The US equity markets soared more than 4% last week recapturing two-thirds of the more than 6% pullback experienced in May.

That strength is carrying over to the beginning of this week with stock market futures are indicating a higher open for the S&P 500 Index and broader market.

Friday’s jobs report came in weaker than expected but the unemployment rate remained at 3.6%, a 50-year low.

Last week’s rally was the strongest since early January and most likely a result of comments from Federal Reserve Chief Jerome Powell that they will “act as appropriate” to sustain the economic expansion. We currently have weakness in the retail sector (consumer spending at malls is slowing but online purchases are strong) and weakness in manufacturing, but these are offset by increasing jobs numbers in construction, hospitality and service providers.

It is clear that the economy is slowing but we still are in an environment of strong consumer confidence, better-than-anticipated corporate profits and low interest rates.

The biggest uncertainty we face is trade. Negotiations are ongoing with Europe (car tariffs), Japan (car tariffs), China (possibility of an additional $325 billion tariff on Chinese goods), Mexico and Canada.

The recent agreement with Mexico will likely allow markets to add on to last week’s gains. However, the policy will be reviewed in 90 days and if Mexico does not hold up its agreement on enforcement and curbing of migration from Central America, we will be back to tariffs on Mexico. The U.S. and China have much at stake in coming to a trade resolution for their own economies and the world economy more broadly and we feel hopeful that a deal will be ironed out which would be a positive for the markets.

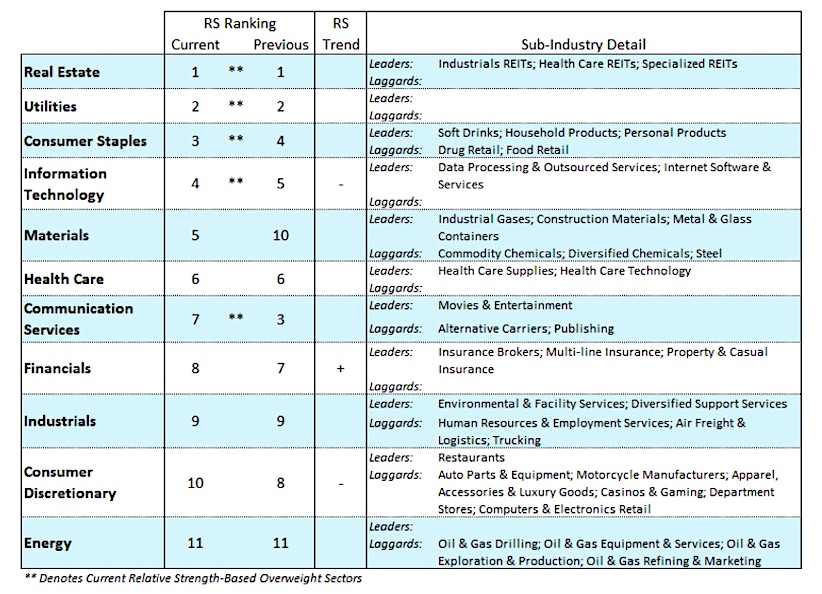

Against a backdrop of trade tensions and a mixed batch of economic numbers, our bias is toward continuing, moderate economic growth for the U.S. economy. I think investors should remain with the strongest sectors of the market.

The big winners have been the defensive sectors of the market, which we have been recommending since early this year. Consumer staples, REITs and utilities show double-digit gains year-to-day before dividends. We would add health care for its secular growth, consumer discretionary that benefits from the plunge in long-term interest rates resulting in increased mortgage refinancing. Investors may want to consider intermediate-term bonds along with other asset classes such as gold and gold stocks to counter the volatility in their equity portfolios.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.