During stock market corrections / pullbacks in a mature bull market I tend to gravitate to stocks that are displaying constructive price action around key moving averages, specifically the 10-week and 40-week simple moving averages. How a stock’s price reacts around its moving averages provides valuable insight into the underlying demand in the stock, particularly institutional demand.

During stock market corrections / pullbacks in a mature bull market I tend to gravitate to stocks that are displaying constructive price action around key moving averages, specifically the 10-week and 40-week simple moving averages. How a stock’s price reacts around its moving averages provides valuable insight into the underlying demand in the stock, particularly institutional demand.

A stock may bounce one day or two days off a daily moving average, but if a stock rebounds from near a key weekly moving average and closes at or near the weekly high it signifies at least short-term commitment. Often the bounce will yield a Bullish Outside on a weekly bar chart (my working chart type). The key advantages of targeting stocks in these price areas is the earlier entry allows a trader to absorb price volatility that may accompany a breakout into new highs and to be positioned in leading stocks that continue to show demand.

In early 2014 I have been able to capitalize on several high probability trade opportunities by applying some of my trading tactics on constructive price action around the 10-week and 40-week moving averages. The following are four of those trades with annotated charts. Please click on the charts to be able to have a clear view.

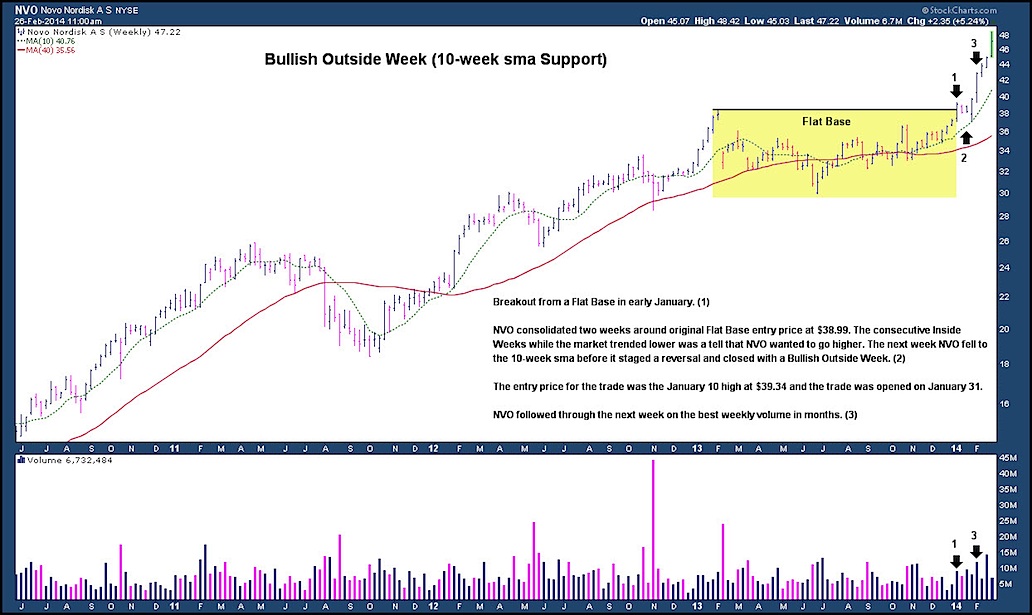

Novo Nordisk (NVO)

NVO is an interesting trade situation that developed in the second half of January 2014. The stock broke out from a Flat Base and then closed with consecutive Inside Weeks as the general equity market declined. The following week NVO tested the 10-week sma before closing with a Bullish Outside Week.

