The equity markets were essentially unchanged last week with the S&P 500 Index and Dow Industrials unable to reach escape velocity to overcome resistance at 2100 and 18000 respectively. And the vanishing yield.

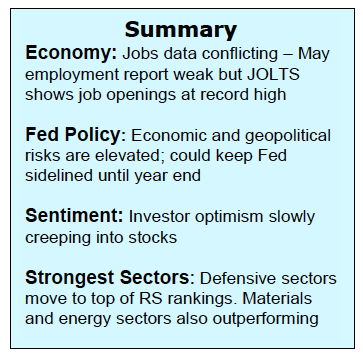

Stocks attempted to breakout on the upside early last week as it became increasingly apparent the Fed is not likely in a position to raise interest rates any time soon. However, the support for the rally faded late in the week as the US Dollar reversed to the upside on the increasing uncertainty as to whether the UK will stay or leave the European Union.

Vanishing Yields

The US Dollar was bolstered by unprecedented demand of U.S. debt by foreign investors as yields plunged overseas. The German DAX fell 2.5% and the yield on the 10-year bund made a new low. As a result, the treasury yield on the 10-year T-note fell to 1.64%, which matches the low for the year recorded in February when the S&P 500 Index was trading almost 200 points lower. Since the inception of the bull market in 2009 the principal support has been low interest and low inflation rates. This has helped bonds. This is expected to remain the most important support for stocks as we move into the second half of 2016. This would imply that stocks will trade in a wide swinging range into the November election with the risk to 2025 and the reward to 2150.

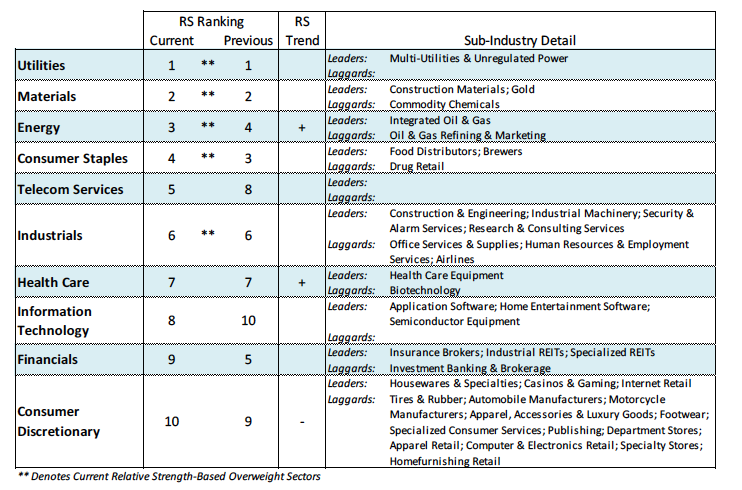

Stock market trends remain positive and the broad market continues to show an increase in the number of issues and groups participating in rallies. However, the weight of the technical evidence tends to confirm that more time is required before another attempt to surpass the 2015 highs is forthcoming. Near term, further attempts at reaching new high ground will likely be delayed by the uncertainty surrounding U.S. interest rates and the reaction to the Brexit vote next week.

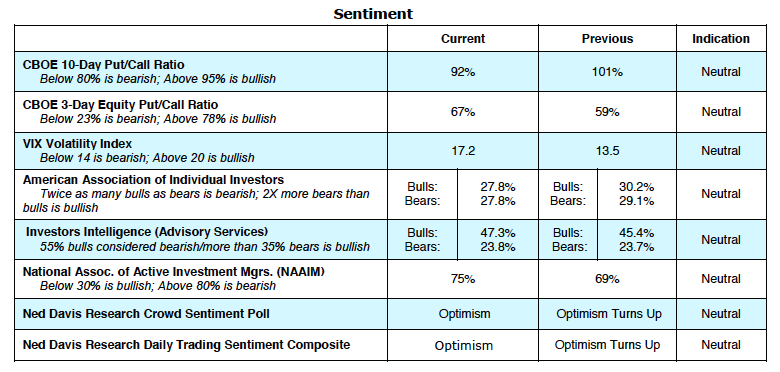

Investor sentiment indicators, for the second week in a row, show optimism creeping into the stock market. Investors Intelligence, which tracks the mood of Wall Street letter writers, showed the third weekly increase in the percentage of bulls. The most recent data from the National Association of Active Investment Managers shows the asset allocation to stocks by professionals climbed to 75% last week from 60% three weeks ago. The CBOE reported last week that the demand for call options exceeded the demand for put options for the first time in several months. The glaring negative is the pervasive lack of upside momentum. Momentum is a function of volume, which has remained low this cycle. Since volume often precedes price, it is likely that an increase in volume will be the signal that new highs are forthcoming this summer.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.