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.