What if the trading range top at 4200 we have been calling for in the S&P 500 turns out as—the top?

Certainly we can make a case for it given higher yields, strong dollar, geopolitical stress, debt issues, government spending, and no real proof we have beaten the battle of inflation?

We at MarketGauge love math.

We love indicators.

We love risk/reward.

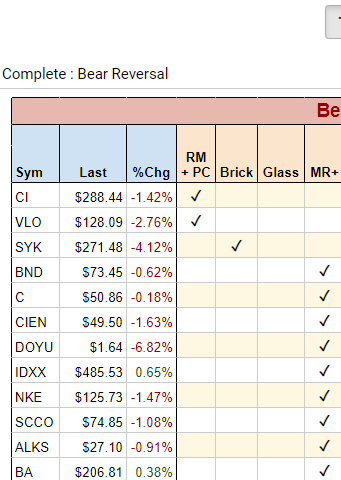

The table called Complete: Bear Reversal shows you a list of trades using some of our proprietary software.

This list of stocks was updated after the close.

The list ranges from stocks well underperforming to stocks that are near but could not clear 52-week highs.

We show you 3 indicators.

We walk you through 1 trade on the list.

Real Motion and Phase Change (Mish’s book covers that in detail. For our purposes, we will focus on Real Motion. This scanner looks for stocks that show momentum is declining even if price has yet to catch up.

Brick refers to a 2-day pattern. A stock makes a new 60+ day high and then reverses closing near the lows.

Mean Reversion Plus finds short-term divergences between momentum (Real Motion) and price based on mean-reverting tendencies of stocks.

Stryker Corp is in a bullish phase on both the daily and weekly charts.

Since Friday, the stock had a brick pattern confirmed by Monday’s action.

After a new 60+ day high, the week began by giving the bulls an opportunity to take some profit.

It also allowed daytraders to sell under the lows of Friday and make money.

Note that the Real Motion indicator shows the beginnings of a mean reversion. The red squares just crossed under the dotted line or Bollinger Band.

Moreover, if that stock has topped out, traders have a risk to above the 60+ day high to possibly see a move closer to $250.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) Target 420 with 390-400 support

Russell 2000 (IWM) 190 now support and 202 major resistance

Dow (DIA) 343.50 resistance and the 6-month calendar range high

Nasdaq (QQQ) 300 is now the pivotal area

Regional banks (KRE) 65.00 resistance

Semiconductors (SMH) 246 is the 23-month moving average-it failed it Monday on low volume

Transportation (IYT) The 23-month MA is 244-now resistance

Biotechnology (IBB) Sideways action

Retail (XRT) 78.00 the 23-month MA resistance and nearest support 68.00

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.