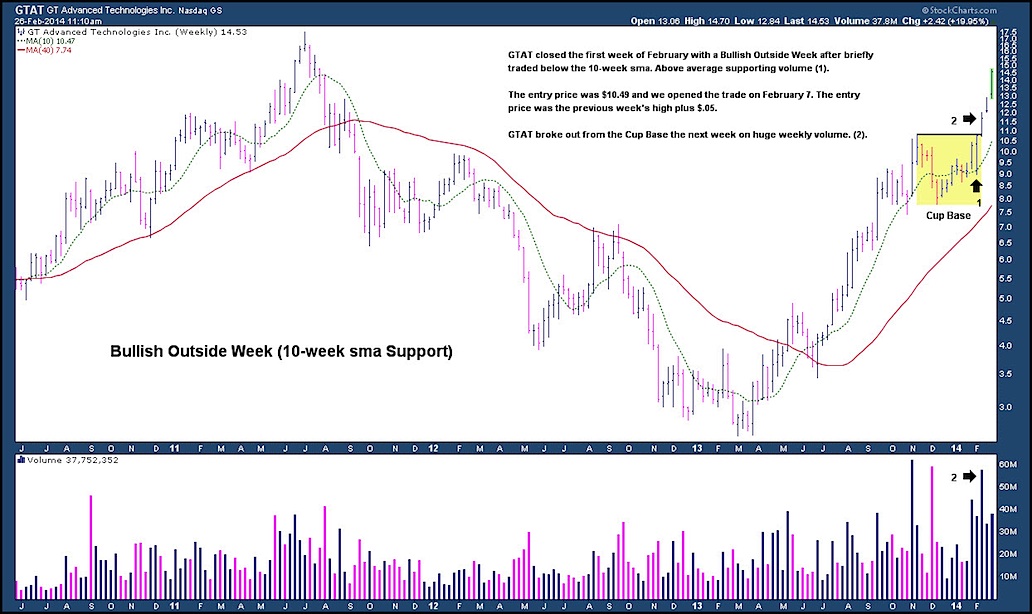

GT Advanced Technologies (GTAT)

GTAT shows a powerful continuation of the Bullish Outside Week as it broke out from a Cup Base.

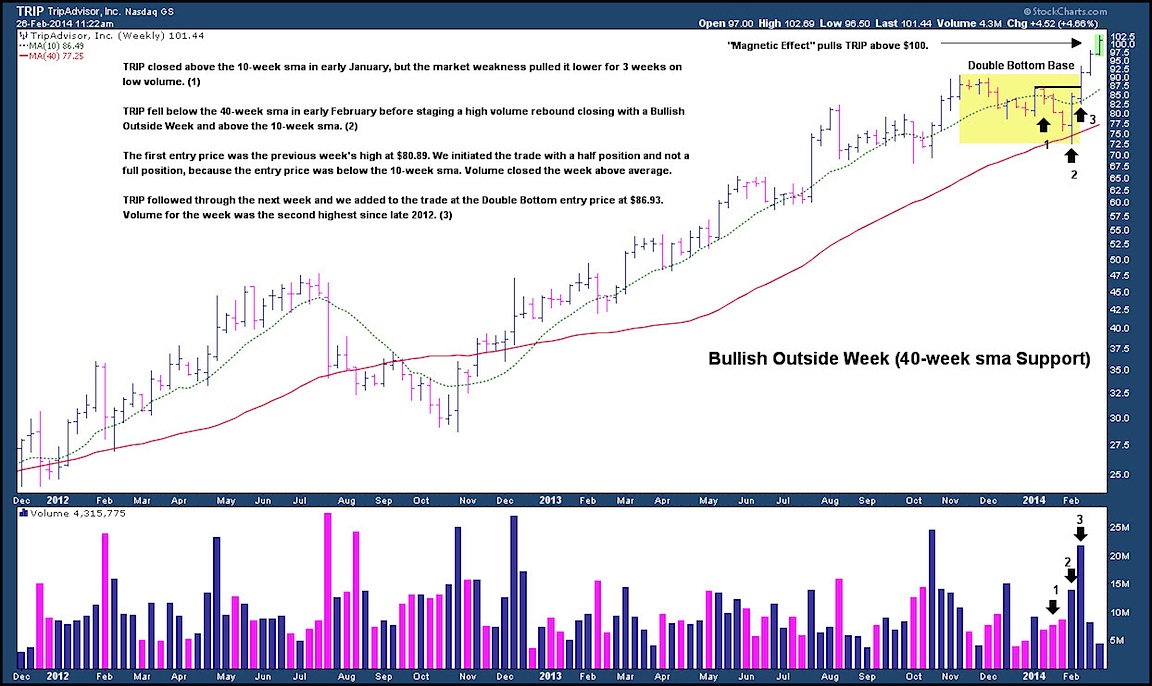

TripAdvisor (TRIP)

TRIP is an example of how a trader can use the 40-week sma and a Bullish Outside Week.

