The equity markets tumbled nearly 5% last week, pushing the S&P 500 into the red for the year.

The turmoil in the financial markets in the fourth quarter is likely due to concerns over U.S./China relations and worries about a flattening yield curve.

The U.S. has decided not to be oblivious to our long-standing issues with China of intellectual property theft, among other abuses. Early last week the stock market rallied on news of a productive G-20 meeting of U.S. officials with Chinese President Xi. However, the large selloff in the market that occurred mid-week may in part be due to investors’ realization that the trade talks with China will be a long-term process in order to achieve free and fair trade.

The good news is that the Chinese need access to U.S. markets. According to author Gordon Chang, last year Chinese merchandise trade surplus against the U.S. was 88.9% of its overall merchandise trade surplus.

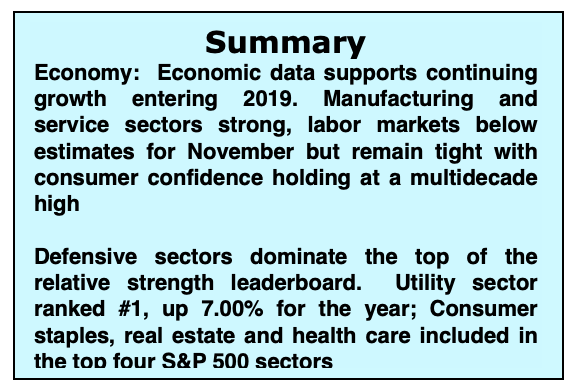

A potential yield curve inversion where 3-year rates exceeded 5-year rates caused concerns of an economic downturn. An inverted yield curve can be a predictor of a recession; however, we do not foresee an economic downturn with continuing (but slower) economic expansion, business optimism, wages and productivity up, unemployment at record lows, and increased spending by businesses and government.

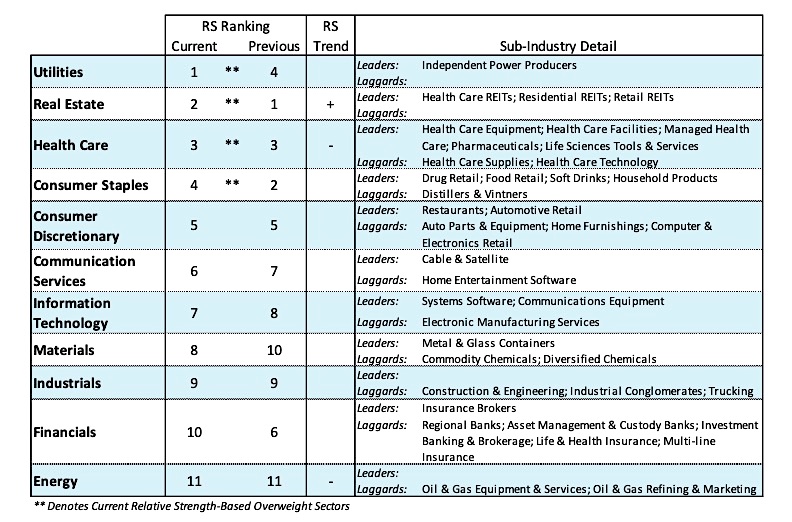

Stocks enter the new week oversold which could lead to a rally. Looking further out, we see the market continuing to struggle with themes of slower economic growth, and trade and monetary policy. We encourage our clients to refer to our sector analysis and to stay with the strongest groups which continue to be utilities, consumer staples and health care.

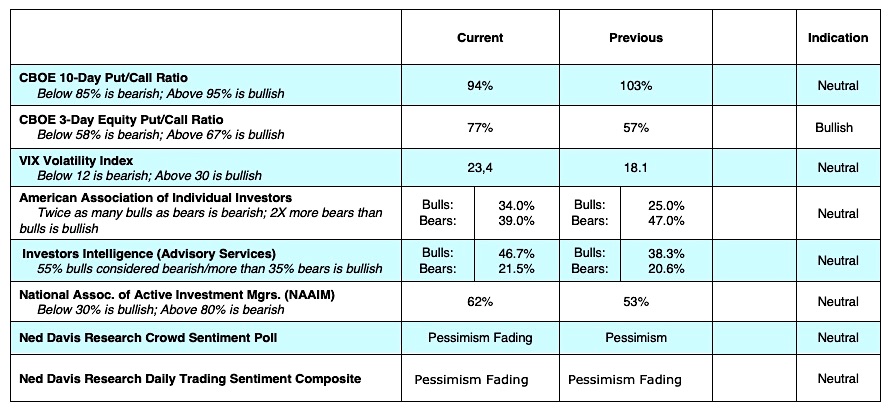

The technical indicators argue on the side of caution. At the start of the year volatility increased over what was seen in 2017 and gradually moved higher in the fourth quarter as witnessed by last week’s 1000 point move by the Dow Industrials and the 8.0% drop by the Dow Transports. We anticipate volatility to grow even stronger as measured by the CBOE Volatility Index (INDEXCBOE: VIX) climbing to 35 or higher (VIX closed at 23 on Friday). The stock market is plagued by the strong and persistent downside momentum.

Last week witnessed another session where downside volume overwhelmed upside volume by a ratio of 13 to 1. Before we can identify a low in the market that could lead to a sustainable rally, we need to see the downside momentum broken. This would require two sessions where upside volume exceeds downside volume by a ratio of 10 to 1 or more. Investors’ sentiment also remains problematic with most measures of investor psychology showing widespread complacency. At an important bottom we are likely to see complacency turn to excessive pessimism that historically has accompanied a new buying opportunity.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.