By Adam Graham

By Adam Graham

Like many investors, I’m always looking for a shred of information, outside of fundamental data, which may help me gauge the momentum of a particular stock. Moreover, how can an investor like me benefit from insider activity or upstream dynamics that will impact a specific industry or stock?

Earlier this week I happened to catch Steven Rattner’s appearance on CNBC’s Squawk Box. The topic of conversation originally centered on Facebook’s (FB) IPO and how he, and another guest, felt about it as an investment opportunity. Both men agreed that they would not be participating, labeling it “Muppet Bait”, otherwise an investment for ignorant, hype-chasing retail investors.

Although I believe strongly in Facebook’s position in today’s social and business environment, I don’t disagree with their assessment. Facebook’s IPO will undoubtedly lure into the market and take advantage of many individuals who are otherwise not savvy enough to be picking stocks themselves and have no understanding of it’s true valuation. Indeed, Rattner went on to state that “… individual investors shouldn’t be playing the stock market any more than you should be taking out your own appendix”, as you can see for yourself at about 1:15 here.

As a retail investor myself, I can relate to Rattner’s position. While it struck me as patronizing, elitist and a sweeping generalization, I’ve experienced numerous frustrations from perceived “gaming” by insider knowledge I’m not privy to. Rattner certainly knows much more than I do about market and economic undercurrents (remember, he became “Car Czar” charged with resuscitating the US auto industry after the crisis, following an illustrious career as a Private Equity fund manager, I-Banker and economic/ financial journalist). While I’m in no position to refute his position, I also have no intention of packing it in, closing my stock positions and moving exclusively to ETFs and mutual funds, as he suggests I do.

This leads to the actual point of this article, as my purpose has little to do with Facebook as a specific investment, but is focused more broadly on the disadvantages facing retail investors and an interesting group of ETFs that, rather than being used as investments, can be employed by us “home gamers” to pull back the curtain and see how industry insiders feel about the direction of the markets and specific stocks. Specifically, I’m referring to Insider Sentiment ETFs, which I just became aware of, including:

- Guggenheim Insider Sentiment ETF (NYSE: NFO)

- Direxion Large-Cap Insider Sentiment Shares ETF (NYSE: INSD)

- Direxion All Cap Insider Sentiment Shares (NYSE: KNOW)

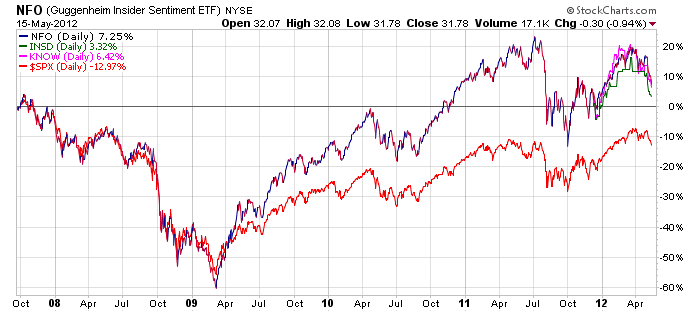

Since their inception all 3 funds have outperformed the S&P, lending credence to my premise:

My Premise: I believe home investors can use these funds to learn where the smart money is accumulating, without having to look up insider filings for company after company. How? The fund managers do the work for you. Specifically, NFO tracks Sabrient’s Insider Sentiment Index and regularly adjusts its portfolio of 100 stocks to “reflect favorable corporate insider buying trends and recent earnings estimate increases by Wall Street analysts that follow the stocks, giving them the potential to outperform”.

In summary, if execs, directors and large shareholders are accumulating additional shares in a business, it’s a very strong statement that the future is looking rosy for that particular company.

As famed Wall St. sage, Peter Lynch, stated: “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise”

My Suggestions:

- Begin tracking some of the specific stocks being acquired in these funds and see how they perform vs. the market over the next month or so.

- If they tend to outperform and you like the industry and company’s fundamentals, consider using these ETFs as an additional arrow in your stock analysis quiver.

- DON’T stop investing just because Steven Rattner insinuates that we, the investing proletariat, aren’t capable of beating the market.

—————————————————————-

Twitter: @joagraha @seeitmarket Facebook: See It Market

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of his employer or any other person or entity.

No position in any of the securities mentioned at the time of publication.