Geoff Bysshe, the President of MarketGauge contributed to this article.

The stock market’s biggest headwind in 2026 may not be what you investors are thinking.

If history is any guide, Wall Street is going to have a very difficult balancing act in 2026—and it’s not between the Bulls and the Bears. In fact, it’s between the Bulls and the Bulls.

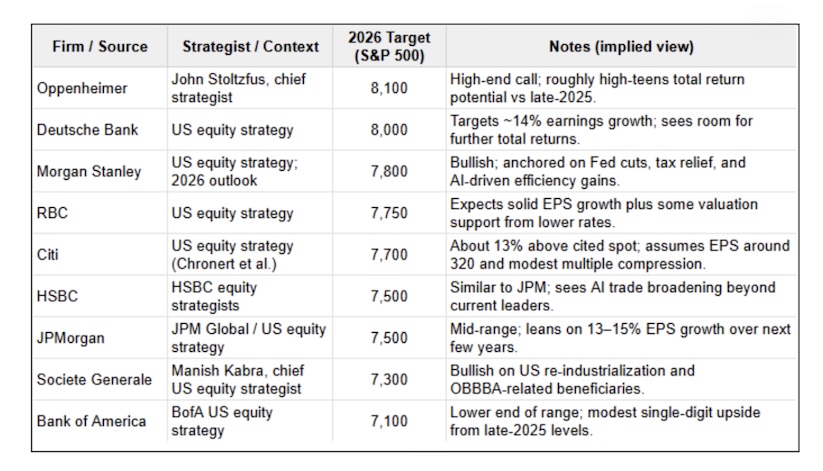

As you can see from the table below, there isn’t a single major bank with a target for the S&P 500 Index (INDEXSP: .INX) in 2026 that’s lower than where we currently stand at about 6,900.

Here are some of the S&P 500 targets:

While some may see this as bullish, the contrarian view is quite clear.

In the words of Warren Buffett:

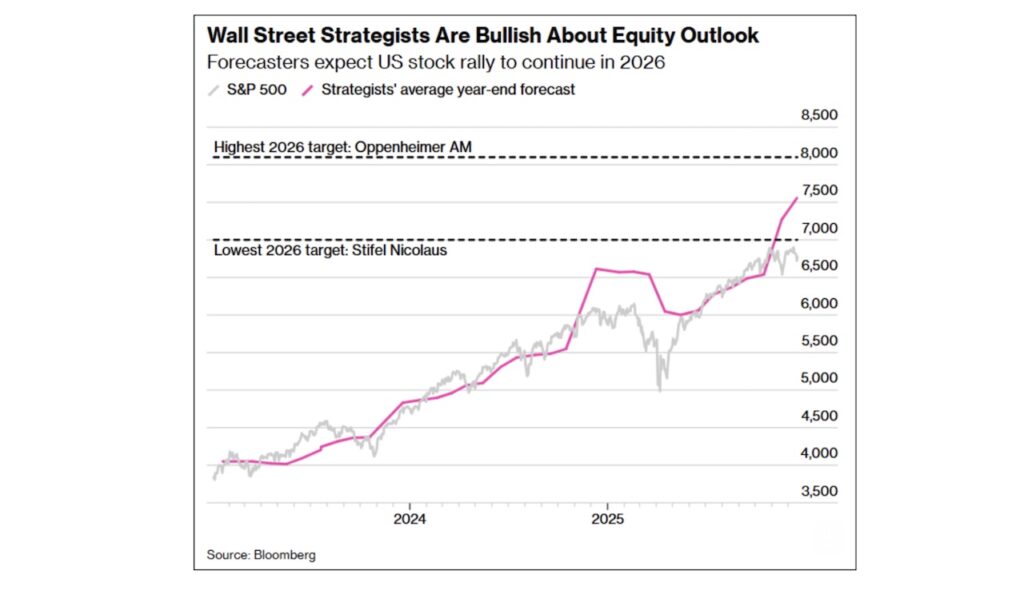

“Be fearful when others are greedy and be greedy when others are fearful.”Visually, the chart below shows that over the last several years, Wall Street targets have tended to be below the current market price, except at the beginning of last year (2025), which proved to be a period of overly optimistic expectations.

With respect to last week’s market outlook, I would not call the current environment a euphoric top, but finding a narrative that will provide an increasingly bullish consensus looks like it will be hard to find.

“Give them a number or a date, but never both.”

– Wall St. strategists’ axiom

In fairness to the Wall Street strategist, their optimism in early 2025 was ultimately proven correct, as we closed significantly higher than their early 2025 targets.

Timing the market is tough. It’s hard to be bullish when everyone else is bearish, but it’s even more difficult to be bullish and correct when everyone else agrees with you.

An easier market forecast in a time like this is that the market will see an increase in volatility. This is Wall Street’s way of saying an increase in the number of drawdowns from market highs.

Another outcome, which is already beginning to play out, is that the bull market will continue higher, but there will be significant market rotation.

The first trading day of the year was a clear example of the market rotation that has been underway for some time.This type of market action is great news for active swing traders, as it can provide many more opportunities to buy your favorite trends on a pullback. And when pullbacks are created by market rotation, they are a healthy characteristic of durable bull markets.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.