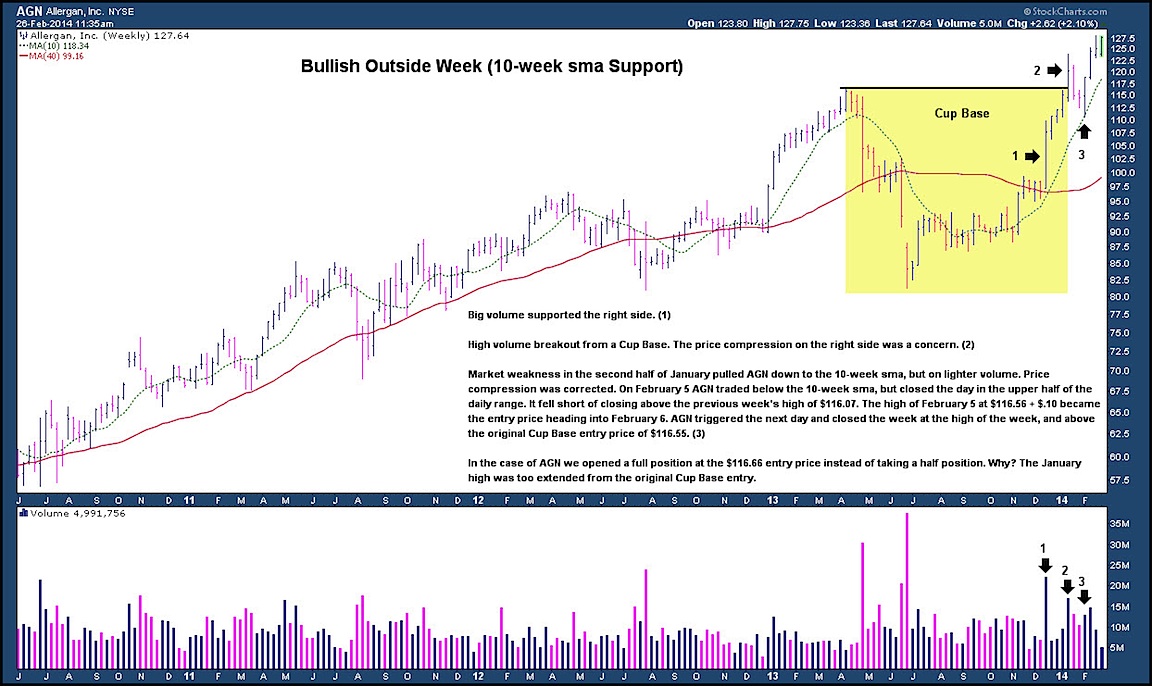

Allergan, Inc. (AGN)

AGN was a trade opportunity that I initially passed on as it broke out from a Cup Base in mid-January 2014. When AGN pulled back to the 10-week ska, I became interested in the trade and used the Bullish Outside Week to open the trade.

There are more examples of trades I placed applying the same trading tactics with moving averages. Some of those stocks I have traded or opted out are FSL, WDAY, KYTH, UBNT, VNET, LCI, CFX, TSLA, etc. Obviously, not all these trades will work out. The key in these cases is to apply the selling criteria of your trading program that matches the trade situation.

Of the aforementioned stocks, I currently have open trades in AGN, GTAT, UBNT and FSL at the time of publication. Please note that I closed out the NVO and TRIP trades on February 25, 2014.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.