The U.S. equity markets rallied last week, recording their biggest weekly gain in six months.

Stocks were supported by better-than-expected fourth-quarter corporate earnings announcements, fresh economic data that highlighted the strength of the U.S. economy, and expectations that the economic impact from the coronavirus will be temporary.

More than half of the S&P 500 Index has reported results for the fourth quarter showing modest earnings improvement.

However, projections for first-quarter 2020 earnings will likely be down because of the impact on the economy from the coronavirus and because Boeing, our largest exporter, halted production of its 737-max aircraft.

The blue-collar boom continues with 225,000 new jobs added last month, well above what forecasters were expecting. Wages are going up and the labor force participation rate went up.

The labor market appears resilient in the face of early January ISM Manufacturing Data that reported a loss of 12,000 manufacturing jobs. However, the Institute issued a six-month forecast for manufacturing to recover in 2020.

Last week, the ISM Non-Manufacturing Index indicated an expansion in the services sector, which accounts for more than two-thirds of U.S. economic activity, suggesting the economy should continue to grow moderately.

Can the stock market continue this resiliency in the face of economic risks posed by the coronavirus?

Thousands of factories and companies (including 2000 U.S. companies) have shut down in China and supply chains are severely disrupted. The duration of this virus will determine how long businesses will be sidelined and what the effect will be on China and the global economy.

Alejandra Grindal, senior global economist at Ned Davis Research, states that historically once a crisis in the global economy has been contained, economic activity rebounds. Her stance is that the global economic recovery has not been derailed but more likely delayed.

While we expect volatility to continue until the virus is contained, the foundation for this stock market is still positive. The U.S. economy appears to be on solid footing backed by last week’s jobs numbers, which should continue to support consumer spending, the backbone of this economy and stock market.

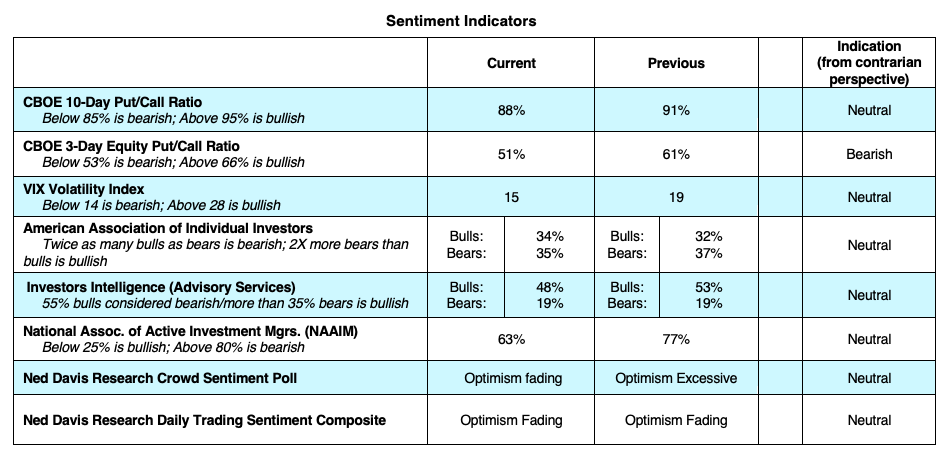

Despite last week’s run to new highs, fewer S&P 500 stocks participated in the rally than seen at the previous peak in January. Additionally, there was a quick return of investor optimism as evidenced by equity ETF inflows last week totaling $18 billion, which is more than was seen over the previous four weeks combined. From a contrary opinion viewpoint, the return of investor optimism leaves the market vulnerable to a short-term reversal.

Low inflation, low interest rates, slow but steady growth in corporate earnings and good economic numbers along with trade deals with China, Mexico and Canada all support an economy and a stock market that should continue to move higher. Additionally, the Federal Reserve still has room to cut interest rates should we experience an economic setback.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.