Where We Are

The U.S. stock market has been hammered over the last two weeks as the coronavirus shut down business across the country and jobless claims spiked.

Additionally, the speed of the decline has been exacerbated by the oil shock when Saudi Arabia increased its production output and sent worldwide energy prices spiraling downward.

U.S. Treasury securities fell to record lows.

We are looking at real contraction in the U.S. economy. Social distancing will have a major impact on economic growth.

U.S. industries will face difficulties created by global supply chain disruptions and overseas weakness will also weigh on U.S. exports.

What is being done to curb spread of the coronavirus?

We know that the virus will be contained because it has been contained in China, South Korea, and several other countries are reporting stabilization. However, things will look worse for a while because we will see more cases of the coronavirus emerge because we are doing more testing.

The good news is that it appears that a great job is being done to slow the spread of the coronavirus. Governments, individuals and businesses are stepping up to hopefully contain this virus and to contribute to a strong recovery.

The Federal Reserve has been working fast to flood the market with liquidity. Thirty-eight central banks have lowered interest rates and many are buying bonds and setting up emergency loan programs in order to keep businesses solvent and people employed and paid so that when the virus is contained people can go back to their jobs and businesses can rebound.

The news changes so rapidly on this virus. As I write this memo, Congress announced it could not come to an agreement on a massive stimulus package that would include income replacement for households and is designed to help small to mid-size companies borrow money, with loan forgiveness.

Additional stimulus would be made available for lending to other distressed companies. The news of the stalemate in Congress on Sunday night sent the equity futures trading limit down 900 Dow points Sunday evening. Best guess is that the bill will be rewritten with similar language and passed sometime on Monday.

Where are we headed?

According to U.S. Treasury Secretary Mnuchin, if the virus can be contained within the next couple of months, the likelihood is we would see a tick-up in third-quarter GDP and a sizable rebound in the fourth quarter with low interest rates, low energy prices and pent-up demand.

If this goes into summer, it will be harder to bounce back because layoffs will accelerate and some businesses will fail. Whether the U.S. falls into recession depends on the duration of this virus and whether GDP growth ticks back up in the third quarter or remains in negative territory. However, it is more important to focus on how fast the economy can rebound once this virus is contained.

Will we see a fast or prolonged recovery in the stock market?

Investor confidence will rely on seeing a slowdown in new cases of the coronavirus and if there is a sense that the Administration and Congress are moving quickly. Brian Skorney, Baird Senior Research Biotechnology Analyst, believes the peak pain in the U.S. will be somewhere between two and four weeks from now.

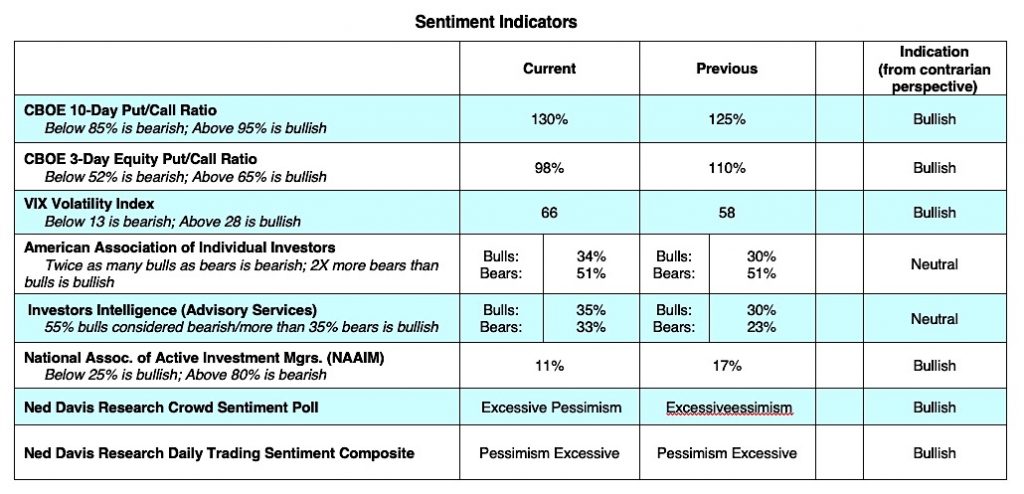

It is difficult to rely on fundamental analysis with price and earnings projections not quantifiable. We have been watching the technical indicators which have been very reliable. The initial stage of the bottoming process often sees a contraction of the number of stocks hitting new 52-week lows and volume contracting. We are not there yet. On Friday, the S&P 500 Index closed below the support level of 2347, which was the December 2018 low. The next level of support will be 2000-2100.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.