Over the past two years, we have seen inflation soar. And with that has coming rising interest rates.

This week’s CPI and PPI data have only confirmed consumers fears. But how much of the latest inflation data is baked into current interest rates?

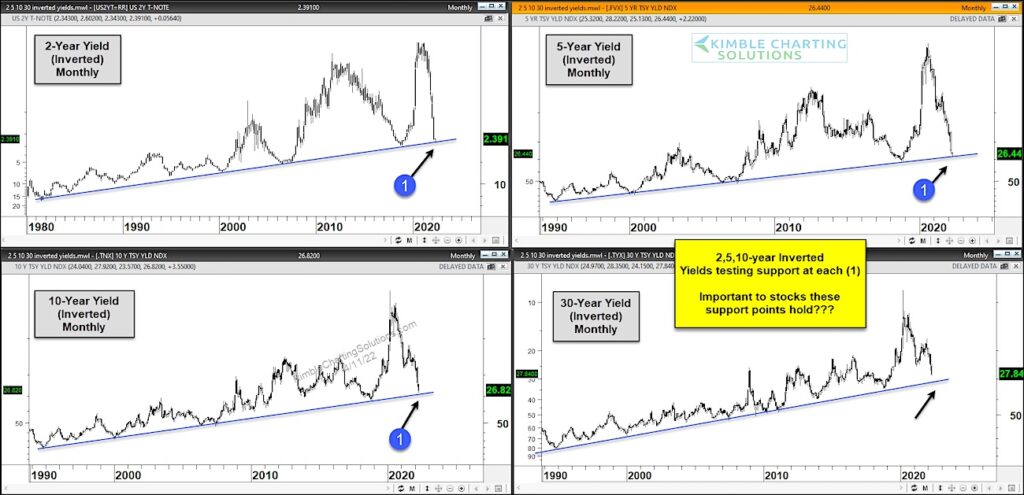

Today we take a look at a chart 4-pack of the 2-year, 5-year, 10-year, and 30 year US treasury bond yields. And as we have done in the past we invert the charts. This flips the script and takes away some or our current bias.

So line (1), which is overhead resistance, is shown here on the “inverted” chart as support. Note that line (1) is a long-term trend line with major implications.

On the “inverted” chart, it is important for stocks, bonds, and consumers that these support lines hold. Or else rates could surge higher and signal a trend change. Stay tuned!

2 / 5/ 10/ 30 Year Treasury Bond Yields “Inverted” Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.