It’s options expiration week.

Let’s look at Volatility Index (INDEXCBOE:VIX) and S&P 500 (INDEXCBOE:.INX).

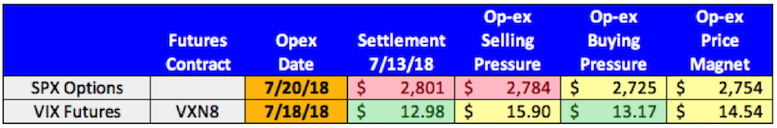

This week, VIX Volatility options expire on Wednesday morning, the S&P 500 (SPX) options expire on Friday morning.

These events often are accompanied by volatility as the large traders exit or roll their positions in order to maximize profit and purge risk.

The SPX options market data suggests that large traders will maximize their profits if the SPX pulls back to the $2,750 level.

Moreover, the VIX options market data currently suggests that large traders will maximize their profits if the VIX settles near $14.50 on Wednesday morning.

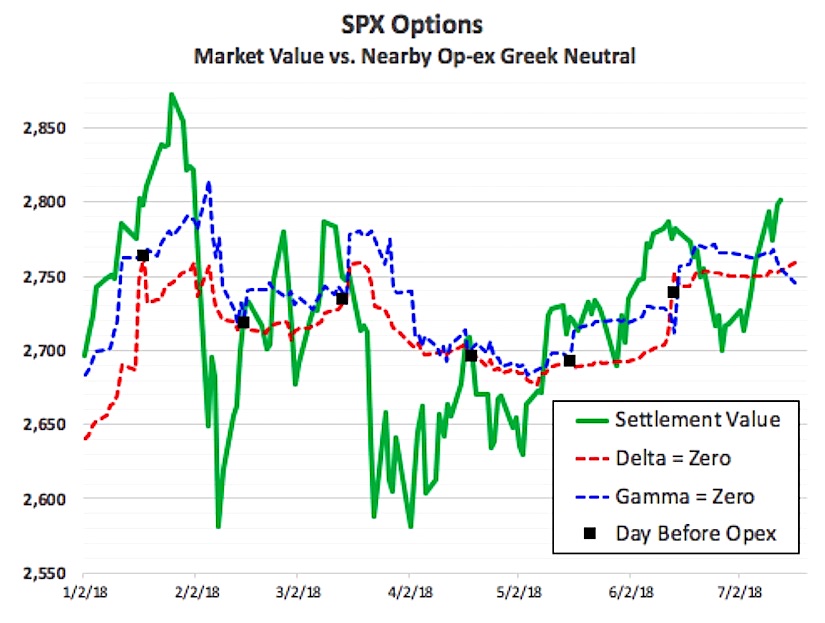

Here is the value of the SPX graphed together with the option market analytics that we calculate each morning. The value of SPX tends to mean-revert with the price level where the options market delta and gamma are near zero.

To learn more about the Op-ex Price Magnets, please visit our website.

Twitter: @Viking_Analytix

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.